Enterprise revenue teams are entering a new era—one defined by AI-native platforms, codeless configuration, and data models built for automation rather than legacy workflows. As Gartner’s 2026 CIO Agenda makes clear, organizations with complex products, hybrid services, and multi-region delivery must modernize their revenue systems or risk operational bottlenecks, shrinking margins, and stalled growth.

Traditional CPQ tools—especially code-heavy or CRM-dependent systems—were not designed for today’s speed, complexity, or AI requirements. They rely on rigid logic, fragmented data, and custom development to keep up with evolving service offerings. The future belongs to AI-native, codeless CPQ platforms capable of managing configuration, pricing, margin governance, and revenue lifecycle operations in one unified architecture.

This article explains what an AI-native CPQ platform is, why it matters now, and how enterprises can prepare for the next generation of quoting and revenue lifecycle automation.

Quick Q&A: Understanding AI-Native, Codeless CPQ

What is AI-native, codeless CPQ?

AI-native, codeless CPQ is a modern configure-price-quote platform designed to automate complex product configuration, pricing, quoting, and margin governance without custom code. These platforms are built on flexible, API-first data models and integrate directly with AI and large language models to support advanced pricing intelligence, configuration assistance, and automated revenue workflows.

Why do enterprises need AI-native CPQ?

Enterprises need AI-native CPQ when they manage:

-

Complex service catalogs or hybrid product/service bundles

-

Multi-region delivery with different cost structures

-

Margin-sensitive deals requiring accurate cost-to-serve data

-

Large quote volumes that cannot rely on custom-coded logic

-

Legacy CPQ tools nearing end-of-life or architectural limits

AI-native CPQ reduces operational risk, eliminates custom code maintenance, speeds up quoting, and provides real-time margin governance.

How is AI-native CPQ different from traditional CPQ?

Traditional CPQ tools rely on rigid rules engines, custom development, and static data models.

AI-native CPQ platforms provide:

-

Codeless configuration logic

-

Dynamic and flexible data models

-

AI-driven assistance for pricing and configuration

-

Deep revenue lifecycle integration (beyond quoting)

-

Lower maintenance and faster time-to-change

Where does servicePath™ fit in this new category?

servicePath™ is an AI-native enterprise CPQ and revenue lifecycle platform designed specifically for complex service providers, including MSPs, telecom operators, and tech-enabled service organizations. The platform delivers:

-

Codeless configuration and pricing logic

-

AI-ready architecture and integrations

-

Deep cost-to-serve and margin governance

-

Global catalog management

-

Unified CPQ + revenue lifecycle operations

servicePath™ enables enterprises to modernize quoting, protect margins, and operationalize AI across the entire revenue lifecycle.

TL;DR: The Revenue Yield Gap in Gartner’s 2026 CIO Agenda

Gartner’s 2026 CIO Agenda survey of 3,100 CIOs managing $351 billion in IT spending reveals a critical disconnect: 87% plan to increase AI and GenAI budgets, yet 48% of digital initiatives fail to meet business targets. The culprit? Application modernization strategies that prioritize technical transformation over revenue impact—specifically, the failure to adopt AI-native codeless CPQ architecture as the foundation for revenue intelligence.

For the approximately 6,000 organizations using SteelBrick CPQ (moved to “End-of-Sale” status on March 19, 2025), this disconnect has become existential. The modernization imperative is clear, but the path forward—migrate to Revenue Cloud Advanced or architect for AI-native revenue intelligence—will determine whether CPQ transforms from bottleneck to competitive advantage.

This isn’t about quote automation. It’s about revenue yield optimization—the North Star metric that aligns pricing confidence, deal velocity, and margin intelligence with Gartner’s top priorities: application modernization (71%), AI operationalization, and composable architecture. Bain & Company research proves pricing-confident companies achieve 3 percentage point profit margin premiums and double the revenue growth rates of pricing-reactive competitors.

The question isn’t if you’ll modernize CPQ—it’s how intelligently you’ll architect for the AI economy. AI-native codeless CPQ architecture eliminates technical debt while enabling revenue intelligence. Your revenue architecture determines whether you lead or lag.

