Why Cash Velocity—Not Just Cash Flow—Is the Real Test for Enterprise CFOs in 2026

Table of Contents

- Why Cash Velocity Matters More Than Cash Flow in 2026

- What Is Configuration-Induced DSO?

- The Revenue Execution Gap Explained

- How ASC 606 Compliance Accelerates Cash

- ROI Calculator: Modern Revenue Architecture

- 5 CEO Metrics for Revenue Transformation

- Why servicePath™ Eliminates Cash Delays

- Diagnostic Checklist: Test Your DSO Health

- FAQ: Cash Velocity Questions Answered

- Next Steps: Accelerate Your Cash Conversion

Why Cash Velocity—Not Just Cash Flow—Is the Real Test for Enterprise CFOs in 2026

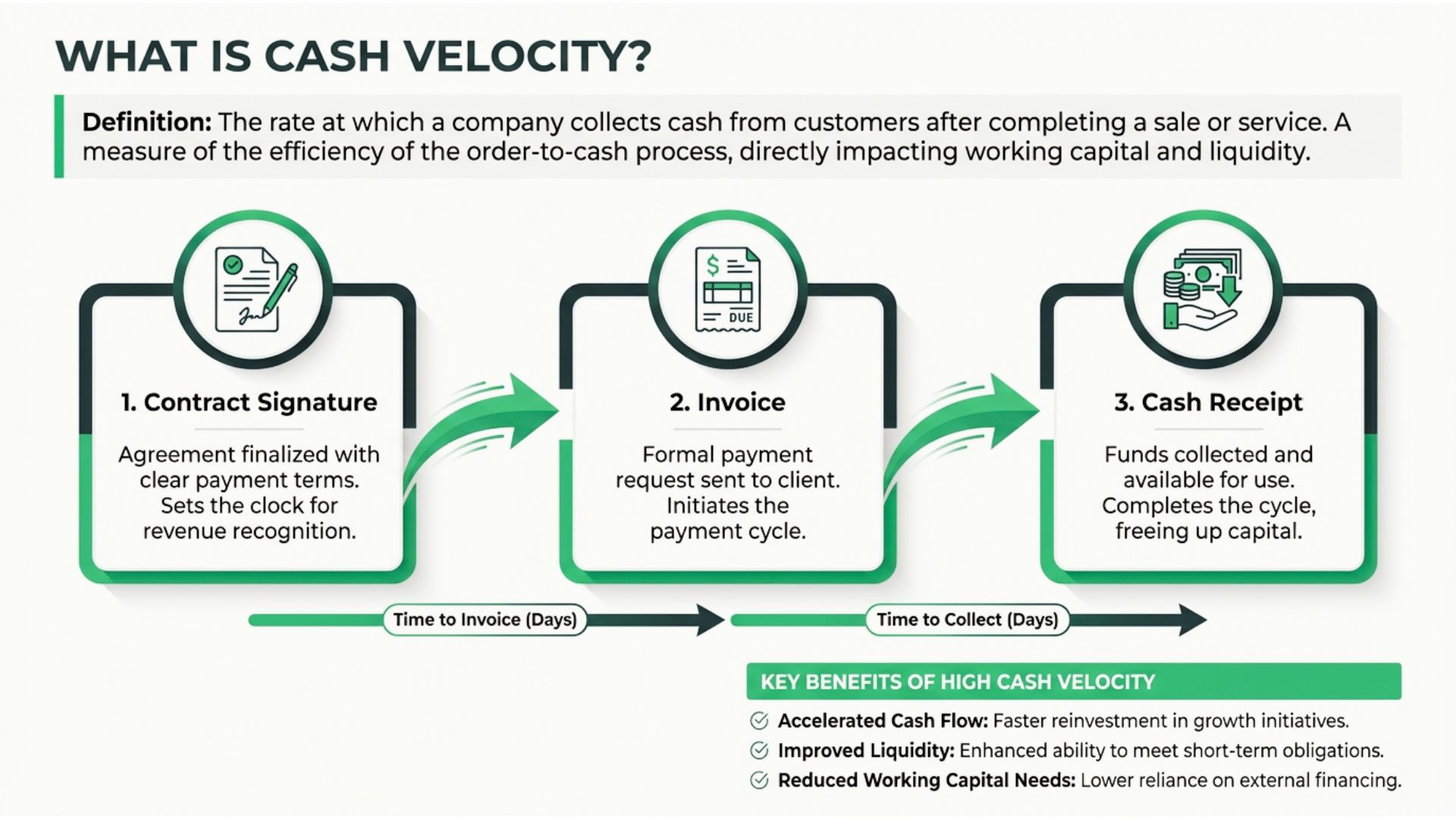

Cash velocity measures how fast signed contracts translate into recognized revenue and realized cash. Unlike cash flow (which tracks total money movement), cash velocity identifies where and why delays occur between signature and payment.

