TL;DR — AI continuum CPQ strategy in one minute

AI continuum CPQ strategy lets enterprises capture AI’s upside without losing control of pricing or customer data. With 78% of orgs already using AI (McKinsey) and $67.4B lost to hallucinations in 2024 (Nova Spivack), winners anchor AI to audited systems of record (CPQ/CRM) and treat AI as a querying layer, preserving accuracy, auditability, and data sovereignty.

Executive summary — why an AI continuum CPQ strategy matters now

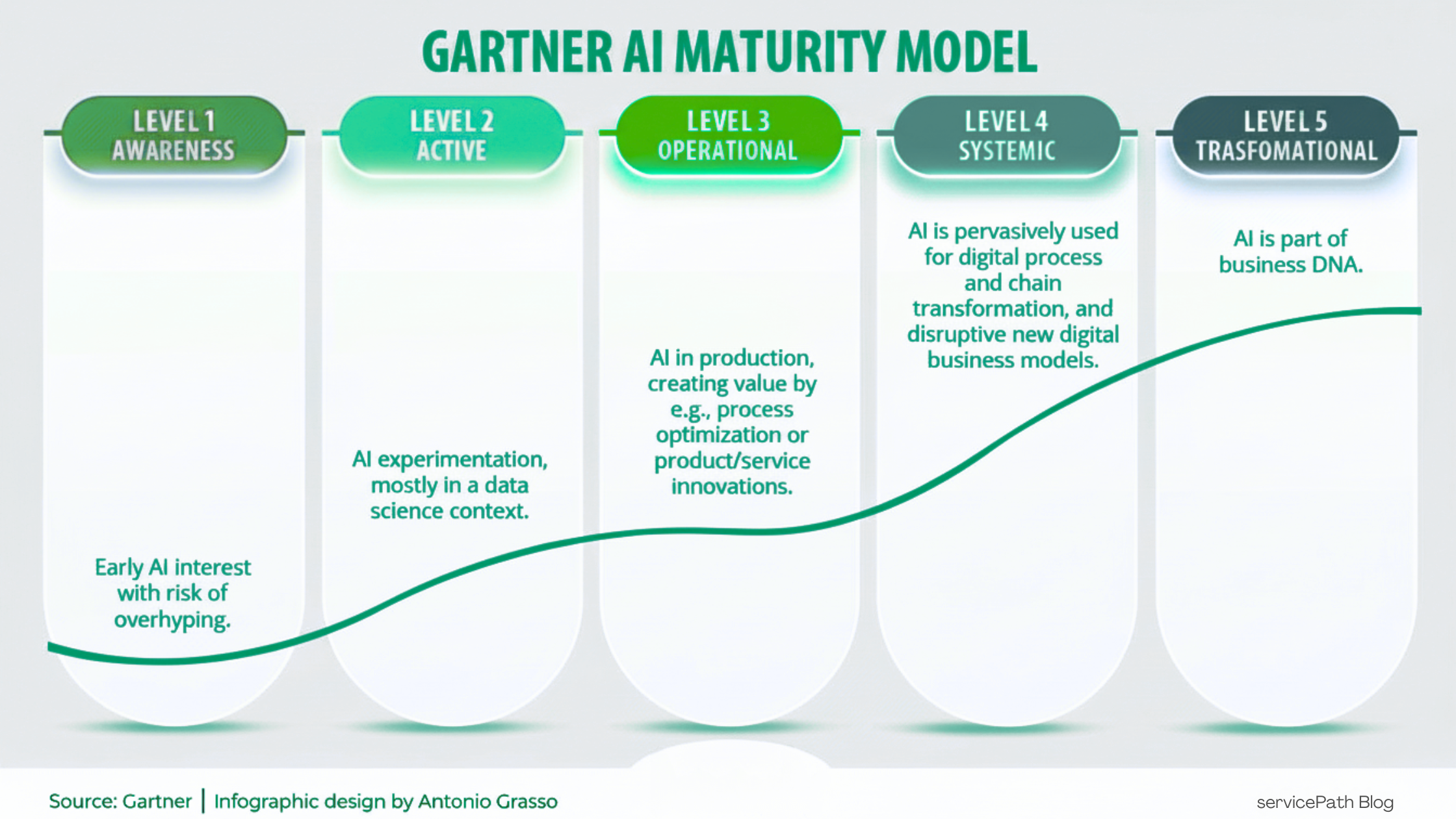

AI has moved beyond experimentation into mainstream deployment. 72% of CEOs say proprietary data is the key to GenAI value (IBM 2025 CEO Study), and 78% of organizations report using AI in at least one business function (McKinsey). Meanwhile, enterprises are consolidating spend into core IT and business-unit budgets, and ~37% now operate 5+ models, elevating the need for a governed truth layer (a16z Enterprise AI 2025). Production is rising but value remains uneven—only ~31% of use cases reached full production in 2025 (double 2024), and governance gaps remain (ISG: State of Enterprise AI 2025). The practical response: treat AI as a querying layer over audited systems of record (CPQ/CRM/ERP) and enforce role-based access control, zero data retention, encryption, and immutable logs from day one. Default+3IBM Newsroom+3McKinsey & Company+3

Where servicePath™ fits: anchor AI to a CPQ system of record so every answer is fast, accurate, and auditable—without copying sensitive pricing logic into third-party models. See examples: servicePath case studies. servicepath.co