Why Revenue Yield Is the Missing Link

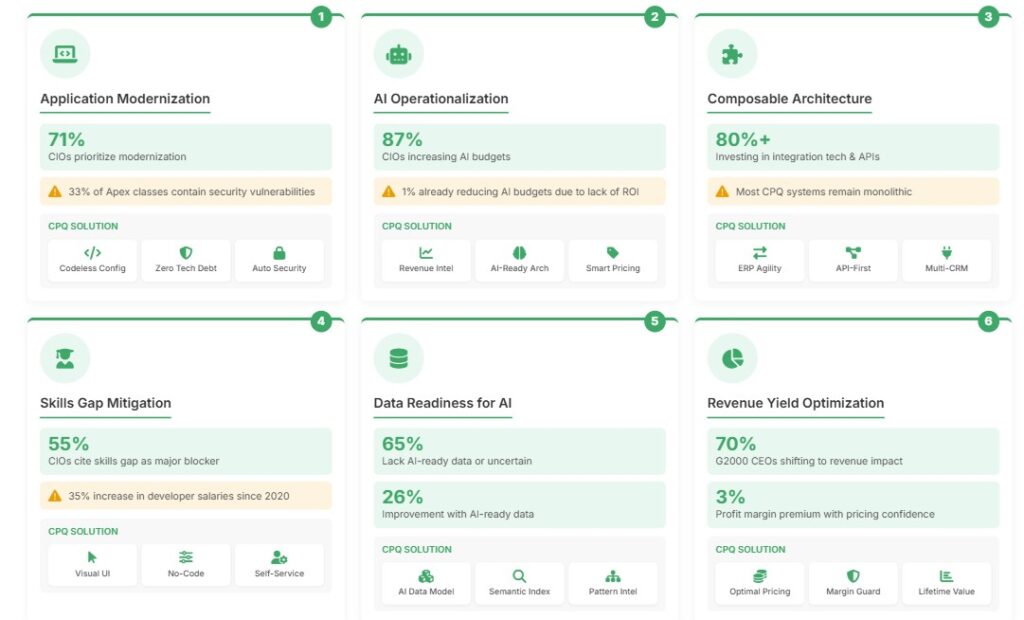

Gartner’s 2026 CIO Agenda identifies application modernization as the #1 priority for 71% of surveyed CIOs, yet the research exposes a troubling pattern: technology transformation divorced from revenue impact. While $1.5 trillion will be spent on GenAI in 2025 (rising to $2+ trillion in 2026), the fundamental question remains unanswered: how do you operationalize AI to drive measurable revenue yield?

The SteelBrick CPQ end-of-sale announcement on March 19, 2025 has created an urgent modernization mandate for approximately 6,000 organizations. But this transition represents far more than a platform migration—it’s the defining moment when enterprise leaders must choose between replicating legacy complexity or architecting for AI-native revenue intelligence.

Revenue yield optimization emerges as the North Star metric that connects Gartner’s disparate priorities into a unified strategy:

- Application Modernization (71% priority): Eliminate technical debt that blocks AI integration

- AI Operationalization: Transform CPQ from rules engine to revenue intelligence platform

- Composable Architecture (80%+ investing in integration): Enable agile revenue process evolution

- Skills Gap Mitigation (55% cite as AI blocker): Democratize configuration through codeless design

- Data Readiness (65% lack AI-ready data): Build pricing intelligence from transactional patterns

The case for AI-native codeless CPQ architecture isn’t theoretical. Bain research demonstrates that pricing-confident companies achieve 3 percentage point profit margin premiums, with 1% price improvements translating to ~6% profit gains. Forrester research shows 25-30% improvements in quote accuracy and 40% reductions in sales cycles when organizations implement intelligent CPQ architectures.

For CIOs, CFOs, and CROs navigating the SteelBrick transition, the strategic question is clear: Will your modernization strategy position CPQ as a revenue yield engine—or simply automate the bottlenecks you already have?

Gartner’s 2026 CIO Agenda: The Revenue Yield Lens

Gartner’s 2026 CIO Agenda, based on a survey of 3,100 CIOs managing $351 billion in IT spending across 88 countries, identifies six strategic priorities. Yet when viewed through a revenue yield optimization lens, these priorities reveal a critical gap: CPQ architecture.

1. Application Modernization (71% Priority): The $847 Million Technical Debt Tax

71% of CIOs prioritize application modernization, but most underestimate the hidden costs of legacy CPQ architectures. Research by Hubbl Diagnostics found that 33% of Apex classes contain security vulnerabilities and 20% of Visualforce components have critical issues—the foundation of traditional Salesforce CPQ implementations.

Consider the maintenance burden: A mid-market enterprise with 500 custom Apex classes (a modest SteelBrick deployment) faces:

- 165 classes with security vulnerabilities requiring remediation

- Ongoing monitoring of Salesforce release cycles (3x per year) for breaking changes

- Developer dependencies for every pricing logic adjustment

- Regression testing across custom code bases with each update

- Skills retention risks as Apex/Visualforce expertise becomes increasingly niche

The technical debt tax is quantifiable: At an average of $150-200/hour for Salesforce developers, maintaining, securing, and evolving a complex SteelBrick instance can exceed $500K-$1M annually—resources that deliver zero revenue impact.

This is why AI-native codeless CPQ architecture eliminates the technical debt tax entirely. Configuration becomes a business user capability, security vulnerabilities disappear with zero custom code, and AI integration happens at the data model level—not through brittle API connections to legacy systems.

2. AI Operationalization: From Tool Proliferation to Revenue Intelligence

Gartner reports that 87% of CIOs plan to increase AI and GenAI budgets, yet 1% have already begun reducing AI budgets due to tool proliferation without measurable ROI. The disconnect? AI implementations that automate tasks rather than optimize outcomes.

CPQ represents the highest-leverage AI operationalization opportunity in the revenue stack:

- Pricing Intelligence: AI models analyze historical deal patterns to recommend optimal pricing strategies

- Deal Velocity Optimization: Intelligent approval routing based on deal characteristics and stakeholder availability

- Margin Protection: Real-time analysis of discount impact on profitability across product portfolios

- Configuration Guidance: Natural language interfaces that translate sales intent into technical quotes

- Renewal Risk Prediction: Early warning systems for pricing-sensitive accounts

But here’s the constraint: AI operationalization requires AI-ready architecture. Gartner’s research reveals 65% of organizations lack AI-ready data or are uncertain about their readiness, yet those with AI-ready data achieve 26% improvement in business outcomes.

Traditional CPQ platforms treat AI as an add-on—a chatbot layer over legacy data models. AI-native codeless CPQ operationalizes revenue intelligence at the data model level: the data model is designed for LLM consumption, with natural language embeddings, semantic search capabilities, and BYOLLM (Bring Your Own Large Language Model) flexibility. When GPT-6-7 launches in 2026-2027 or Claude Sonnet 5 in 2026, your CPQ doesn’t require re-architecture—you simply swap the foundation model.