Key difference:

- Cash flow = total money in vs. money out

- Cash velocity = speed from contract signature → invoice → cash receipt

Executive Summary: What CFOs Need to Know

The Bottom Line: 70% of companies have DSO above 46 days, but most delays don’t come from slow-paying customers—they come from internal configuration errors that trigger accounting holds.

What’s changing in 2026:

- Top CFO Priority #1: Digital transformation of finance (50% of CFOs)

- Top CFO Priority #2: Optimizing cash management (45% of CFOs)

- AI Adoption: 87% of CFOs predict AI will be critical to finance operations

- The Disconnect: Cash conversion lags despite tech investments

Why it matters: Organizations are automating broken processes instead of fixing the structural issues where cash delays originate.

Source: Deloitte Q4 2025 CFO Signals™ Survey | CFO Brew 2026 Priorities Analysis

The Revenue Execution Gap: Where Cash Delays Really Begin

Definition: What Is the Revenue Execution Gap?

The Revenue Execution Gap is the structural disconnect between:

- How revenue is sold (sales configurations)

- How it’s contracted (legal terms)

- How it’s billed (finance systems)

The Hidden Cost: 1-5% Revenue Leakage

Hard data:

- Companies lose 1-5% of earned revenue annually due to misconfigurations

- For a $100M company: $1M – $5M walks out the door

- Root cause: Internal machinery failures, not customer payment issues

Where ASC 606 Creates Bottlenecks

Under ASC 606 / IFRS 15 revenue recognition standards, contracts must have:

- Identifiable rights

- Clear payment terms

- Commercial substance

The Problem: When sales reps use non-standard language or vague “future service” promises, they invalidate contracts from a revenue recognition standpoint.

Result: Finance stops the invoice. Cash stops moving.

Expert Insight: According to LBMC’s 2026 Revenue Recognition Analysis: “Private companies continue to face challenges with ASC 606 compliance, especially with bundled services, variable pricing, and contract changes.”

Configuration-Induced DSO: The Metric Finance Isn’t Measuring

What Is Configuration-Induced DSO?

Configuration-Induced DSO = Days added to cash collection specifically due to deal configuration errors that trigger accounting stops.

Traditional DSO measures total collection time.

Configuration-Induced DSO isolates the delay before invoices even reach customers.

The Data: 70% of Companies Have DSO Problems

2025 Benchmark Data:

- 70% of companies have DSO extending beyond 46 days (Source: ResolvePay 2025 Analysis)

- National average DSO: 39.07 days (Credit Research Foundation Q3 2025)

- Best Possible DSO: 35.70 days

- Gap: 3.37 days of avoidable delay

Step 1: The Allocation Trap

Sales rep closes bundle deal: Software + Support + Training = $300,000 flat price

Step 2: The ASC 606 Block

Finance cannot bill immediately because they must manually calculate Standalone Selling Price (SSP) for each distinct performance obligation (ASC 606 Step 4)

Step 3: The Latency

Deal sits in spreadsheet queue for 12 days while controller calculates allocation

Result: 12 days of Configuration-Induced DSO before invoice generation

Step 4: The CPQ Solution

Modern CPQ architecture acts as a DSO Compression Engine:

- Enforces SSP logic at configuration moment

- Automates ASC 606 Step 4 (Allocate Transaction Price)

- System “knows” accounting split before customer signs

- Allows immediate invoice generation upon closure

Performance Impact: Organizations report 40-60% billing cycle compression for complex deals

2026 CFO Priorities: The Shift from Cost Control to Cash Optimization

What Are CFOs Prioritizing in 2026?

According to CFO Brew’s analysis of Deloitte data:

Top 3 CFO Priorities for 2026:

For Finance Talent: 49% of CFOs cite automating processes to free employees for higher-value work as top priority

The Insight: Manual revenue processes don’t just slow billing—they consume expensive talent that should focus on strategic analysis, not spreadsheet allocation.

The Business Case: ROI of Revenue Architecture Transformation

What Is the Typical ROI Timeline for Modern CPQ?