The AI landscape — adoption facts shaping your AI continuum CPQ strategy

Current adoption metrics for an AI continuum CPQ strategy

- Adoption: 78% of organizations use AI in at least one function (McKinsey). McKinsey & Company

- Budget shift / model sprawl: AI spend has graduated from “innovation” pools to core IT/business line items; ~37% of enterprises now run 5+ models (a16z). Andreessen Horowitz

- Execution gap: Only ~31% of use cases are fully in production; outcomes still lag ambition (ISG). Default

- Risk: $67.4B global bill from hallucinations/misuse in 2024 (Nova Spivack). Nova Spivack | Explorer

- CPQ market: scaling fast as the AI-ready revenue core; expected to grow ~$3.5B (2025–2029) at ~16.9% CAGR (Technavio CPQ Market Analysis). Technavio

What it means: Adoption ≠ maturity. Multi-model stacks and rising risk make CPQ-anchored architectures with audit trails and zero-retention/role-based controls non-negotiable.

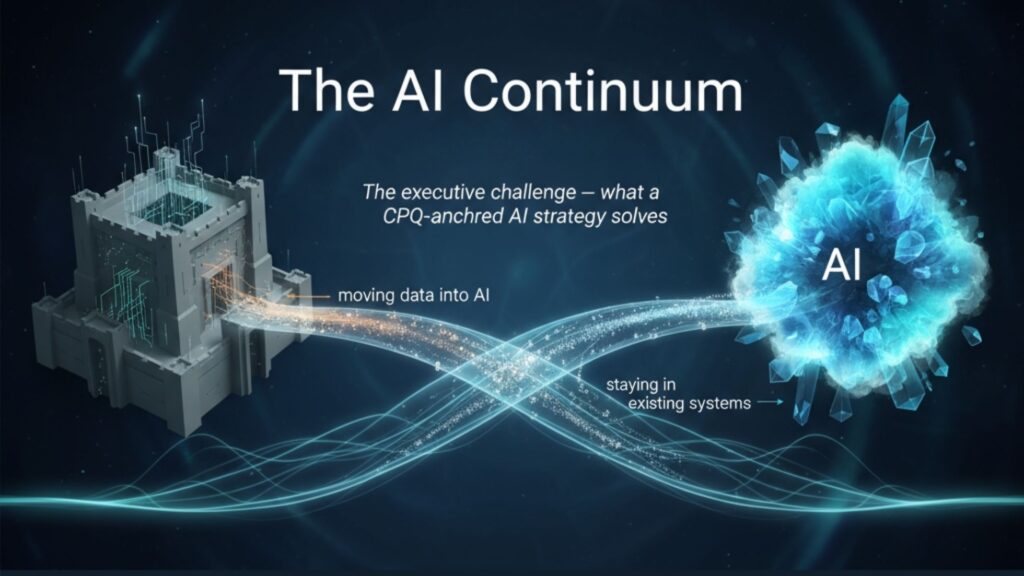

The executive challenge — what a CPQ-anchored AI strategy solves

Artificial Intelligence isn’t a destination; it’s a continuum. For senior leaders, the pressure to “adopt AI” is immense, often creating more confusion than clarity. The conversation quickly turns to large language models (LLMs) and generative tools, sparking a critical, yet often overlooked, question: Where should our most valuable enterprise data sleep?

