TL;DR: The Executive Summary

-

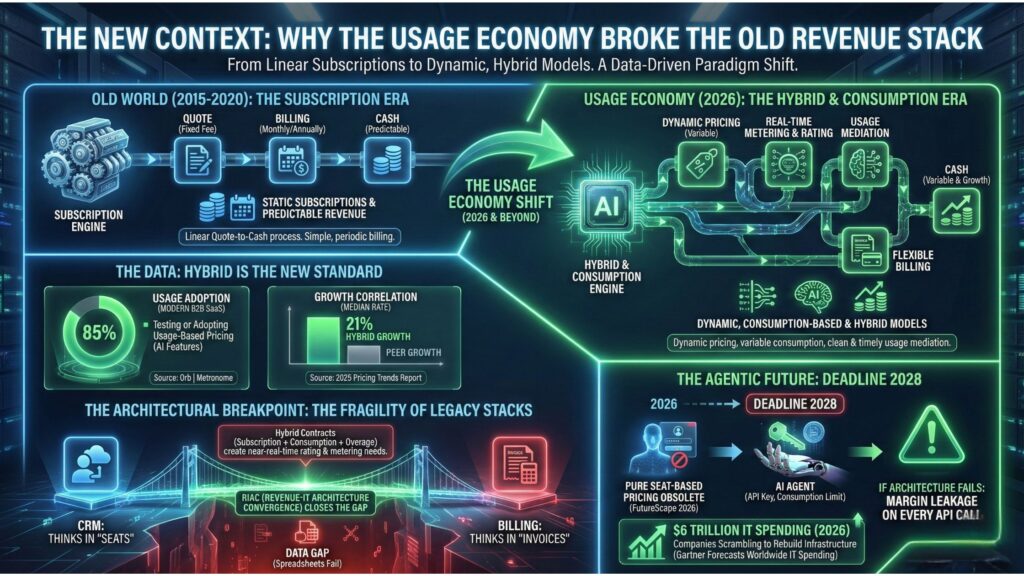

The Problem: The “Usage Economy” has arrived. By 2026, the market has shifted decisively toward hybrid and consumption models. However, most enterprise IT stacks (CRM/CPQ/Billing) were built for static subscriptions. Consequently, when you add M&A to this mix, the result is Revenue Latency—a dangerous gap between commercial strategy and system execution.

-

The Concept: Revenue-IT Architecture Convergence (RIAC) is a new strategic framework. Specifically, it moves away from “Old School” consolidation (forcing every acquired unit onto one monolithic Salesforce instance). Instead, it pivots to “New School” orchestration (using a Multi-CRM Revenue Hub to unify commercial logic while letting IT systems remain diverse).

-

The 2026 Data:

-

Usage is King: 85% of SaaS companies are now testing or deploying usage-based pricing (Orb | Metronome pricing).

-

Hybrid Models Win: Furthermore, companies using hybrid pricing grew at a median rate of 21% in 2025, outperforming pure subscription models.

-

The “Agentic” Shift: IDC predicts that by 2028, pure seat-based pricing will be obsolete as AI agents replace human tasks, forcing a total refactoring of value propositions (FutureScape 2026).

-

M&A Surge: Morgan Stanley forecasts global M&A deal volume to rise 20% in 2026 as financial sponsors return to the market (Investment Outlook 2026). Additionally, Willis Towers Watson projects that private equity dealmaking will accelerate as firms face pressure to deploy over $2 trillion in accumulated dry powder amid less restrictive debt markets (M&A Outlook 2026).

-

Tech Debt Tax: Finally, CIOs estimate that tech debt now comprises 20–40% of their entire technology estate value, paralyzing innovation (Tech debt: Reclaiming tech equity).

-

-

The Solution: You don’t need a 2-year ERP migration. Rather, you need a Revenue Interoperability Hub (like servicePath™) that acts as the “Brain” managing complex logic, while your various CRMs act as the “Body.”

Introduction: The “Day 100” Reality Check

Revenue-IT Architecture Convergence (RIAC) has become the most critical operational imperative in the private equity and enterprise software world. As we approach 2026, the gap between commercial ambition and technical reality is widening. Ultimately, this creates a “Day 100” reality check that catches even the most sophisticated dealmakers off guard.

The Lifecycle of an Integration

First, on Day 1: The deal closes. The press release goes out. At this stage, the investment thesis is sound: the combined entity has complementary products, massive cross-sell potential, and a shared market opportunity.

Subsequently, on Day 30: The “Integration Steering Committee” meets. However, the reality on the ground is different.

-

The acquired company runs on HubSpot; conversely, you run on Salesforce.

