Executive Summary

The SteelBrick CPQ sunset is here. On March 19, 2025, SteelBrick-lineage Salesforce CPQ moved to End-of-Sale for new purchases and upgrades. Innovation now centers on Revenue Cloud Advanced and Revenue Cloud Billing (SalesforceBen). This is not a siren. It is a clock quietly starting. It is the signal to design for usage, to switch on explainable AI, and to bring Finance into design time (Usage Economy Summit).

Field write-ups align. Revenue Cloud Advanced (RCA) is modern and API-first. However, for heavy SteelBrick customization, the move behaves like a re-implementation, not a drop-in swap (Aquiva Labs; HIC Global Solutions; Reddit: thread 1, thread 2). The best teams ask a better question than “What replaces CPQ?” They ask: “What revenue model do we need in 36 months, and which architecture makes that outcome inevitable?”

TL;DR

- SteelBrick CPQ → EOS. Salesforce directs innovation to RCA and Billing; existing customers can renew and receive support (SalesforceBen).

- Three shifts hardened in San Francisco: usage is inevitable; AI must move the P&L; Finance is a co-architect, not a month-end referee (Usage Economy Summit).

- RCA reality: modern, API-first, improving—yet often a re-implementation for heavily customized SteelBrick orgs (Aquiva Labs; HIC Global; Reddit 1, 2).

- Decisions over dates: define motions, codify Finance guardrails, choose target architecture, run a live pilot, and measure the deltas that matter. The SteelBrick CPQ sunset is the catalyst.

San Francisco, straight talk

San Francisco rewards candor. The fog arrives on time; markets do not. At the Usage Economy Summit 2025 (Hyatt Regency Downtown SOMA), the tone matched the moment. There was less prediction and more prescription. People did not come for slide theater. They came to decide what to build next.

The bench was deep and practical: product leaders, finance leaders, engineers, investors, and operators. Names you will know included Sangram Vajre (GTM Partners), Marcos Rivera (Pricing I/O), Monica Kanchhal and Aditya Thakur (Salesforce), Christopher Engman (#Megadeals), Preethy Padmanabhan (Emergent Ventures), Himanshu Mishra (KPMG US), Adam Howatson (LogiSense), Ben Murray (The SaaS CFO), Mark Stiving (Impact Pricing), Ali Arsanjani (Google), Priya Saiprasad (Touring Capital), Ashmeet Sidana (Engineering Capital), and Anupam Rastogi (Emergent Ventures) (Usage Economy Summit).

In the hallways one question dominated: “What’s your CPQ plan?” Not “Which vendor?” A plan that assumes change, protects margin, earns Finance’s confidence, and does not derail the quarter.

What the SteelBrick CPQ sunset changed

On March 19, 2025, SalesforceBen published Salesforce’s statement: SteelBrick-lineage Salesforce CPQ moved to End-of-Sale for new purchases and upgrades. Existing customers can continue to renew and receive support. New and updating customers are directed to Revenue Cloud Advanced and Revenue Cloud Billing (SalesforceBen).

Read this as a shift in gravity, not an alarm bell. The product still runs. However, it is no longer the center of future investment. That matters because CPQ sits at the ignition point of revenue. If quoting wobbles, everything downstream suffers: approvals stall, margins leak, billing disputes multiply, and revenue recognition stretches.

Leaders are treating the SteelBrick CPQ sunset as a decision window. They are designing for usage, explainable AI, and Finance at design time. For planning inputs, review Salesforce’s Revenue Lifecycle Management packaging and pricing (Salesforce). For board context, check Past Product & Feature Retirements (historical, not predictive) (Salesforce Help). For sentiment, see Matthew Pieper’s post and a five-year horizon analysis (LinkedIn: Pieper, analysis).

The official statement was bureaucratically precise:

“Salesforce is evolving its CPQ & Billing offerings. Current Salesforce CPQ & Salesforce Billing customers will continue to receive full access including customer support and can renew and add additional licenses. For new customers and existing CPQ and Billing customers who are looking to update their products, we now offer Revenue Cloud Advanced and Revenue Cloud Billing.”

Translation: You can keep using it. You can renew it. But it’s not being developed. No new features. No AI integration. And as one systems architect wrote on LinkedIn: “EOL doesn’t mean that a product doesn’t work; it means that the company that made it no longer supports it.”

This matters because CPQ—Configure, Price, Quote—sits at the revenue engine’s ignition. When it fails, nothing downstream works properly. Quotes don’t generate. Deals stall. Billing disputes multiply. Revenue recognition becomes guesswork.

And here’s what’s genuinely interesting: the roughly 6,000 organizations still running Salesforce CPQ aren’t panicking. They’re planning. The sophisticated ones, anyway.

The Real Conversation: Dates vs. Decisions

At the Summit, I didn’t speculate about timelines. That’s Salesforce’s domain. But having spoken with dozens of CROs, CFOs, and revenue operations leaders over three days, a pattern emerged.

You can orbit rumors of renewal deadlines, or you can anchor on decisions that actually change outcomes:

- Revenue motions (24–36 months).