Do you move it into the AI, or does it stay in your existing systems? The answer will define the success and security of your AI strategy, particularly in the complex world of technical sales and enablement.

The market dynamics are staggering. Andreessen Horowitz’s 2025 enterprise CIO survey reveals that AI budgets grew 75% beyond already high forecasts, with one CIO noting, “what I spent in 2023 I now spend in a week.” The global AI market reached $391 billion in 2025 and is projected to surge to $1.81 trillion by 2030, representing a compound annual growth rate exceeding 35%.

Yet here’s what should keep every executive awake at night: Gartner’s 2025 CEO Survey reveals that 77% of global CEOs believe their executive teams lack AI savviness, while IBM’s research shows that 68% of CEOs say AI changes aspects of their business they consider core.

“The AI continuum represents the biggest strategic inflection point I’ve seen in my career,” observes Daniel Kube, CEO of servicePath™. “It’s not about adopting AI faster than your competitors—it’s about adopting it smarter. The enterprises that succeed will be those who understand that their data architecture is their competitive moat, not just their AI tools.”

The Danger of a Data Free-for-All

The temptation to pour your enterprise data—pricing structures, product configurations, customer histories, and quoting logic—directly into a third-party AI is understandable. It seems like the fastest path to innovation. However, this approach is fraught with risk. Letting your core data “sleep” inside an external AI model is like giving away the keys to your most valuable asset.

The financial devastation from rushed AI implementations has become undeniable. Comprehensive studies reveal that AI hallucinations alone cost enterprises $67.4 billion globally in 2024, with 47% of business leaders admitting they’ve made major decisions based on incorrect AI outputs (Nova Spivack).

“We’re seeing a disturbing pattern where companies are so eager to implement AI that they’re bypassing fundamental data governance principles,” warns Marc Benioff, CEO of Salesforce. “AI is the ultimate amplifier of human intelligence, but it can only be as good as the data it accesses and the systems that govern that access.”

For CFOs tracking financial performance, the numbers paint a stark picture. Grant Thornton’s 2025 CFO Survey found that while 77% of CFOs report a 2x ROI from Gen AI investments, only 52% of organizations are realizing value from generative AI beyond cost reduction. This gap between promise and performance reflects fundamental architectural flaws in how enterprises approach AI integration.

Loss of Control

Your proprietary data is now part of their system, subject to their terms, their security protocols, and their potential vulnerabilities. Kyriba’s 2025 US CFO Survey reveals that 78% of CFOs report major concerns about security and privacy risks in AI, with data governance failures ranking as the top barrier to AI investment.

CFO Lens: Control and liability go hand-in-hand. If data leaves your governed system of record, risk compounds—financially and legally.

Risk of Inaccuracy

LLMs can “hallucinate”—producing plausible but incorrect information. When it comes to complex quotes and technical specifications, a plausible error can cost you millions, damage customer trust, and create contractual nightmares. ISG’s State of Enterprise AI Adoption Report 2025 shows that while 31% of AI use cases reached full production (double from 2024), expectations that AI would cut costs have largely proven incorrect.

CMO Perspective: An AI that confidently misquotes your pricing isn’t just wrong — it’s brand-damaging.

Security & IP Leaks

Your unique business logic and competitive pricing strategies become training data, potentially exposed or leveraged in ways you never intended. This represents not just a security breach, but a transfer of competitive advantage to third parties.

Your data is not just a resource; it’s the structured, curated result of years of business operations. It needs a secure home, not a public playground.

“Every enterprise leader needs to understand that their data isn’t just information—it’s their competitive DNA,” explains Daniel Kube, CEO of servicePath™. “When you put that DNA into a third-party AI system, you’re essentially giving your competitors access to decades of hard-won business intelligence. The AI continuum demands a smarter approach.”

Your Systems of Record: The Safe Harbor for Data

The most effective and secure strategy is to keep your data where it belongs: in your existing, trusted systems of record. For sales organizations, this is your Configure, Price, Quote (CPQ) platform and your CRM. These systems are the bedrock of your revenue operations because they are the verifiable source of truth, built with enterprise-grade security and the structure needed to maintain data integrity.