-

Their pricing logic is hard-coded into a legacy ERP or, worse, lives in the heads of three deal desk managers.

-

Moreover, their “usage data” is trapped in a homegrown SQL database that doesn’t talk to your billing system.

The Integration Reality Gap

Although the “100-Day Plan” is a staple of M&A strategy, the technical reality is vastly different. In practice, integrating different CRM instances during enterprise M&A typically takes 6 to 18 months. Furthermore, for complex enterprises with heavy customization or process harmonization needs, it can extend to 2 years or longer .

As a result, this gap—between the 100-day expectation and the 18-month reality—becomes the Integration Tax. In 2026, waiting 18 months for a unified catalog is a competitiveness crisis. In addition, the “Agentic Era” of AI is here, meaning customers are consuming value in ways that legacy systems cannot track.

Imagine being 70% faster than the alternative. That creates 14 to 18 months of runway where you are selling a product that didn’t exist in that other market . While your competitors are still mapping data fields, you are driving revenue.

We call the solution Revenue-IT Architecture Convergence (RIAC).

The New Context: Why the Usage Economy Broke the Old Revenue Stack

In the “Old World” (circa 2015–2020), revenue architecture was simple. You sold subscriptions. Additionally, billing was periodic (monthly/annually) and predictable. Therefore, the “Quote-to-Cash” process was linear.

In the Usage Economy of 2026, that linearity is gone. Pricing is dynamic, consumption is variable, and execution depends on clean, timely usage mediation.

The Data: Hybrid is the New Standard

This shift is not merely theoretical; rather, it is empirical.

-

Usage Adoption: Recent analysis of the monetization market shows that nearly 85% of modern B2B SaaS companies have either adopted or are testing usage-based pricing (UBP) to capture value from AI features (Orb | Metronome pricing).

-

Growth Correlation: Similarly, according to the 2025 Pricing Trends Report, companies utilizing hybrid pricing models (blending recurring platform fees with consumption components) are growing faster, with a median growth rate of 21% compared to their peers.

The Architectural Breakpoint

This shift exposes the fragility of legacy stacks. For example, when a customer signs a contract that includes a committed platform fee (Subscription), a prepaid bucket of AI tokens (Consumption), and an overage rate, your architecture must be able to rate, meter, and bill that usage in near-real-time. If your CRM thinks in “seats” and your billing system thinks in “invoices,” you have a data gap that spreadsheets can no longer fill. This gap is exactly what Revenue-IT Architecture Convergence (RIAC) is designed to close.

The Agentic Future

IDC’s FutureScape 2026 report puts a deadline on this transition. Specifically, they predict that by 2028, pure seat-based pricing will be obsolete because AI agents will replace human tasks (FutureScape 2026). When your customer is an AI agent, it doesn’t need a “login”—it needs an API key with a consumption limit.

Consequently, if your architecture can’t handle those updates instantly, you are leaking margin with every API call. This is why Gartner forecasts IT spending to cross $6 trillion in 2026—companies are scrambling to rebuild their infrastructure for this new reality (Gartner Forecasts Worldwide IT Spending).

Multi-CRM Reality: “Customer 360” Became “Customer Fractured”

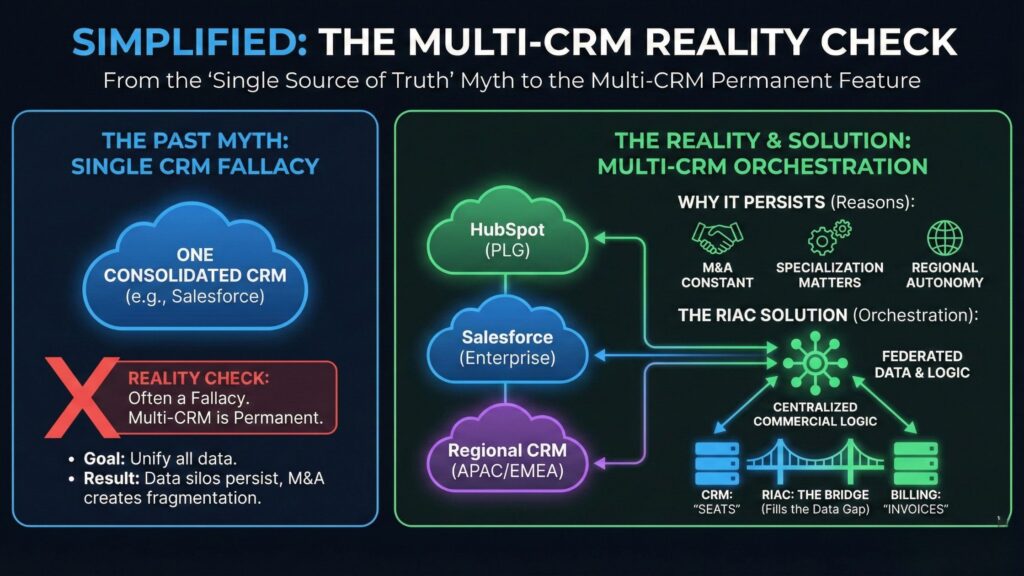

For the last decade, the holy grail of IT strategy was “The Single Source of Truth”—consolidating everything onto one massive CRM instance (usually Salesforce).