According to 2026 CPQ Industry Analysis:

ROI Timeline:

- Positive ROI: Within 12-18 months

- Payback Period: Shortens as adoption increases

- Break-even: Typically 8-14 months for mid-market

1. Efficiency Gains

- 30-50% reduction in quote cycle time

- 40-60% faster billing cycles for complex deals

- 70-85% reduction in invoice disputes (pricing/terms)

2. Revenue Protection

- 1-5% of revenue recovered from eliminated billing errors

- 50-70% reduction in configuration mistakes

- Revenue leakage elimination from unbillable scenarios

3. Operational Savings

- 60-80% less time on manual revenue allocation

- Reduced headcount requirements for order processing

- Fewer escalations to Deal Desk

ROI Calculation Example: $100M Company

Scenario: Company losing 3% to billing errors = $3M annual leakage

Year 1 Recovery:

- Recover 50% of leakage = $1.5M

- Reduce DSO by 10 days = $2.7M cash flow improvement (assuming 10% cost of capital)

- Total Year 1 Impact: $4.2M

Implementation Cost: Typical enterprise CPQ = $150K-$500K

Net ROI Year 1: 740% – 2,700%

The Compliance Dividend: How ASC 606 Becomes a Velocity Accelerator

What Are the 5 Steps of ASC 606?

Most CFOs view ASC 606 and IFRS 15 as compliance burdens. But when integrated into CPQ workflow, they become frameworks for speed.

Step 1: Identify the Contract

ASC 606 Requirement: Contract must have commercial substance, approved terms, identifiable rights, payment terms

CPQ Automation:

- Enforces contract validity at configuration

- Prevents non-standard terms

- Ensures proper legal entities selected

- Requires explicit payment terms before quote finalization

Audit Finding: As LBMC notes, auditors look for “signed agreements or enforceable terms” and proper “customer credit risk assessment”

Step 2: Identify Performance Obligations

ASC 606 Requirement: Each distinct promise to transfer goods/services must be separately identified

CPQ Automation:

- Products/services configured as distinct line items

- Clear obligation types (license vs. maintenance vs. implementation)

- Bundling rules keep obligations visible

Critical Challenge: LBMC emphasizes: “Deciding whether to account for deliverables separately or together takes careful judgment. The outcome directly influences when and how revenue is recognized.”

Step 3: Determine Transaction Price

ASC 606 Requirement: Identify consideration expected, accounting for variable consideration, financing, non-cash, etc.

CPQ Automation:

- Pricing rules handle variable components systematically

- Payment terms and approval workflows ensure commercial soundness

- Multi-currency transactions processed automatically

Pain Point Addressed: As LBMC identifies: “Rebates, discounts, and usage-based pricing can skew revenue timing”

Step 4: Allocate Transaction Price – THE VELOCITY BREAKTHROUGH

ASC 606 Requirement: Allocate based on Standalone Selling Prices (SSP) for each obligation

CPQ Automation:

- SSP logic embedded in pricing engine

- System calculates allocation in real-time

- Finance knows accounting split before customer signs

- Invoice generated immediately upon closure

Impact: Eliminates 7-15 day allocation queue = Zero Configuration-Induced DSO

Step 5: Recognize Revenue

ASC 606 Requirement: Recognize when control transfers—point in time or over time

CPQ Automation:

- Recognition schedules auto-generate based on obligation type

- Subscription components → monthly schedules

- Implementation milestones → deliverable triggers

- Usage components → metering system connections

The Compliance Dividend: Key Takeaway

Traditional View: ASC 606 = compliance burden that slows billing

Modern Reality: When automated upstream, ASC 606 = velocity accelerator

Why: You’re fast because you’re compliant, not despite compliance

Term: We call this the Compliance Dividend—operational and financial benefits when regulatory requirements are automated vs. manually applied

Hybrid Drag: The Hidden Tax on Modern Revenue Models

What Is Hybrid Drag?

Hybrid Drag = Cash and margin friction introduced when subscription, usage, and services models run on legacy CPQ/billing foundations never designed for this orchestration.

The Market Reality: 85% Have Adopted Hybrid Pricing

Data Point: Approximately 85% of companies have adopted usage-based or hybrid pricing models

What “Hybrid” Means:

- Subscription licenses (recognized ratably over time)

- Usage-based compute (recognized as consumption occurs)

- Professional services (recognized at milestones)

- Performance-based pricing (contingent consideration)

Why Legacy Systems Fail: The Architecture Problem

Legacy systems weren’t architected for deals where single customer relationships contain:

- Multiple obligation types

- Different recognition patterns

- Varying billing frequencies

- Distinct measurement criteria

Without modern CPQ: Finance must manually reconcile these distinct revenue streams

The SaaS-Specific Challenge

LBMC’s 2026 analysis highlights SaaS pain points:

Quote: “Subscription escalators create contract assets when we recognize revenue before invoicing. Bundled implementation and support services make it unclear to distinguish what constitutes a separate obligation. High-volume SaaS firms can no longer rely on manual tracking.”