Market Validation for the CPQ-Centric Strategy

Global CPQ software market: $3.1B (2024) → $8.9B (2032); 14.2% CAGR (Technavio)

2025–2029 growth of $3.5B, 16.9% CAGR (Technavio)

For CIOs evaluating infrastructure investments, this isn’t just growth—it’s recognition that CPQ platforms serve as the foundation for AI-ready revenue operations. PROS’s Future of CPQ Trends Report 2025 identifies five critical trends: integrated data systems, hybrid selling, simplified configurations, automated quote generation, and AI-native architectures.

“The companies winning with AI aren’t those putting their data into AI systems,” notes Satya Nadella, CEO of Microsoft. “They’re the ones building AI that can intelligently access their secure, well-governed data repositories. The platform is the strategy.”

Bottom line: AI should not be a new database for your core logic. Instead, it should be an intelligent layer that accesses this source of truth in a controlled, secure manner.

The financial case is compelling: enterprises with high-performing IT organizations have up to 35% higher revenue growth and 10% higher profit margins (BCG, 2025). This advantage compounds when AI capabilities are built on secure, reliable data foundations rather than ad-hoc integrations with external systems.

The boardroom test — audit trails for an AI continuum CPQ strategy

In enterprise sales, the audit trail is non-negotiable: who quoted what price, when it was approved, and which contract version was sent. This chain of custody underpins compliance, revenue recognition, and governance.

Modern quoting is a multi-system process (CRM, ERP, PLM, CPQ). Each node adds integration risk. Introducing an unmanaged public LLM into that flow can break the chain of custody and create gaps your auditors can’t certify.

BCG’s 2025 research shows successful AI programs devote ~70% of effort to people, processes, and governance—not tech alone. If one node is a public LLM with opaque data policies, the entire transformation becomes vulnerable.