Subscriptions (seats/tiers/terms); usage (metered, pooled, burst, overage); hybrids (committed spend + variable); one-time + maintenance; channel variants; self-serve → sales-assist handoffs; ramps and escalators; renewals, amendments, expansions. List them in plain English; pick the two that will matter most next year. - Finance non-negotiables.

Codify ASC 606/IFRS 15 requirements, approval auditability, tax accuracy, clean handoffs to billing and provisioning, and close cadence. Make Finance a first-class stakeholder in pricing design—upfront, not after. - Change appetite.

- In-stack suite when the suite covers usage, AI, and finance needs without heroics.

- Hybrid (most common winner): keep Salesforce CRM as the system of engagement; adopt best-of-breed CPQ for complex pricing, usage, approvals, and finance-grade handoffs.

- Best-of-breed end-to-end when scale and complexity demand specialized systems across CPQ, rating, billing, and rev-rec.

- Timeline anchors.

Renewal dates, fiscal cycles, competing initiatives, and any M&A that could complicate sequencing. Decisions without anchors drift.

The question isn’t “When does Steelbrick actually die?”

The question is: “Given we have 18-24 months of calm before urgency hits, what should we build?”

Industry analysts following Salesforce’s historical product retirement patterns project a timeline:

- 2025-2026: Support quality declines as engineering resources shift to Revenue Cloud. Reddit discussions already document longer ticket resolution times.

- 2026-2027: Aggressive migration incentives. Account executives receive compensation tied to Revenue Cloud transitions. One Reddit user reported being told “CPQ is going end of renewal in August 2026,” though the community disputed this as sales pressure rather than policy.

- 2027-2028: Formal End-of-Life announcement with 12-18 month mandatory migration deadline.

Apparound’s analysis summarizes the progression: “2025–2026: Declining support. 2026–2027: Aggressive campaigns; reduced legacy discounts. 2027–2028: Formal End of Life announcement.”

Read it as a shift in gravity, not an alarm bell. The code still runs; it simply won’t be the center of future investment. And because CPQ sits at the ignition point of revenue, wobbles propagate: approvals stall, margins leak, billing disputes multiply, revenue recognition becomes interpretive, and month‑end stretches.

Treat EOS as a decision window. Leaders are using it to codify what they already wanted: an architecture that treats usage, AI, and Finance as first‑class citizens. For planning, see Salesforce’s public Revenue Lifecycle Management packaging/pricing (Salesforce) and the broader context in Past Product & Feature Retirements (history for boards—not date predictions) (Salesforce Help). For sentiment around SteelBrick’s arc, see Matthew Pieper’s LinkedIn post and a five‑year horizon analysis (Pieper; analysis).

The Sessions That Mattered (And What They Revealed)

Adam Howatson, CEO, LogiSense: “Thriving Through Change”

Howatson’s thesis: volatility is permanent. The companies winning aren’t the ones with perfect forecasts—they’re the ones with adaptive infrastructure.

His example hit home: A SaaS company launched with pure subscription pricing. Customer adoption patterns suggested usage-based made more sense. But their CPQ couldn’t handle it without heroics. By the time they rebuilt the infrastructure, two competitors had captured market share with more flexible pricing.

The implication: Your CPQ must natively support hybrid models—committed minimums plus overages, pooled consumption, burst pricing—without every deal becoming a “special request.” If your rating engine can’t handle nuance, your margin erodes. One deal at a time.

Sangram Vajre, CEO, GTM Partners: “The Usage Economy Playbook”

Vajre presented research tracking unicorn pricing models. Finding: usage-based pricing is no longer innovation. It’s table stakes.

But here’s the uncomfortable truth: most organizations lack the infrastructure. They have usage data. They know consumption patterns. But quoting a hybrid deal—subscription base plus usage tiers plus committed spend—requires manual spreadsheets and email threads.

“Treat pricing as a product,” Vajre emphasized. “Codify rules, approvals, and guardrails directly into CPQ. If discounting is your only growth lever, you’ve already lost.”

Marcos Rivera, CEO, Pricing I/O: “Monetizing AI”

Rivera separated AI theater from AI revenue. His metric: Does AI reduce cycle time, prevent discount leakage, or increase attach rates?

If not, it’s a demo.

His example: A company implemented “AI-powered pricing.” Sales reps ignored it because recommendations came without explanation. Finance blocked it because they couldn’t audit the logic. Eventually, it was turned off.

“AI in CPQ should explain why it recommended a price,” Rivera argued. “‘Because the model said so’ isn’t governance.”

Monica Kanchhal, Product Director, Salesforce: “Salesforce’s Journey”

This was the session that surprised people. Kanchhal spoke candidly about Salesforce’s internal transition to usage-based pricing—not as marketing, but as operational reality.

The hardest part? Not technology. Organizational alignment.

“Getting Finance, Sales, and Product to agree on pricing changes is harder than building the system,” she said. “We learned to bring Finance into design workshops, not implementation meetings. By then it’s too late.”

The audience—many facing CPQ migrations—took notes. Because this validated what they suspected: the technology enables transformation, but people and process determine success.

Ben Murray, Founder, The SaaS CFO: “Modern Finance”

Murray presented research on companies that designed revenue recognition into their pricing architecture versus those who bolted it on later.