Translation: Hybrid models break manual processes at scale

Why Sales Leaders Should Champion Modern CPQ

How Does Modern CPQ Benefit Sales Teams?

Sales leaders often view CPQ changes skeptically, concerned about deal friction. But modern architecture accelerates sales cycles while improving compliance.

Real-World Performance Data

According to sales compensation research, modern platforms deliver:

For Sales Reps:

- 16x faster commission calculation

- 98% reduction in payout-related queries

- 500% more time for admins/reps to review payouts

- Faster billing = faster commissions

For Sales Operations:

- Real-time quota tracking and earnings visibility

- Automated approval workflows (reduced deal delays)

- Pre-validated configurations (eliminated post-signature rejections)

Enterprise Case Study: Commission Acceleration

Quote from Implementation: “End-to-end automation drastically reduces manual effort while providing real-time dashboards giving reps visibility into quota attainment, earnings breakdowns, and performance forecasts.”

The Sales Benefit: When billing happens faster, commissions arrive faster—directly impacting rep motivation and retention

Customer Experience: The Hidden Benefit of Pre-Bill Integrity

What Is Pre-Bill Integrity?

Pre-Bill Integrity = Validating commercial and accounting logic before invoice issuance

Analogy: “Shift-left” for finance—just as DevOps moved quality checks earlier in development cycles, leading finance teams move validation upstream in revenue cycles