In 2026, we must admit that this goal is often a fallacy. Multi-CRM is not a temporary bug; on the contrary, for many large enterprises, it is a permanent feature.

Why Multi-CRM Persists

This phenomenon doesn’t happen because leaders love complexity. Rather, it occurs because:

-

M&A is constant: You buy companies faster than you can integrate them.

-

Specialization matters: A PLG (Product-Led Growth) division might thrive on HubSpot, while the Enterprise Sales team needs the rigor of Salesforce.

-

Regional autonomy: APAC and EMEA divisions often run localized instances for compliance or historical reasons.

Research from New Breed indicates that 95% of companies have identified significant gaps in their CRM operations, with data silos being a primary culprit (Reinvent Your Strategy with HubSpot).

The Revenue-IT Architecture Convergence (RIAC) Implication

In a RIAC-mature organization, you accept Multi-CRM as a reality. Crucially, you don’t try to force every salesperson onto one screen. Instead, you ensure that commercial logic—your products, your pricing rules, your approval workflows—is centralized and “federated” out to those CRMs.

If you don’t, you simply cannot scale. As Forrester notes in their 2025 Partner Ecosystem report, the complexity of managing indirect and direct channels simultaneously requires systems that can speak multiple languages (The State Of B2B Partner Ecosystems, 2025 | Forrester).

If your CRM thinks in ‘seats’ and your billing system thinks in ‘invoices,’ you have a data gap that spreadsheets can no longer fill. You need an architecture that doesn’t just support today’s outcome models, but is engineered to absorb the pricing paradigms you haven’t invented yet.“

M&A and Transformation Outcomes: The Failure Modes Repeat

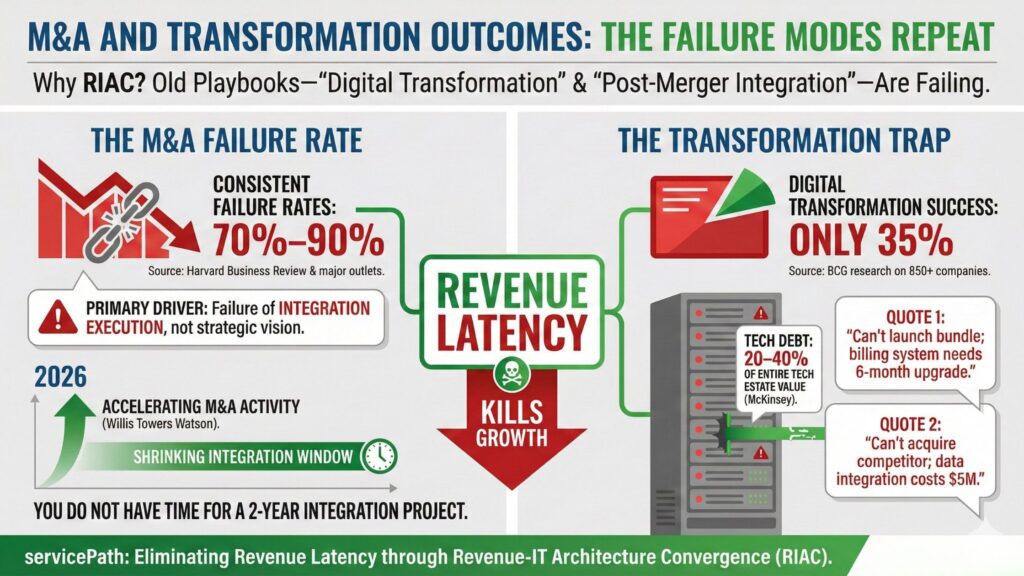

Why do we need a new acronym? Why Revenue-IT Architecture Convergence (RIAC)? Fundamentally, because the old playbooks—”Digital Transformation” and “Post-Merger Integration”—are failing at an alarming rate.

The M&A Failure Rate

The statistics are stubborn. Harvard Business Review and other major outlets consistently cite M&A failure rates between 70% and 90%. Therefore, the primary driver is not a lack of strategic vision; rather, it is a failure of integration execution.