3. Composable Architecture (80%+ Investing): The Integration Imperative

Over 80% of enterprises are investing in integration technologies and APIs, yet most CPQ implementations remain monolithic systems that resist composability. The SteelBrick transition exposes this architectural weakness: organizations discover their CPQ is coupled to Salesforce in ways that make extraction and evolution prohibitively complex.

Composable CPQ architecture enables:

- ERP Agility: Migrate from NetSuite to SAP without CPQ disruption

- CRM Flexibility: Support Salesforce, HubSpot, and Microsoft Dynamics from a single CPQ instance

- Payment Orchestration: Integrate Stripe, Adyen, or emerging payment platforms without core system changes

- Analytics Independence: Feed data to Tableau, Power BI, or custom data lakes via real-time APIs

- Workflow Extensibility: Orchestrate approvals across Slack, Teams, email, or custom notification systems

The composability test is simple: Can you replace any system in your revenue stack without re-implementing CPQ logic? If the answer is no, you’re architecting technical debt into your modernization strategy.

4. Skills Gap Mitigation (55% Cite as Blocker): The Democratization Imperative

55% of CIOs cite skills gaps as a major blocker to AI initiatives. For CPQ, this manifests as the “developer bottleneck”: every pricing rule change, approval workflow adjustment, or product configuration update requires Apex/Visualforce expertise.

The scarcity economics are brutal: Salesforce developer salaries have increased 35% since 2020, with senior Apex developers commanding $150-200/hour. Organizations find themselves in a lose-lose scenario: hire expensive specialized talent or tolerate revenue process rigidity.

AI-native codeless CPQ democratizes configuration through visual interfaces. When pricing logic, approval workflows, and product configurations are expressed through visual interfaces rather than code, RevOps teams become self-sufficient. The “skills gap” transforms from a hiring problem to a capability distribution opportunity.

The business impact is immediate: Forrester research shows organizations implementing low-code/no-code solutions achieve 25-30% improvements in quote accuracy simply because business experts—not developers translating requirements—configure the logic.

5. Data Readiness for AI (65% Uncertain): The Revenue Intelligence Foundation

65% of organizations lack AI-ready data or are uncertain about their readiness, yet Gartner’s research proves organizations with AI-ready data achieve 26% improvement in business outcomes. For CPQ, “AI-ready data” means structured pricing histories, deal outcome patterns, discount impact analyses, and configuration intelligence—the raw material for revenue optimization.

Traditional CPQ platforms accumulate transactional data but lack the semantic structure that makes it AI-consumable. Quotes become database records, not learning artifacts. Pricing decisions remain tribal knowledge, not algorithmic intelligence.

AI-native CPQ architecture treats data as a strategic asset:

- Natural Language Embeddings: Every product description, pricing rule, and approval justification is semantically indexed

- Deal Pattern Recognition: ML models identify correlations between quote characteristics and win rates

- Pricing Confidence Scores: Historical data informs real-time recommendations with statistical backing

- Configuration Intelligence: AI learns from successful quotes to guide future configurations

- Margin Impact Modeling: Predictive analytics forecast profitability across deal scenarios

The difference between transactional data and revenue intelligence is architecture. AI-ready CPQ doesn’t retrofit intelligence onto legacy systems—it generates intelligence as a byproduct of every transaction.

6. Revenue Yield Optimization: The North Star Metric

While Gartner’s 2026 CIO Agenda doesn’t explicitly name “revenue yield optimization,” it emerges as the connective tissue linking all six priorities. IDC research predicts that by 2026, 70% of G2000 CEOs will shift AI ROI measurement from operational cost savings to revenue growth impact.

Revenue yield optimization reframes CPQ from a quoting tool to a strategic platform that answers:

- What is the optimal price for this customer, product mix, and competitive context?

- Which deals warrant approval complexity, and which should auto-approve based on risk profiles?

- How do we maximize margin without sacrificing win rates?

- Where are we leaving revenue on the table through pricing inconsistency?

- What configurations drive the highest customer lifetime value?

Bain & Company’s research proves the business case: pricing-confident companies achieve 3 percentage point profit margin premiums and double the revenue growth rates of pricing-reactive competitors. For a $500M revenue organization, a 3-point margin improvement translates to $15M in incremental profit—every year.

The CPQ architecture question becomes existential: Are you building a quote generation system, or a revenue yield optimization engine?

The Three Stages of AI in Enterprise Revenue Systems

Understanding where your organization sits in AI maturity determines your modernization path:

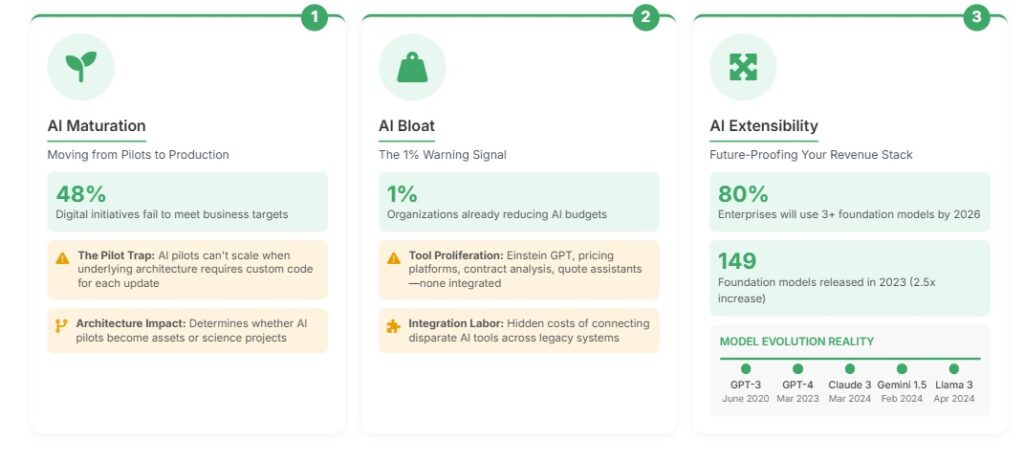

Stage 1: AI Maturation (Moving from Pilots to Production)