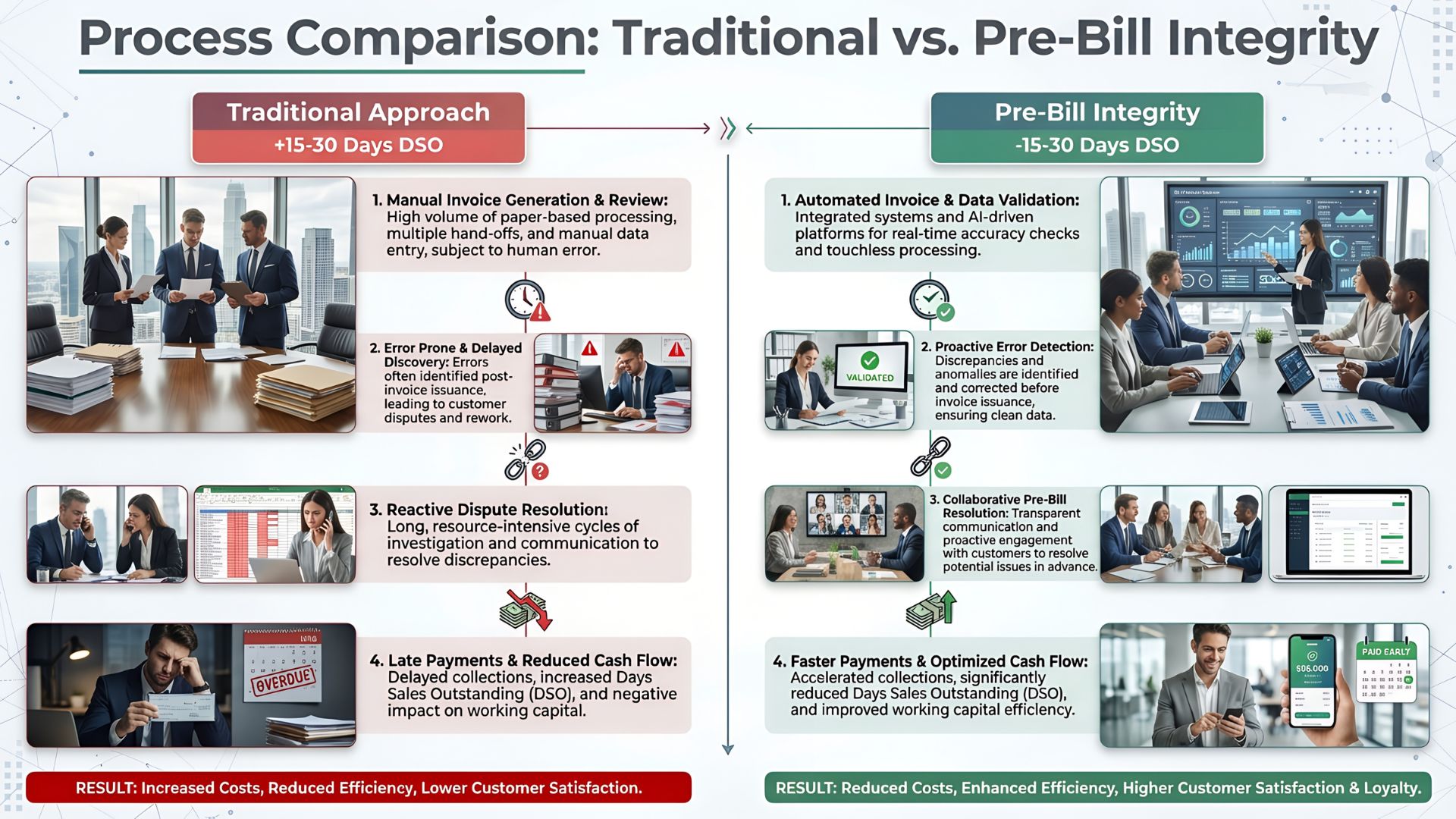

Process Comparison: Traditional vs. Pre-Bill Integrity

Traditional Approach (adds 15-30 days to DSO):

- Sales closes deal

- Contract signed

- Invoice generated

- Invoice sent

- Customer disputes

- Error discovered

- Credit memo issued

- Corrected invoice sent

- Payment clock restarts

Pre-Bill Integrity Approach (eliminates delays):

- Sales configures deal

- Automated validation runs (SSP calculation, obligation identification, ASC 606 compliance)

- Errors flagged before quote

- Deal corrected in draft

- Contract signed with validated structure

- Invoice auto-generated with verified accuracy

- Customer receives correct invoice immediately

- Payment arrives on schedule

The Customer Impact: Improved NPS

According to customer satisfaction research:

Quote: “Disputes and chargebacks can be time-consuming and costly to resolve. Inaccurate invoicing can lead to lost revenue and profits.”

Additional Finding: Invoice validation can increase NPS by “exceeding customers’ expectations, delivering value, and solving problems.”

The Bottom Line: Pre-Bill Integrity doesn’t just help finance—it improves customer experience and retention

The CEO Dashboard: 5 Metrics That Prove Revenue Architecture Transformation

What KPIs Should CEOs Track for Revenue Transformation?

According to revenue operations leadership research, CEOs and revenue leaders in 2026 should track these critical metrics:

Metric #1: Net Revenue Retention (NRR)

What it measures: Revenue retained and expanded from existing customers

Formula: (Starting revenue + expansion – contraction – churn) ÷ starting revenue

Decision triggers:

- NRR improving: Invest in expansion plays, build “next best product” offers

- NRR declining: Fix onboarding, product value delivery, renewal processes

Metric #2: Gross Margin by Revenue Stream

What it measures: Revenue minus direct delivery costs, by stream (subscriptions, usage, services)

Decision triggers:

- Margin improving: Double down on profitable streams, protect pricing

- Margin eroding: Raise prices, redesign delivery, or stop unprofitable offerings

Metric #3: Pipeline Coverage Quality

What it measures: Pipeline value relative to bookings target, with quality metrics (stage integrity, close probability)

Decision triggers:

- Coverage + quality strong: Lean into higher-value deals, protect price

- Quality weak: Fix stage definitions, retrain forecasting discipline

Metric #4: CAC Payback Period (by motion)

What it measures: Time to recover customer acquisition costs from gross profit, by acquisition channel

Decision triggers:

- Payback improving: Invest more in best motion, increase volume

- Payback worsening: Fix conversion rates, pricing, or sales cycle

Metric #5: Forecast Accuracy (30/60/90)

What it measures: How close forecasted bookings/revenue match actuals over 30/60/90-day windows

Decision triggers:

- Accuracy improving: Invest confidently, hire, scale programs

- Accuracy poor: Tighten forecast calls, enforce stage criteria

CEO Insight: The Clean Control Panel

Quote from research: “In 2026, the companies that win won’t be the ones with the most data. They’ll be the ones with the cleanest control panel and the discipline to act on what it says.”

Why AI Hasn’t Accelerated Cash (Yet)

What Percentage of CFOs Are Prioritizing AI in 2026?

Deloitte’s Q4 2025 survey reveals:

54% of CFOs say integrating AI agents into finance will be one of their top transformation priorities in 2026

But here’s the uncomfortable truth: AI is only as good as the data architecture beneath it

Why AI Fails Without Data Architecture

The Problem: When these live in separate systems, AI can’t operate:

- Contract terms in PDFs

- Pricing rules in spreadsheets

- Amendments in email chains

- Revenue schedules in separate systems

What AI Can Do: Flag anomalies

What AI Can’t Do: Fix underlying fragmentation

The 5 Foundations Required for AI Success

Companies seeing real AI-driven improvements have done foundational work first:

- Unified quote-to-cash data model (deal structure, pricing, contracting, billing share common schema)

- Elimination of manual data bridges (no spreadsheet handoffs between CPQ, ERP, billing)

- Standardized pricing logic (codified in CPQ, not tribal knowledge)

- Automated pre-bill validation (accounting compliance enforced at configuration)

- Real-time revenue visibility (finance, sales, delivery aligned around shared metrics)

Key Takeaway: Establish data architecture foundations first. Then AI delivers meaningful acceleration.