Willis Towers Watson and other analysts project that M&A activity will accelerate significantly in 2026. As deal volume rises, the window for integration shrinks. Simply put, you do not have time for a 2-year integration project.

The Transformation Trap

Similarly, “Digital Transformation” often fails to deliver ROI.

-

BCG research on 850+ companies shows that only 35% achieve their digital transformation objectives.

-

Furthermore, McKinsey reports that CIOs estimate tech debt amounts to 20–40% of the value of their entire technology estate (Tech debt: Reclaiming tech equity).

In a revenue context, tech debt looks like: “We can’t launch that bundle because the billing system needs a 6-month upgrade.” “We can’t acquire that competitor because integrating their data will cost $5M.”

This is the Revenue Latency that kills growth.

Definition: What Revenue-IT Architecture Convergence (RIAC) Is

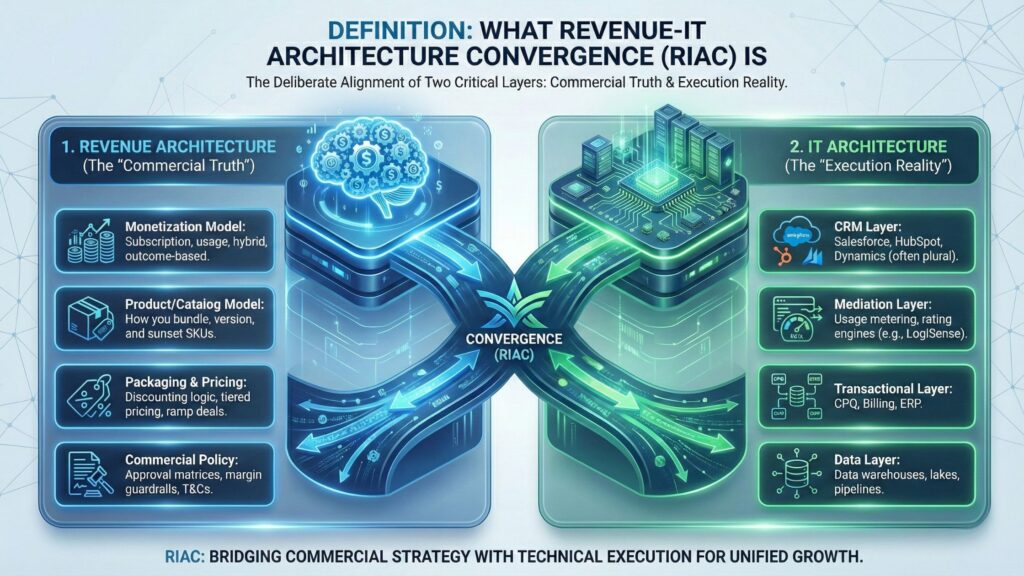

Revenue-IT Architecture Convergence (RIAC) is the deliberate alignment of two critical layers:

1. Revenue Architecture (The “Commercial Truth”)

-

Monetization Model: Subscription, usage, hybrid, outcome-based.

-

Product/Catalog Model: How you bundle, version, and sunset SKUs.

-

Packaging & Pricing: Discounting logic, tiered pricing, ramp deals.

-

Commercial Policy: Approval matrices, margin guardrails, T&Cs.

2. IT Architecture (The “Execution Reality”)

-

CRM Layer: Salesforce, HubSpot, Dynamics (often plural).

-

Mediation Layer: Usage metering, rating engines (e.g., LogiSense).

-

Transactional Layer: CPQ, Billing, ERP.

-

Data Layer: Data warehouses, lakes, pipelines.

The Core RIAC Question

Can our architecture support how we want to make money—across all CRMs and business units—at the speed the market demands?

If the honest answer is “No” or “Yes, but it takes 9 months,” you don’t have a tool problem. To clarify, you have an architecture problem.