Organizations moving beyond experimentation face architectural decisions with decade-long consequences. Gartner’s finding that 48% of digital initiatives fail to meet business targets often traces to systems that cannot scale AI from pilot to production.

The Pilot Trap: Many organizations have successfully piloted AI in CPQ—an AI chatbot that helps sales reps find products, a pricing optimizer that runs overnight. But when they attempt enterprise rollout, the underlying code-heavy architecture collapses. If your current system requires custom code to add a single pricing rule, it cannot scale to handle hundreds of AI-recommended rules updated dynamically.

What This Means for CPQ: Architecture determines whether AI pilots become production assets or expensive science projects. Systems requiring developer intervention for every AI capability update cannot compete in markets where pricing strategies change weekly, not annually.

Stage 2: AI Bloat (The 1% Warning)

Gartner’s data showing 1% of organizations reducing AI spend is a leading indicator. “AI Bloat” occurs when organizations accumulate AI tools without integration strategy.

The Tool Proliferation Problem: A typical enterprise might have Einstein GPT in Salesforce, a standalone pricing optimization platform, a third-party contract analysis tool, and custom-built AI assistants for quote generation. Each tool requires separate training, different data pipelines, and dedicated maintenance. None talk to each other. The CFO looks at the AI invoice and asks: “Which of these tools actually increased revenue?”

What This Means for CPQ: Bolting AI features onto legacy code-heavy systems creates bloat. You end up with AI quote assistants that can’t access AI pricing engines that can’t communicate with AI approval routers. The cost isn’t just licensing fees—it’s the hidden expense of integration labor, data synchronization failures, and user confusion over which tool to use when.

Stage 3: AI Extensibility (Future-Proofing Your Revenue Stack)

Organizations positioned for long-term success build systems with BYOLLM (Bring Your Own LLM) capabilities and natural extensibility. McKinsey partners observe: “The difference between leaders and laggards often comes down to whether AI capabilities are embedded in workflows or exist as standalone tools.”

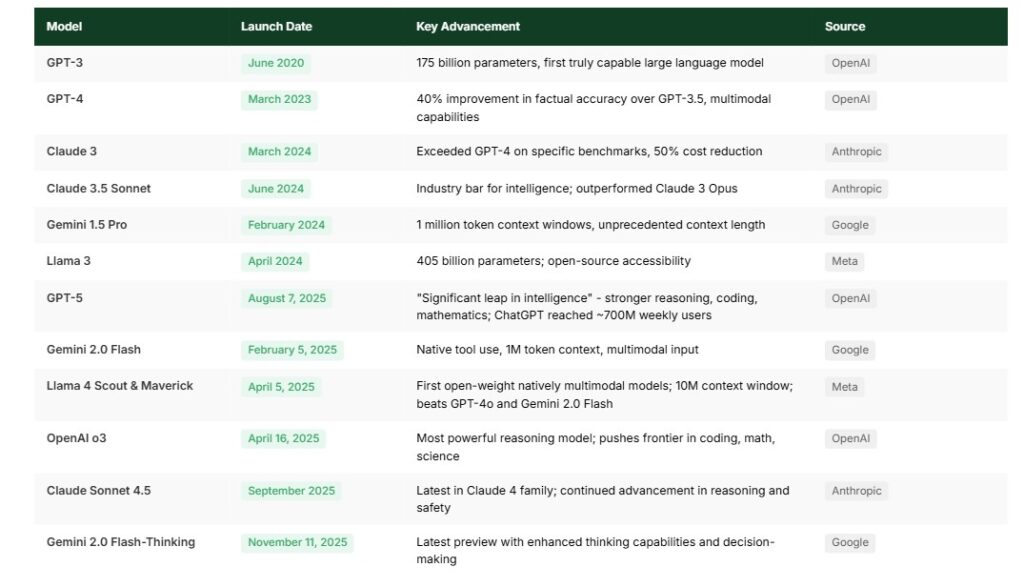

The Model Evolution Reality: GPT-3 launched in June 2020 with 175 billion parameters. GPT-4 launched in March 2023, delivering 40% improvement in factual accuracy over GPT-3.5. Claude 3 launched in March 2024, exceeding GPT-4 on specific benchmarks while offering 50% cost reduction. Gemini 1.5 Pro launched in February 2024, introducing 1 million token context windows. Llama 3 launched in April 2024, bringing 405 billion parameters to open-source. Stanford HAI reports 149 foundation models were released in 2023—a 2.5x increase from 2022. Gartner predicts 80% of enterprises will use 3+ foundation models by 2026.

Organizations that hard-coded GPT-3 integrations faced expensive and time-consuming migrations. In contrast, organizations with model-agnostic architectures simply updated an API endpoint.