Deal Structure Precision: Where Cash Velocity Is Won or Lost

What Is Deal Structure Precision?

Deal Structure Precision = The capability to capture and execute complex commercial arrangements with complete fidelity across downstream systems without manual intervention

Why It Matters: Quality Determined at Construction

Critical Insight: The quality of cash outcomes is determined at deal construction, not collection

When sales configures complex deals, every component needs precision:

- Pricing rules translate from CPQ → billing without re-entry

- Service components trigger project creation with correct milestones

- Usage metrics connect to consumption data sources

- Performance obligations map correctly for ASC 606

- Amendment logic updates downstream systems consistently

The Legacy System Problem

Most enterprises discover existing tooling was never designed for this integration.

Market Signal: Legacy Salesforce CPQ officially entered “End of Sale” in March 2025

What This Means: Market-wide rethinking of revenue architecture underway

The Leader’s Question

Ask yourself: Does my quoting engine understand my revenue recognition policy?

If NO: You’re building future DSO into every deal you sign

Why servicePath™: Built for Revenue Velocity, Not Just Quote Velocity

What Makes servicePath™ Different?

servicePath™ represents a fundamentally different approach—designed specifically to eliminate the Revenue Execution Gap by connecting commercial intent to financial execution without manual translation.

Feature #1: Unified Revenue Execution Platform

Unlike legacy CPQ (where billing/revenue operations are afterthoughts requiring complex integration)

servicePath™ connects:

- Quoting

- Contracting

- Billing

- Revenue operations

…in a single platform

Capabilities:

- Deal configuration enforcing financial policies at creation point

- Contract generation with machine-readable terms billing systems execute automatically

- Automated billing handling subscriptions, usage, milestones, hybrid models systematically

- Revenue visibility providing real-time insight without manual reconciliation

Feature #2: Hybrid Monetization Without Hybrid Drag

Architected for: Modern enterprises operating multiple business models simultaneously

Handles in single platform:

- Subscription + usage + services + outcome-based pricing

- All revenue models with proper accounting treatment

- Real-time usage integration without manual reconciliation

- Milestone tracking with automated invoice triggering

Result: Pricing innovation without operational chaos or cash delays

Feature #3: Finance-Led Revenue Operations

Key Distinction: servicePath™ isn’t a sales tool finance retrofits—it’s a finance platform sales uses to configure deals

Governance Model:

- Finance defines rules: Pricing policies, discount authorities, approval workflows, accounting treatments (configured by finance, not IT)

- Sales operates within guardrails: Structure creative deals meeting customer needs, but can’t violate financial policies/accounting standards

- Operations execute automatically: Compliant deals trigger billing, revenue recognition, cash application systematically

Vision Delivered: Gartner’s 2026 conference explores “Autonomous Finance”—servicePath™ delivers this as operational reality, not future aspiration

The Architecture Question Every CFO Should Ask

What Question Should CFOs Ask About Revenue Architecture?

As Gartner’s Finance Symposium explores “Autonomous Finance: Building Resilient, AI-Driven and Value-Centric Enterprises,” one question should dominate:

Are you automating broken processes, or fixing the architecture that creates cash delays in the first place?

What Separates 2026 Leaders from Followers?

Organizations breaking away aren’t implementing:

- Better collections tools

- More sophisticated forecasting models

They are making architectural decisions that eliminate friction:

- Treating revenue data as strategic infrastructure (addresses: 52% of CFOs prioritize improving data quality, access, usability)

- Embedding financial validation at deal configuration (not back-office reconciliation)

- Eliminating manual handoffs (removing spreadsheet bridges creating delays/errors)

- Measuring pre-bill accuracy (tracking KPIs at source where Configuration-Induced DSO originates)

- Selecting platforms enabling autonomous finance (not just automating tasks—creating integrated workflows where AI operates)