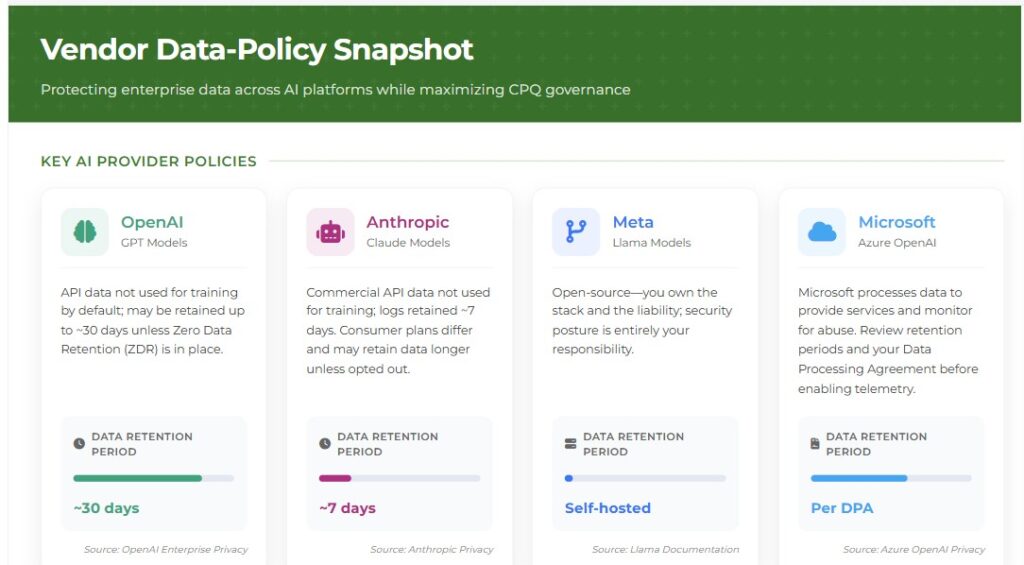

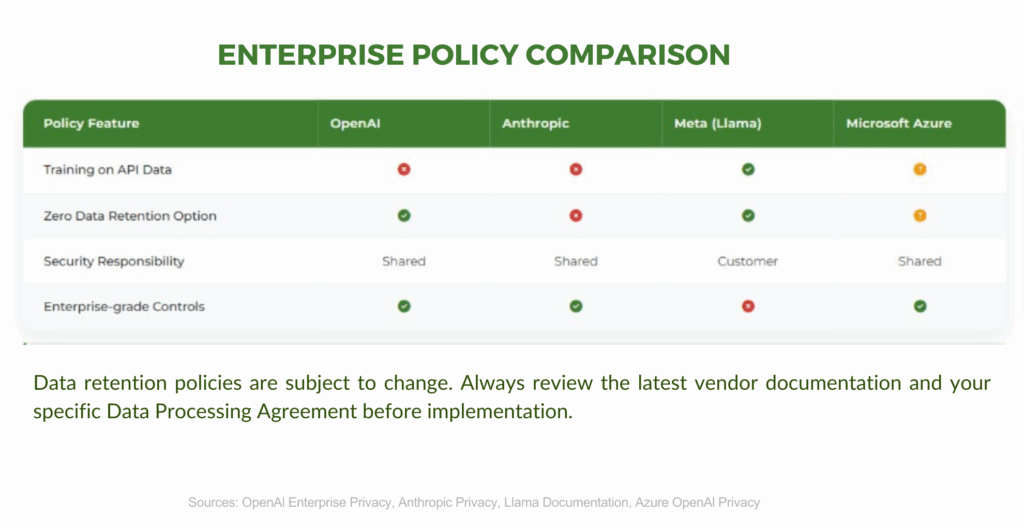

Vendor Data-Policy Snapshot for CPQ-Governed AI

- OpenAI (GPT): API data not used for training by default; may be retained up to ~30 days unless Zero Data Retention (ZDR) is in place. Source: OpenAI Enterprise Privacy

- Anthropic (Claude): Commercial API data not used for training; logs retained ~7 days. Consumer plans differ and may retain data longer unless opted out. Source: Anthropic Privacy

- Meta (Llama): Open-source—you own the stack and the liability; security posture is entirely your responsibility. Source: Llama Documentation

- Microsoft Azure OpenAI: Microsoft processes data to provide services and monitor for abuse. Review retention periods and your Data Processing Agreement before enabling telemetry. Source: Azure OpenAI Privacy

The Board Reality Check

Would directors approve sending your pricing book, customer list, and roadmap to a third party that may retain data for ~30 days (or more under certain plans) with ambiguous reuse terms? That’s an audit gap and a governance risk most boards won’t accept.

“This is a time when you should be getting benefits from AI—and hope your competitors are just experimenting. But getting benefits requires getting the fundamentals right first.” — Erik Brynjolfsson, Stanford

While 31% of AI use cases are now in production according to McKinsey, successful outcomes require solid governance foundations.

The Governance Solution (What to Adopt, What to Avoid)

✅ Adopt: Query-Over-Truth Architecture Keep your core pricing, configuration, and customer data in your CPQ and CRM systems. Let AI query these systems through governed APIs. This preserves data immutability, maintains approval workflows, and scales as your organization adopts multiple AI models—which 37% of companies now do according to a16z research.

❌ Avoid: Copy-and-Paste Data Export Exporting price books or customer histories directly into third-party AI models increases data exposure risk, breaks separation of duties controls, and complicates SOX compliance attestations.

Bottom Line for Leadership

Treat AI as the interface, not the database. Anchor all AI-generated content to your audited CPQ and CRM systems, require zero retention at external AI services, and log every AI interaction. This approach captures AI’s productivity benefits without creating audit gaps or intellectual property exposure.

The companies succeeding with enterprise AI aren’t necessarily using the most advanced models—they’re the ones maintaining control of their data while accelerating their processes.

“Winners put data governance at the center of their AI strategy, not as an afterthought.” — Ruth Porat, CFO, Alphabet

Ready to Secure Your AI Future? Start Here

See servicePath™ in Action

Watch AI-powered quoting that actually works—without putting your data at risk. Our 15-minute demo shows you exactly how to get AI benefits while keeping your pricing and customer data secure.