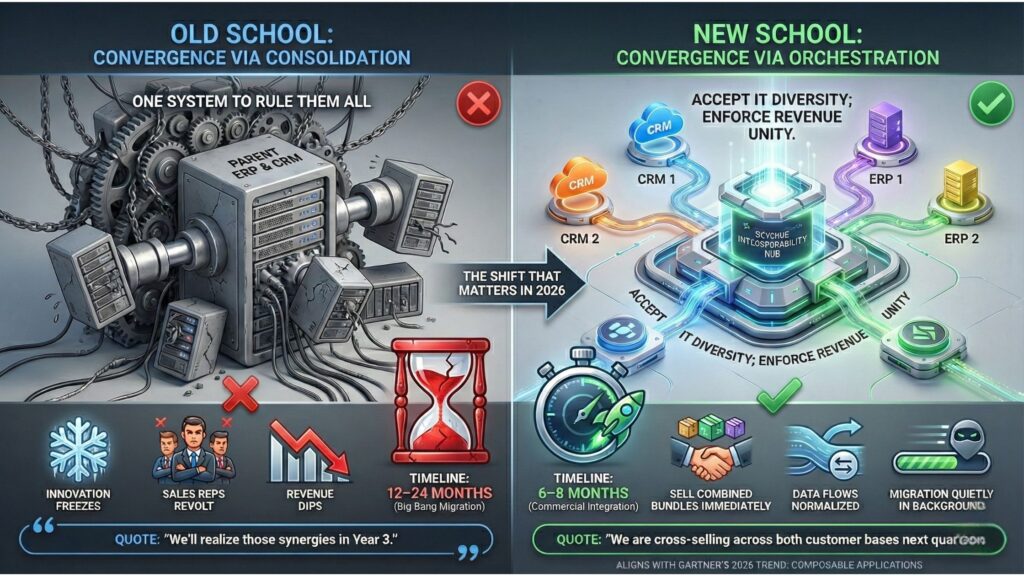

Old School vs. New School RIAC: The Shift That Matters in 2026

The path to convergence has evolved considerably.

Old School: Convergence via Consolidation

-

Philosophy: “One System to Rule Them All.”

-

Strategy: Force every acquired unit to migrate to the parent ERP and CRM immediately.

-

Timeline: 12–24 months of “Big Bang” migration.

-

Result: Innovation freezes. Also, sales reps revolt. Revenue dips during the transition.

-

Quote: “We’ll realize those synergies in Year 3.”

New School: Convergence via Orchestration

-

Philosophy: “Accept IT Diversity; Enforce Revenue Unity.”

-

Strategy: Use a Revenue Interoperability Hub (like servicePath™) to centralize the commercial logic while leaving the front-end CRMs and back-end ERPs loosely coupled.

-

Timeline: 90 days to “commercial integration.”

-

Result: You sell combined bundles immediately. Moreover, data flows are normalized. Migration happens quietly in the background (or never).

-

Quote: “We are cross-selling across both customer bases next quarter.”

This approach aligns with Gartner’s 2026 Trend of “Composable Applications,” where modularity allows for rapid reconfiguration of business capabilities (Gartner Strategic Technology Trends).

Important Note for Enterprise Architects: New School RIAC is also Antifragile. By decoupling the commercial logic from the CRM database, you future-proof your stack. Consequently, if you decide to swap Salesforce for HubSpot (or vice versa) in 2027, your pricing engine, approval workflows, and product catalog remain untouched. You swap the “spoke,” but the “hub” remains stable.

How Revenue-IT Architecture Convergence (RIAC) Impacts You

RIAC lands differently depending on your role in the organization.

For Sales Leadership / Sales Teams

-

The Win: Imagine your ability to launch new products from newly acquired acquisitions immediately.

-

The Outcome: You hit quotas and targets by driving new revenue streams from the portfolio faster than conventional methods.

-

The Synergy Accelerator:Specifically, RIAC makes the acquisition accretive faster . By cross-selling products immediately, the sum of the parts becomes greater than the whole in months, not years.

-

The Compensation Peace of Mind: Because transaction data is unified, split-crediting and attribution are automated—ensuring your reps get paid accurately for cross-selling, regardless of which CRM the deal originated in.