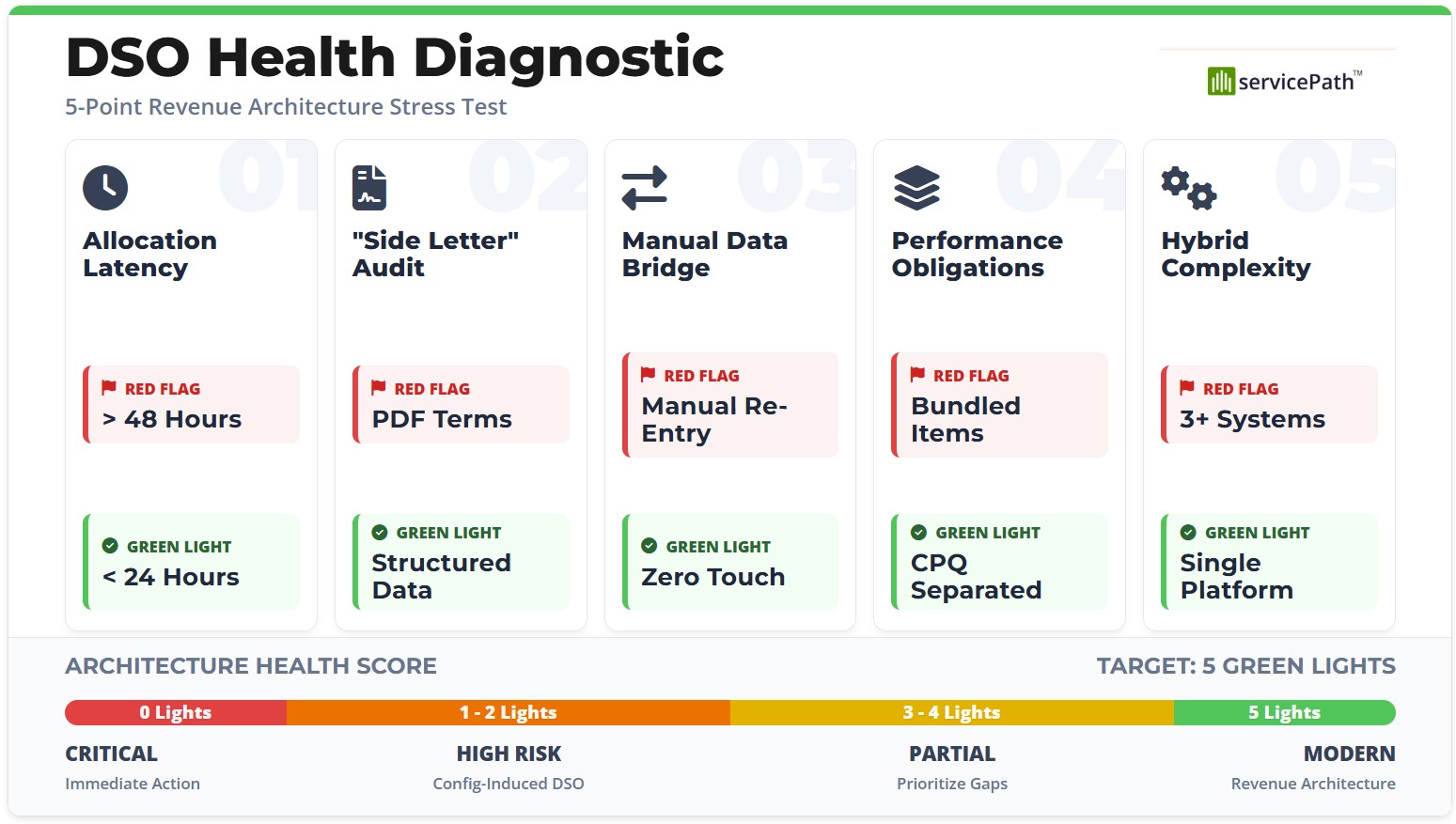

Diagnostic Checklist: Is Your Organization Suffering from Configuration-Induced DSO?

Use this 5-point diagnostic to assess whether your revenue architecture is creating avoidable cash delays:

Test #1: The “Allocation Latency” Test

Question: When a bundle is sold, does the invoice go out immediately, or does it queue for “revenue allocation”?

RED FLAG: RevRec review queue taking >48 hours for standard deals = Step 4 ASC 606 failure

GREEN LIGHT: Invoice auto-generates within 24 hours of signature

Test #2: The “Side Letter” Audit

Question: Can sales attach “special terms” PDFs that billing systems can’t read?

RED FLAG: Side letters contain non-standard terms that preclude revenue recognition—DSO spikes when audit discovers them

GREEN LIGHT: All terms structured in machine-readable format within CPQ

Test #3: The “Manual Bridge” Audit

Action: Map data flow from Quote → Order → Invoice. Count manual export/copy/paste steps.