The Model Evolution Reality: 2020-2025

Industry Trend: Stanford HAI reports 149 foundation models were released in 2023—a 2.5x increase from 2022. By 2025, the pace has accelerated further with multiple major releases monthly.

Migration Reality: Organizations that hard-coded GPT-3 integrations faced expensive and time-consuming migrations when GPT-4 launched. Those same organizations faced another migration cycle when GPT-5 launched in August 2025. In contrast, organizations with model-agnostic architectures simply updated an API endpoint each time.

Real-World Example: When GPT-5 launched on August 7, 2025, organizations with model-agnostic CPQ architectures switched from GPT-4 to GPT-5 over a weekend. Code-heavy systems required 4-6 month migration projects—during which competitors gained advantages from GPT-5’s enhanced reasoning capabilities.

Looking Ahead: The Model Plurality Era Accelerates

Current State (November 2025):

- Multiple model families releasing updates monthly

- OpenAI o3 and o4-mini reasoning models now available

- Claude Sonnet 4.5 competing with GPT-5

- Gemini 2.0 Flash-Thinking with latest preview

- Llama 4 proving open-source can compete with closed models

What’s Next:

- GPT-6-7: Sam Altman announced the next major model will be called “GPT-6-7” (not simply GPT-6), with no 2025 launch but potentially shorter interval than GPT-4 to GPT-5 (28 months)

- Continued rapid iteration across all major vendors

- Gartner predicts 80% of enterprises will use 3+ foundation models by 2026

Industry Perspective:

Dario Amodei (Anthropic CEO): “We’re entering the era of ‘model plurality’ where organizations will routinely deploy 5-10 different models optimized for specific tasks.”

Sequoia Capital: “The companies winning in AI are those building model-agnostic architectures. The half-life of any given model’s superiority is measured in months, not years.”

What This Means for CPQ

AI-native systems built on vector databases with native embeddings allow organizations to:

- ✅ Leverage whichever models best serve their needs (GPT-5 for reasoning, Claude Sonnet 4.5 for cost efficiency, Llama 4 for privacy)

- ✅ Swap models as the landscape evolves—which happened 10+ times in 2025 alone

- ✅ Deploy multiple models simultaneously for different use cases

- ✅ Adopt new models immediately as they emerge

Real-World Scenario:

When your CFO asks: “Should we switch to Llama 4 Maverick which beats GPT-4o at half the cost?”

- ❌ Code-Heavy CPQ: “That requires a six-month re-implementation project with our development team”

- ✅ AI-Native CPQ: “Yes, we can A/B test it this week against our current model and measure pricing accuracy”

The 2026 Challenge: With GPT-6-7, Claude 5, Gemini 3.0, and Llama 5 likely releasing in 2026, organizations with model-agnostic architectures can adopt immediately—without vendor lock-in, migration projects, or waiting for vendor roadmaps. Organizations locked into code-heavy systems will watch competitors gain 6-12 month advantages while they negotiate re-implementation budgets.

SteelBrick CPQ End-of-Sale: A Market Inflection Point

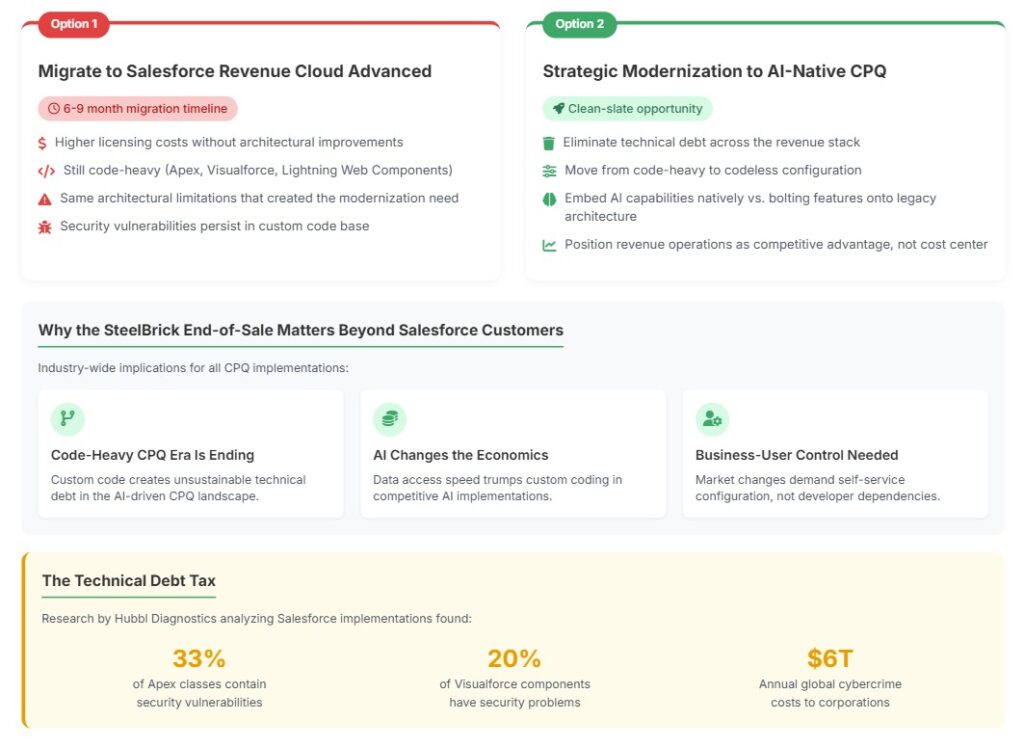

On March 19, 2025, Salesforce moved SteelBrick CPQ to “End-of-Sale” status. For the approximately 6,000 organizations running SteelBrick CPQ, this announcement forces a strategic decision:

Option 1: Migrate to Salesforce Revenue Cloud Advanced

-

6-9 month migration timeline

-

Higher licensing costs

-

Still code-heavy (Apex, Visualforce, Lightning Web Components)

-

Same architectural limitations that created the modernization need

Option 2: Strategic Modernization to AI-Native CPQ

-

Clean-slate opportunity to eliminate technical debt

-

Move from code-heavy to codeless configuration

-

Embed AI capabilities natively vs. bolting features onto legacy architecture

-

Position revenue operations as competitive advantage, not cost center

Why the SteelBrick End-of-Sale Matters Beyond Salesforce Customers

Even if you’re not a SteelBrick customer, this announcement signals a broader industry shift:

The Code-Heavy CPQ Era Is Ending: When the dominant CPQ vendor acknowledges its original architecture can’t support modern AI and automation requirements, it validates what RevOps leaders have known for years—custom code creates unsustainable technical debt.

AI Changes the Economics: Traditional CPQ systems were built when developers were the bottleneck. In the AI era, data access and integration velocity are the bottlenecks. Systems requiring custom code for every AI integration cannot compete.

Revenue Operations Demands Business-User Control: CFOs and CROs can no longer wait weeks for developer resources to configure pricing rules. When market conditions change daily, RevOps teams need self-service configuration—not engineering tickets.

The Technical Debt Tax

Research by Hubbl Diagnostics analyzing Salesforce implementations found:

- 33% of Apex classes contain security issues

- 20% of Visualforce components and triggers have security problems

Global cybercrime costs corporations $6 trillion annually. For revenue systems handling customer data, pricing logic, and deal approvals, every custom code line represents potential vulnerability.

The SteelBrick end-of-sale creates a rare opportunity: organizations can choose between replicating existing technical debt or modernizing to architectures designed for AI from day one.

Revenue Yield: The Unifying Metric That Connects AI Spend to Business Outcomes

CIOs face relentless board questions: “We’re spending millions on AI—where’s the revenue impact?” Traditional metrics fail to answer this:

- Pipeline Coverage measures opportunity volume, not revenue capture efficiency

- Win Rate ignores pricing optimization and margin erosion

- Sales Cycle Length doesn’t account for quote accuracy or approval bottlenecks

- Quota Attainment rewards volume without measuring theoretical revenue potential

Revenue Yield Formula

Revenue Yield = (Actual Revenue Captured) / (Theoretical Maximum Revenue from Installed Base)

This metric connects every AI investment to measurable revenue impact:

Three Pillars of Revenue Yield Optimization:

- Pricing Precision: AI-recommended pricing based on customer segment, competitive landscape, historical win rates, and real-time inventory/demand signals. Bain research shows pricing-confident companies achieve 3 percentage point profit margin premiums vs. competitors, with 1% price improvement typically yielding approximately 6% profit improvement.

- Quote Velocity: Eliminate manual quote generation, approval routing delays, and configuration errors. Forrester research finds modern CPQ systems enable 25-30% improvements in quote accuracy and up to 40% reductions in sales cycle time.

- Revenue Capture: Prevent leakage from manual errors, missed renewals, underpriced deals, and suboptimal product bundles. IDC projects 70% of G2000 CEOs will shift AI ROI focus from cost reduction to revenue growth by 2026.

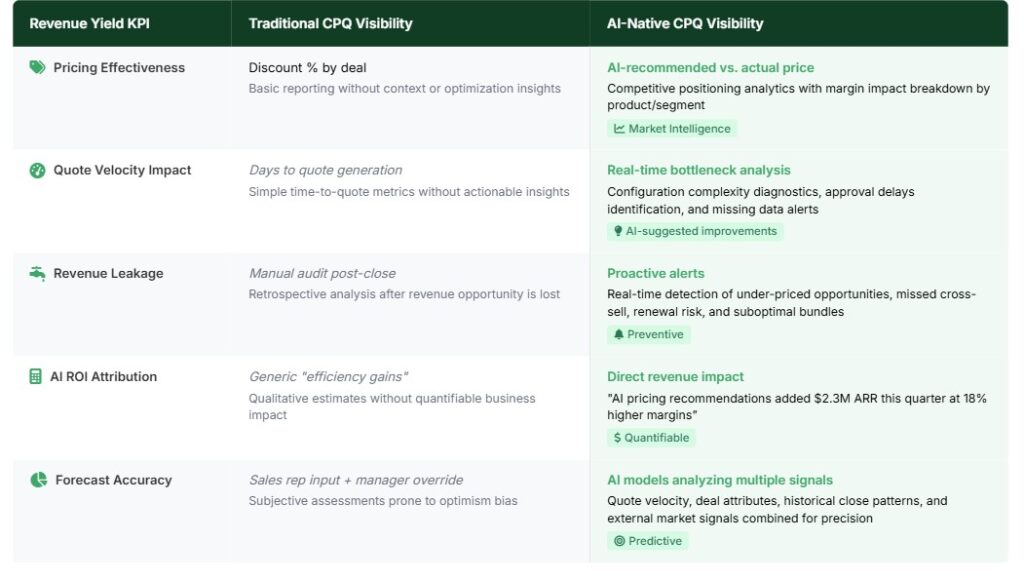

Revenue Yield Dashboard—The View CIOs Need

Traditional CPQ systems provide operational metrics (quotes generated, approval pending, discounts requested). AI-native CPQ provides strategic intelligence:

Measuring Revenue Yield: The Dashboard That Matters

When the CFO asks “What’s our AI ROI?”, Revenue Yield provides the answer: “AI-native CPQ increased revenue yield from 67% to 81%, capturing an additional $14M from existing pipeline without increasing CAC.”