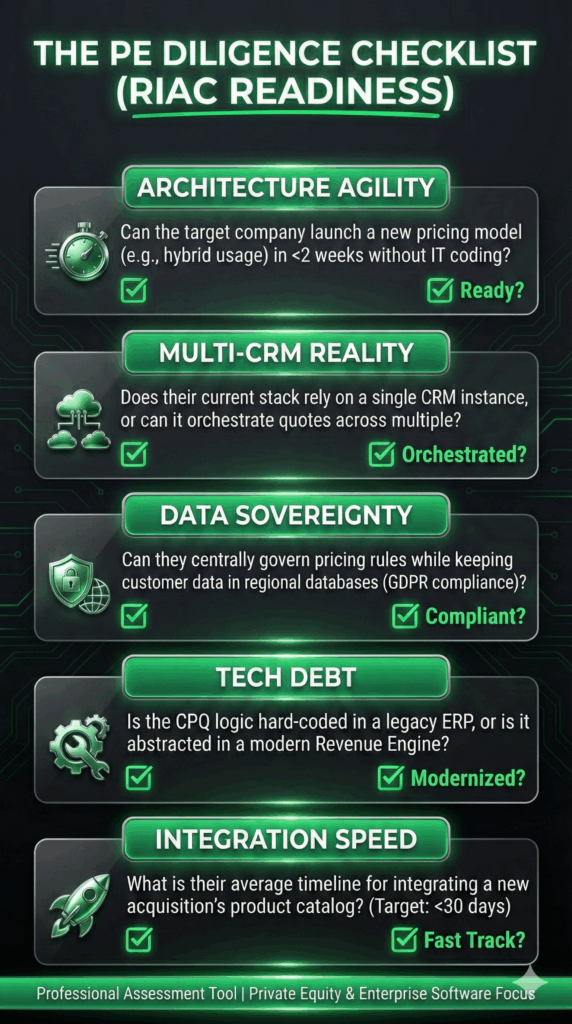

For PE Operating Partners / Corp Dev

-

The Win: Faster synergy capture. By decoupling “commercial integration” from “IT consolidation,” you can realize revenue gains months (or years) earlier.

-

The Tool: Use “RIAC Readiness” as a due diligence lens. Assess a target’s ability to plug into your revenue platform before you buy.

-

The Trend: Morgan Stanley forecasts deal volumes to rise 20% in 2026, meaning the speed of integration will be a competitive differentiator.

-

The Exit Multiplier: A clean, unified revenue architecture increases your valuation at exit. Buyers pay a premium for assets that are ‘plug-and-play’ rather than ‘fixer-uppers’ filled with tech debt.

For CFOs

-

The Win: Pricing governance without bottlenecks. In a hybrid pricing world, manual spreadsheets are a compliance risk. RIAC ensures that every quote—regardless of which CRM it came from—adheres to defined margin guardrails.

-

The Metric: Reduced revenue leakage (fewer billing errors, zero rogue discounting).

-

The Compliance Bonus: Centralizing commercial logic ensures that revenue recognition data (ASC 606 / IFRS 15) is consistent across all business units, simplifying audits.

-

The Context: Bain & Company found that companies confident in their pricing power realize a 3-11% profit margin premium (Expanding Profit Margin Through Intelligent Pricing).

For CIOs / CTOs / Enterprise Architects

-

The Win: A blueprint for Multi-CRM that doesn’t involve “spaghetti code.” It provides a clear rationale for investing in API-first, canonical data models.

-

The Relief: A way to pay down tech debt where it hurts revenue most, rather than just doing “IT for IT’s sake.”

For CRO / RevOps

-

The Win: One quoting truth across systems. No more “swivel chair” processes for reps.

-

The “Invisible” Experience: Crucially, for the sales rep, nothing changes. They stay in their familiar CRM (Salesforce, Dynamics, etc.). The orchestration happens in the background. Adoption friction is near zero.

-

The Outcome: Higher quote velocity. Reps spend time selling, not configuring.

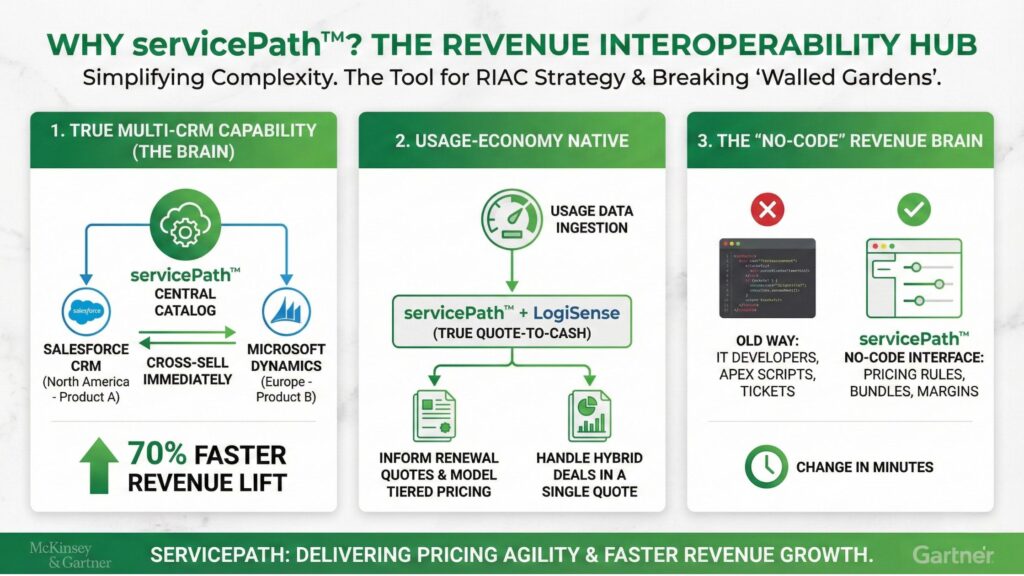

Why servicePath™? The Revenue Interoperability Hub

This brings us to the pivotal question: If Revenue-IT Architecture Convergence (RIAC) is the strategy, what is the tool?