RED FLAG: Manual re-entry of pricing logic after signature guarantees cash latency

GREEN LIGHT: Zero manual data bridges—full automation from quote to invoice

Test #4: Performance Obligation Clarity

Question: Does your quoting tool explicitly separate distinct obligations (License vs. Implementation)?

RED FLAG: Selling “Software + Setup” as single line item forces finance to manually unbundle for ASC 606 compliance—exactly the pain point LBMC identifies as ongoing in 2026

GREEN LIGHT: CPQ enforces obligation separation at configuration

Test #5: Hybrid Complexity Stress Test

Question: Can your system automatically invoice deals with (A) subscription, (B) usage overages, and (C) services milestones in one accurate bill?

RED FLAG: Needing three systems or spreadsheets to calculate = architecture creating Hybrid Drag

GREEN LIGHT: Single platform handles all revenue models with proper accounting

Scoring Your Results

5 Green Lights: You have modern revenue architecture

3-4 Green Lights: Partial modernization—prioritize remaining gaps

1-2 Green Lights: High Configuration-Induced DSO risk—architecture overhaul needed

0 Green Lights: Critical situation—immediate action required

FAQ: Cash Velocity Questions Answered

Question 1: Our DSO is 45 days (industry-average). Why worry about Configuration-Induced DSO?

Answer: According to 2025 benchmark data, 70% of companies have DSO above 46 days—meaning “average” puts you in the bottom tier, not middle.

The Hidden Problem: If 10-15 days of your 45-day DSO comes from delays between signature and invoice generation, that’s pure waste competitors with better architecture have already eliminated.

Action: Isolate how much of your DSO is Configuration-Induced vs. customer payment behavior

Question 2: We’re investing heavily in AI for finance. Won’t AI solve these problems automatically?

Answer: AI can only optimize what’s structured and connected. Deloitte’s survey shows 54% of CFOs prioritize AI agent integration—but success requires foundational work first:

Prerequisites for AI success:

- Unified data models

- Structured contracts

- Automated validation

- Eliminated manual data bridges

Bottom Line: Fix data architecture first. Then AI accelerates meaningfully.

Question 3: Can modern CPQ handle complex custom pricing without compromising flexibility?

Answer: Yes. Modern CPQ delivers maximum value for complexity.

Key Insight: True flexibility means sales responds to customer needs while finance maintains confidence every deal is compliant and executable.

How it works: Guided configuration with intelligent guardrails—not rigid constraints

Question 4: Isn’t ASC 606 compliance primarily an accounting responsibility? Why should it drive CPQ selection?

Answer: ASC 606 compliance begins at deal configuration—when obligations are identified, pricing allocated, terms structured.

Timeline Reality:

- Compliance decisions made: During sales configuration

- Compliance consequences discovered: After contract signed (by accounting)

The Problem: By the time accounting receives signed contracts, critical compliance decisions were already made by sales. If not captured systematically, accounting must reconstruct manually—where delays originate.

Question 5: What’s a realistic ROI timeline for modern CPQ implementation?

Answer: According to industry analysis:

Typical Timeline:

- Positive ROI: 12-18 months

- Payback Period: 8-14 months (mid-market)

- Full Value Realization: 18-24 months

Acceleration Factors: Payback shortens as adoption increases and more deal types flow through the system

Ready to Eliminate Configuration-Induced DSO and Accelerate Cash Velocity?

The 2026 CFO Imperative

As Deloitte’s CFO Signals data confirms: “87% of CFOs predict AI will be extremely important or very important to their finance department’s operations in 2026.”

Critical Reality: AI’s value materializes only when operating on clean, structured, compliance-validated data.

The Path Forward: The path to autonomous finance runs through revenue execution infrastructure.

Take Action: Your Next Steps

Step 1: Book a Demo

See how servicePath™ eliminates the Revenue Execution Gap and enables billing at signature speed (not manual spreadsheet allocation speed)

Step 2: Talk to a CPQ Architect

Schedule consultation with revenue architecture experts to:

- Assess your current state using Configuration-Induced DSO diagnostic

- Identify specific opportunities to accelerate cash conversion

- Build business case for transformation

Step 3: Explore Thought Leadership

Read our blogs on:

- Autonomous finance strategies

- Revenue operations best practices

- Modern CPQ for office of the CFO

Step 4: Review Case Studies

Discover how leading enterprises transformed cash velocity through modern revenue architecture designed around ASC 606/IFRS 15 compliance as accelerator, not bottleneck

Step 5: Master the Vocabulary

Download our glossary with comprehensive definitions:

- Configuration-Induced DSO

- Pre-Bill Integrity

- Hybrid Drag

- The Compliance Dividend

- Revenue Execution Gap