The servicePath™ Approach: 9 Differentiators for AI-Native Revenue Intelligence

servicePath™ offers the only 100% codeless, AI-native CPQ architecture purpose-built for revenue yield optimization. The platform aligns directly with Gartner’s 2026 CIO Agenda through nine core differentiators:

Why AI-Native Codeless CPQ Outperforms Traditional Platforms

1. Zero-Code Architecture (Skills Gap Mitigation)

- 100% visual configuration—no Apex, no Visualforce, no custom code

- Pricing logic, approval workflows, and product rules via drag-and-drop interfaces

- RevOps teams become self-sufficient, eliminating developer bottlenecks

- Zero security vulnerabilities from custom code (addressing Hubbl’s 33% Apex vulnerability finding)

2. AI-Native Data Architecture (AI Operationalization)

- Built on RavenDB with natural language embeddings and semantic indexing

- Data models designed for LLM consumption from inception

- Real-time revenue intelligence as a byproduct of every transaction

- 26% business outcome improvement (per Gartner’s AI-ready data research)

3. BYOLLM Flexibility (Future-Proofing)

- Bring Your Own Large Language Model: Choose GPT-5, Claude Sonnet 4.5, Gemini 2.0, Llama 4, or any foundation model

- Swap models via configuration as technology evolves (no re-architecture required)

- Avoid vendor lock-in to any single LLM ecosystem

4. Composable Architecture (Integration Imperative)

- Platform-agnostic: Integrates with Salesforce, HubSpot, Microsoft Dynamics, or any CRM

- 2,000+ pre-built integrations via Integration Hub

- Replace any system in your revenue stack without CPQ disruption

- Real-time data synchronization across ERP, billing, analytics platforms

5. Revenue Yield Analytics (North Star Metric Focus)

- Real-time dashboards showing margin optimization, win rate correlation, and price realization

- AI-driven pricing recommendations with statistical confidence scores

- Deal velocity intelligence identifying bottlenecks and acceleration opportunities

- Configuration upsell suggestions based on customer LTV patterns

6. Natural Language Interaction (User Experience Revolution)

- Sales reps interact with CPQ via conversational interfaces

- Example: “Create a 3-year enterprise SaaS quote with 20% growth in year 2 and premium support”

- AI translates intent into configured quotes with appropriate pricing, approvals, and workflows

7. Intelligent Approval Orchestration (Deal Velocity Optimization)

- Dynamic approval routing based on deal risk profiles, not rigid hierarchies

- Auto-approve quotes within confidence bands, escalate outliers

- Parallel approval workflows for complex deals

- Stakeholder availability intelligence (route to available approvers)

8. Pricing Intelligence Engine (Margin Protection)

- ML models trained on historical deal outcomes

- Discount impact prediction before quote submission

- Competitive pricing alerts when quotes fall outside market ranges

- Customer segment optimization (pricing by industry, size, geography)

9. G2 Winter 2025 Recognition (Market Validation)

servicePath™ earned multiple G2 Winter 2025 awards:

- Momentum Leader (fastest-growing CPQ platform)

- High Performer Americas

- High Performer Enterprise

- Easiest to Do Business With Enterprise

- Easiest to Use Enterprise

These awards reflect real user experiences—not vendor marketing—validating that AI-native, codeless CPQ delivers measurable business impact.

Where servicePath™ Fits in the New Revenue Stack

Modern revenue operations require integrated platforms, not point solutions. The table below illustrates how AI-native CPQ addresses traditional stack pain points while aligning with Gartner’s 2026 priorities:

Conclusion: The Revenue Architecture Imperative

Gartner’s 2026 CIO Agenda reveals a critical truth: technology transformation without revenue impact is investment without return. 87% of CIOs are increasing AI budgets, yet 48% of digital initiatives fail to meet business targets. The missing link is revenue yield optimization—the strategic framework that aligns application modernization, AI operationalization, and composable architecture with measurable business outcomes.

For the approximately 6,000 organizations navigating the SteelBrick CPQ end-of-sale transition, this moment represents far more than a vendor-mandated upgrade. The choice between legacy complexity and AI-native codeless CPQ determines competitive position.

The evidence is clear:

- Pricing-confident companies achieve 3 percentage point profit margin premiums (Bain)

- 1% price improvement translates to ~6% profit gains (Bain)

- Organizations with AI-ready data achieve 26% improvement in business outcomes (Gartner)

- Intelligent CPQ delivers 25-30% quote accuracy improvements and 40% sales cycle reductions (Forrester)

- Code-based CPQ implementations carry $500K-$1M annual maintenance burdens (Gartner TCO)

The architectural question is existential: Will your CPQ modernization strategy position you as a revenue yield leader—or perpetuate the quote automation constraints that created the SteelBrick complexity in the first place?

The AI economy rewards intelligence, agility, and composability. Revenue Cloud Advanced offers incremental improvements to familiar architectures. AI-native, codeless CPQ offers transformational revenue intelligence.

Your revenue architecture determines whether you lead or lag. Choose wisely.