Most CPQ vendors claim to handle complexity; however, they are built on the “Old School” model. They require you to be 100% on Salesforce, or 100% on their proprietary stack. They are “walled gardens.”

servicePath™ is different. We built our platform from the ground up as a Revenue Interoperability Hub.

1. True Multi-CRM Capability (The Brain)

We are one of the only enterprise platforms that can natively connect to multiple CRM instances simultaneously. But we do more than just connect them—we abstract and unify the local CRM product catalogs.

-

Scenario: You have a Salesforce instance in North America (Product A) and a Microsoft Dynamics instance in Europe (Product B).

-

servicePath™ Solution: We create an overarching central catalog. This allows Sales Team A to sell Product B immediately, and Sales Team B to sell Product A immediately. This cross-sell/up-sell capability drives revenue lift 70% faster than waiting for a full CRM integration .

2. Usage-Economy Native

While others are patching consumption logic onto subscription engines, we partner with leaders like LogiSense to enable true “Quote-to-Cash” for the Usage Economy. We can ingest usage data to inform renewal quotes, model complex tiered pricing, and handle “hybrid” deals (hardware + SaaS + usage) in a single quote.

3. The “No-Code” Revenue Brain

Our platform is designed for Revenue Operations, not just IT developers. For instance, you can change a pricing rule, add a new bundle, or update a margin threshold in minutes, without needing Apex scripts or developer tickets. This gives you the Pricing Agility that Bain & Company identified as a key profit driver.

We don’t just “integrate” with your stack; we converge it. We are the engine of New School RIAC.

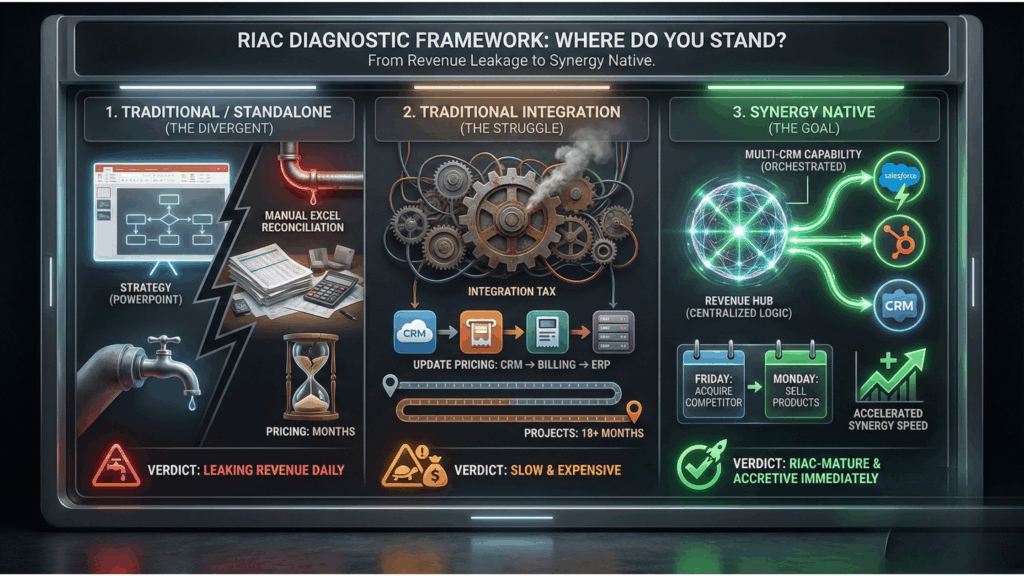

The Revenue-IT Architecture Convergence (RIAC) Diagnostic Framework

Where does your organization stand?

Archetype 1 — Traditional / Standalone (The Divergent)

-

State: You buy companies and leave them alone because integration is deemed too risky or hard. Strategy lives in PowerPoint; execution lives in silos.

-

Symptoms: Pricing changes take months to deploy. Moreover, usage data is manually reconciled in Excel before billing.

-

Verdict: You are leaking revenue every day.

Archetype 2 — Traditional Integration (The Struggle)

-

State: You attempt to consolidate everything using traditional methods.

-

Symptoms: You suffer the “Integration Tax.” You have to update pricing in the CRM, then the Billing system, then the ERP. Projects drag on for 18+ months.

-

Verdict: You are operational, but slow and expensive.

Archetype 3 — Synergy Native (The Goal)

-

State: Commercial logic is centralized and orchestrated via a Revenue Hub.