Let’s Talk Strategy

Tired of AI solutions that put your data at risk? Our team helps you build AI strategies that actually protect what matters most—your competitive advantage .Contact Us

Get Smarter About AI

Skip the hype. Our blog cuts through AI marketing noise with real insights from leaders who’ve actually implemented secure AI strategies. Read Our Insights

See the Results

Real companies, real numbers. Our case studies show 60% faster quoting and 99.9% pricing accuracy—without giving data away to third parties. View Case Studies

Download Our Guides

Get the playbooks that help executives make smart AI decisions. ROI calculators, risk frameworks, and migration guides—all free. Get Your Guides

Speak the Language

Lost in AI terminology? Our glossary translates tech speak into plain English so you can lead confident discussions. Browse Our Glossary

Leaving Salesforce CPQ?

With Salesforce CPQ sunsetting and enterprises seeking more flexible, AI-ready solutions, thousands are looking for better alternatives. See why servicePath™ is the top choice for AI-ready enterprises. Explore Alternatives

Don’t let AI put your most valuable data at risk. servicePath™ gives you AI benefits with real security. Ready to get started?

FAQs — the AI continuum CPQ strategy leaders ask about

Q1: How can we measure ROI from AI investments while maintaining data security?

The key is implementing AI that augments governed workflows rather than replacing them. Track: time-to-quote, approval rework, pricing accuracy, sales-cycle length, and gross margin — all within your CPQ audit trail. Enterprises report strong ROI when AI is anchored to systems of record, not ad-hoc tools.

Q2: What’s the real difference between putting data in AI systems versus keeping it in our CPQ platform?

Control and liability. Third-party models apply their own retention and terms; your CPQ gives you RBAC, auditable workflows, and ZDR options at the integration layer. For example: OpenAI API data isn’t used for training by default but can be retained up to ~30 days without Zero Data Retention; Anthropic API defaults to no training with ~7-day logs (consumer plans differ). Keeping data in CPQ and letting AI query it balances innovation with protection.

Q3: How do we convince our board that we need an AI-ready CPQ platform now?

Present the growth + risk case: CPQ is expanding at ~16.9% CAGR through 2029; AI spend is shifting from “innovation” to core IT budgets; regulation is tightening. Frame CPQ as critical infrastructure that prevents costly AI-related errors and preserves auditability.

Q4: If everyone adopts AI-enhanced CPQ, where’s our moat?

It shifts from tools to implementation quality and data governance. Enterprises with high-performing IT capture outsized growth because they operationalize technology end-to-end — clean data, strong business rules, disciplined change management, and rapid iteration.

Q5: How do we prepare for agentic AI systems that make autonomous decisions?

Start now with bulletproof governance in CPQ: explicit business rules, approvals, citations in outputs, and human-in-the-loop for exceptions. As agentic AI scales, the winners will be those whose agents operate on audited truths rather than best-guess data.

Citations, Facts, and Sources

Primary Research Sources:

- IBM – 2025 CEO Study – CEO priorities and AI governance insights

- Andreessen Horowitz – AI Enterprise 2025 – CIO survey and enterprise AI adoption trends

- McKinsey – AI Statistics – 78% AI adoption rate

- Nova Spivack – The Hidden Cost Crisis – $67.4 billion AI hallucination costs

Market Analysis and Projections:

- Market Growth Reports – CPQ Software Market – CPQ market size and forecasts

- Technavio – CPQ Market Analysis – Growth projections through 2029

- PROS – Future of CPQ Trends 2025 – Industry trend analysis

Executive Leadership Research:

- Gartner – CEO Survey Press Release – Executive AI readiness

- Salesforce – CFO AI Investment Research – CFO perspectives on AI ROI

- BCG – AI ROI for Finance Leaders – Financial impact analysis

Risk and Security Analysis:

- Kyriba – US CFO 2025 Survey – CFO security concerns

- ISG – State of Enterprise AI 2025 – Enterprise adoption maturity

-

IBM 2025 CEO Study: https://newsroom.ibm.com/2025-05-06-ibm-study-ceos-double-down-on-ai-while-navigating-enterprise-hurdles

-

McKinsey State of AI 2025 (PDF): https://www.mckinsey.com/~/media/mckinsey/business%20functions/quantumblack/our%20insights/the%20state%20of%20ai/2025/the-state-of-ai-how-organizations-are-rewiring-to-capture-value_final.pdf

Others

-

a16z Enterprise AI 2025: https://a16z.com/ai-enterprise-2025/

- servicePath — Case Studies: https://servicepath.co/case-studies/