Transform Your Revenue Architecture: Next Steps With servicePath™

The gap between AI investment and revenue impact isn’t closing by itself. As Gartner’s 2026 CIO Agenda makes clear, application modernization and AI operationalization are inseparable—and your CPQ architecture sits at the intersection of both.

Whether you’re navigating the SteelBrick transition or evaluating your current CPQ’s readiness for the AI economy, servicePath™ offers the only AI-native, codeless CPQ architecture purpose-built for revenue yield optimization.

Explore Our Strategic Resources

📚 Dive Into Our Blog Library

Stay ahead of CPQ evolution, AI-native architecture, and revenue optimization strategies. Our thought leadership covers everything from SteelBrick modernization to pricing intelligence and composable CPQ design.

📊 Download Case Studies & ROI Evidence

See how enterprise leaders achieved 40% reductions in sales cycles, 25-30% improvements in quote accuracy, and eliminated millions in technical debt—all with zero-code implementations.

📖 Access Whitepapers & Resource Library

Get in-depth guides on AI-native CPQ architecture, revenue yield frameworks, integration strategies, and modernization roadmaps designed for CIOs, CROs, and RevOps leaders.

→ Browse Resources & Whitepapers

Take Action: Connect With Our Team

🏗️ Talk to a Sales Architect

Every enterprise has unique revenue processes, integration ecosystems, and AI maturity levels. Our sales architects don’t pitch—they design. Schedule a consultative session to map your current state, identify gaps, and architect your AI-native CPQ roadmap.

→ Connect With a Sales Architect

🚀 Book a Live Demo

Experience AI-native, codeless CPQ in action. See how servicePath™ handles complex pricing logic, dynamic approvals, multi-entity quoting, and revenue analytics—all without a single line of code. Watch BYOLLM (Bring Your Own LLM) integrate your chosen foundation model in real time.

Your next move determines whether CPQ remains a quote tool—or becomes your revenue yield competitive advantage.

servicePath™ | AI-Native, Codeless CPQ Architecture | Purpose-Built for Revenue Yield Optimization

Complete Citation Reference List

Gartner Research

- Gartner 2026 CIO Agenda

- What It Takes to Run AI Successfully

- Gartner IT Spending Forecast 2025

- Foundation Models Prediction

- Low-Code Application Development

SteelBrick/Salesforce

Bain & Company

McKinsey

AI Model Research

- OpenAI GPT-3 Research

- OpenAI GPT-4 Research

- Anthropic Claude 3 Family

- Google Gemini 1.5 Pro

- Meta Llama 3

- Stanford HAI 2024 AI Index Report

FAQ: Addressing the Five Questions Boards Are Asking

1. “We’ve already invested millions in our current CPQ. Why would we start over?”

The sunk cost fallacy is expensive. Legacy code-heavy CPQ systems face compounding technical debt—every custom Apex class requires maintenance when Salesforce releases three major updates annually. Business users cannot configure pricing rules without developer resources, creating 6-12 month backlogs. Bolting AI onto code-heavy systems creates “AI Bloat”—tools that can’t share data or integrate.

The Reality: Configuration tasks requiring 40 developer hours can be completed by RevOps users in minutes with codeless architecture. When your pricing analyst deploys AI-recommended strategies in minutes instead of months, time-to-value transforms from quarters to weeks.

2. “How do we know AI recommendations won’t hallucinate pricing that destroys margins?”

Valid concern. servicePath™ implements multi-layer AI safety:

Explainable AI: Every recommendation includes reasoning—”Recommended 12% discount because: (1) comparable deals closed at 10-15%, (2) customer’s budget cycle ends this quarter, (3) competitor bid at 15%.”

Finance Guardrails: AI operates within configured boundaries. If minimum margin is 35%, AI never recommends below that threshold. When finance rejects a recommendation, the system learns. Bain research shows 1% price improvement yields approximately 6% profit improvement—precision matters.

3. “Our sales reps barely use the CPQ we have. Why would AI-native be different?”

Rep adoption failure traces to friction. Traditional CPQ punishes reps with complex wizards, mandatory fields for unavailable data, and black-hole approvals.

AI-native CPQ inverts this: Natural language input generates accurate quotes. Systems pre-fill data from CRM and usage patterns—reps confirm rather than hunt. Real-time validation catches conflicts before quote generation. G2 reviews highlight “ease of use” and “rep adoption” as servicePath™ differentiators.

4. “What’s the real implementation timeline?”

Implementation speed depends on catalog complexity, integration scope, and business process redesign. Unlike code-heavy CPQ requiring developers for configuration, codeless platforms enable business users to validate pricing rules and workflows directly. Research shows 70% of new enterprise applications will use no-code/low-code by 2025, driven by faster deployment.

servicePath™ Advantage: 2,000+ pre-built integrations eliminate custom development. Codeless configuration means business users validate without developer sprints. AI-assisted data migration reduces manual mapping.

5. “How do we avoid vendor lock-in?”

Lock-in stems from proprietary data formats, platform-specific code, and specialized skills.

servicePath™ Prevents Lock-In: Open data standards (JSON, CSV, REST APIs). API-first architecture using industry protocols—not proprietary SDKs. BYOLLM capability means swapping from GPT-4 to Claude requires configuration change, not re-implementation. Codeless configuration uses visual tools—skills transfer across platforms.

The Irony: Organizations fear vendor lock-in, then choose code-heavy platforms that lock them into developer dependencies and technical debt. True lock-in isn’t the vendor—it’s the architecture.