-

Symptoms: Multi-CRM capability. You can acquire a competitor on Friday and sell their products on Monday.

-

Verdict: You are RIAC-mature. As a result, you maximize synergy speed and make acquisitions accretive immediately.

Fast Self-Check: If you acquired a competitor tomorrow, could you sell a cross-portfolio bundle to both customer bases next week? If not, you are not converged.

Conclusion: Orchestration is the Strategy for 2026

2026 won’t reward the companies with the cleanest, most monolithic IT stack. Instead, it will reward the companies that can move fast.

The winners will be those who can:

-

Monetize hybrid usage models without breaking the back office.

-

Operate seamlessly across a Multi-CRM reality.

-

Integrate acquisitions without freezing innovation for a year.

Revenue-IT Architecture Convergence (RIAC) is the bridge between your strategy and your execution. Ultimately, it is the discipline that turns “Revenue Latency” into “Revenue Velocity.”

Don’t let your IT architecture dictate your revenue strategy.

Additional Resources & Next Steps

Ready to move from “Old School” consolidation to “New School” RIAC? Here is how to get started.

1. Validate the Vision See Why Gartner Named Us a Visionary (Again) For the third consecutive year, servicePath™ has been recognized as a Visionary in the Gartner® Magic Quadrant™ for CPQ Application Suites. While legacy vendors struggle with the “Usage Economy,” our architecture was built for it. 👉 Read the Gartner Report

2. Evaluate Your Tech Stack (Urgent) Is Your Current CPQ Heading for the Sunset? Salesforce has officially placed Salesforce CPQ (formerly Steelbrick) on End of Sale (EOS), with a looming End of Life (EOL) roadmap. If your revenue architecture relies on a tool that is no longer being innovated, you are accruing technical debt daily. Discover why servicePath™ is the preferred migration path for complex, high-growth enterprises. 👉 Compare: servicePath vs. Salesforce CPQ

3. See RIAC in Action Real World Case Studies Don’t just take our word for it. See how other PE-backed and enterprise organizations used our Revenue Interoperability Hub to accelerate M&A synergies and launch hybrid pricing models in weeks, not years.

-

Recovering from a Failed CPQ Implementation: Download Case Study

-

Mastering Complexity in Technology Sales: Download Whitepaper

4. Start Your Transformation Stop Guessing. Start Architecting. You don’t need another generic sales demo. You need a strategic conversation about your architecture. Book a session with a servicePath™ CPQ Architect to map your current “Revenue Latency” and design a roadmap for convergence. 👉 Schedule a Revenue Architecture Review 👉 Talk to a CPQ Architect

The PE Diligence Checklist (RIAC Readiness)

FAQ: Handling Internal Pushback

Q1: Isn’t this just RevOps? A: No. RevOps is a function (people and process). Revenue Architecture is the machine (systems and data structure). Revenue-IT Architecture Convergence (RIAC) ensures the machine is actually capable of executing the business model that RevOps designs.

Q2: We’re consolidating onto one CRM—why bother? A: Consolidation is a noble long-term goal; however, it often takes years. RIAC is how you operate profitably during reality (M&A, regional splits, phased migrations). It buys you time and agility today. As Gartner notes, many consolidation projects stall due to complexity; RIAC keeps revenue flowing regardless (Gartner predicts strong growth in worldwide IT spending by 2026).

Q3: Is this a two-year transformation? A: Absolutely not. “Old School” convergence takes two years. In contrast, “New School” RIAC starts with a 90-day proof of value focused on specific hotspots (e.g., fixing usage billing leakage or unifying a specific quote flow).

Q4: How does RIAC help with AI adoption? A: AI requires clean, structured data. If your commercial data is fragmented across 5 systems with different schemas, your AI strategy will fail. RIAC creates a “Single Commercial Truth” that AI agents can reliably access to generate quotes or analyze margins. Notably, IDC emphasizes that data readiness is the #1 blocker to AI success (FutureScape 2026).

Q5: What is the ROI? A: The ROI falls into three buckets:

- Speed: Launch new pricing models in days, not months.

- Synergy: Realize cross-sell revenue from M&A immediately.

- Savings: Reduce the “Integration Tax” of custom coding and manual data reconciliation.

Q6: How does Multi-CRM impact Sales performance? A: It turns “waiting” into “selling.” In a traditional model, sales teams often wait 12–18 months for IT to merge Salesforce instances before they can cross-sell acquired products. With Multi-CRM orchestration, Sales Team A can sell Product B immediately (and vice versa) without leaving their native CRM. This helps reps hit quotas faster, reduces territory friction, and creates immediate revenue lift (accretive value) from the acquisition .