The designed-in group: 40% faster time to market with new pricing models. 70% fewer billing disputes. Cleaner audits.

The bolt-on group: Spreadsheet nightmares. Month-end close extending by days. Controller turnover.

“Finance has evolved from referee to co-pilot,” Murray argued. “Bring them into pricing workshops. Encode their policies directly into CPQ guardrails and revenue recognition integrations.”

Ali Arsanjani, Ph.D., Director, Google: “Pricing the Intelligent Future”

Arsanjani’s talk blended economics with infrastructure reality. AI pricing isn’t just about algorithms—it’s about cost structures.

“Hyperscaler infrastructure changes the cost curve dynamically,” he explained. “Your pricing models must reflect real-world compute costs while aligning to customer value. Otherwise ‘AI margin’ becomes an oxymoron.”

His point resonated: If you’re building or selling AI products, your pricing infrastructure needs to handle dynamic cost-based pricing, consumption tiers, and value-based adjustments—while maintaining margin discipline.

Legacy CPQ, architecturally, can’t do this.

The Investor Panel: What VCs Actually Look For

Preethy Padmanabhan (Emergent Ventures), Priya Saiprasad (Touring Capital), Anupam Rastogi (Emergent Ventures), and Ashmeet Sidana (Engineering Capital) offered the investment lens.

Their message: Scalable GTM matters more than clever pitch decks.

Red flags they watch for:

- Unpredictable revenue recognition

- Pricing models customers can’t explain to their CFOs

- Quoting processes requiring heroics

“A clean, auditable CPQ process isn’t just operational efficiency,” Saiprasad noted. “It’s a valuation driver. We’ve seen deals delayed and valuations reduced when revenue operations are a black box.”

If you’re venture-backed or planning an exit, sloppy revenue operations create risk.

I presented “From Discounts to Overage: How CPQ Powers Usage-Based Models.” The post-session questions were telling. No one asked whether CPQ can technically support usage. They asked whether End-of-Sale could be the catalyst to design for usage and AI now—without detonating quarter-end.

Inside my keynote: bring back the scale

Coming out of those sessions, I framed the talk around three pictures that tie the whole story together.

The IBM scale. The first CPQ was literal: a scale. Configure, price, weigh. In a usage world, the “weighing” is digital—real cost-to-serve, real consumption, real margin—surfaced inside the quote. If you can’t measure the economics at the moment of configuration, you’re not pricing; you’re guessing.

From “jagged intelligence” to “jagged economics.” AI is brilliant in places and baffling in others. Left unchecked, that jaggedness shows up in the P&L: dazzling experiences paired with uneven unit economics. The remedy isn’t “more AI,” it’s guardrails—deterministic pricing rules, margin floors, explainable recommendations, and role-based overrides—so every quote carries proof of profit before it leaves the building.

Predictability in chaos (the Shinkansen lesson). Japan’s bullet train isn’t on time by luck; it’s on time by design. Revenue operations need the same architecture: clean event capture, accurate rating, governed quotes, and contract-as-system-of-record—flowing through event-driven handoffs so every system agrees on the math. Do that, and you get Shinkansen reliability in your revenue engine: fast, quiet, and on schedule, even when the market isn’t.

Those three pictures aren’t metaphors; they’re a checklist: weigh economics in-quote, govern jagged AI with rules, and engineer punctuality with event-driven design.

2025 field reality—and prudent expectations for 2026

The ecosystem is already speaking plainly. Community threads describe slower ticket resolution on legacy CPQ, uneven sales guidance about renewal risk, and a clear message that Revenue Cloud Advanced (RCA) is a modern, API-first path—not a drop-in replacement for heavily customized estates.

-

Field observations on implementation tradeoffs and expectations:

• Moving from CPQ to Revenue Cloud—what to expect (Reddit r/salesforce)

• CPQ end of renewal (Reddit r/salesforce) -

Independent practitioner and partner views:

• Salesforce CPQ vs Revenue Cloud Advanced Migration—RCA is API-first and promising, but “hasn’t achieved 100% parity” for heavy customizers and requires re-implementation (Aquiva Labs).

• Salesforce CPQ End of Sale—overview and implications (HIC Global Solutions).

• Salesforce CPQ End of Sale—why Apparound is the smart move (vendor POV, useful for contrasting migration narratives) (Apparound). -

Pricing transparency for Salesforce’s current revenue stack:

• Revenue Lifecycle Management Pricing (Salesforce)—public pricing and packaging signals for planning (Salesforce). -

A realistic “cost of waiting” frame for executives:

• Salesforce CPQ end-of-life: the cost of waiting to migrate (Conga). -

Historical cadence of product retirements (context for boards):

• Past Product & Feature Retirements (Salesforce Help).

Risk of waiting (pragmatic view):

If you wait: higher change-management compressions, fewer options, and more brittle legacy customization.

If you move now: controlled pilots, room to fix seams, better pricing governance. (See the practitioner posts and migration writeups above for context.)

The most disciplined operators aren’t waiting for a press release to grant them permission. They’re using a clear present to build a better future.

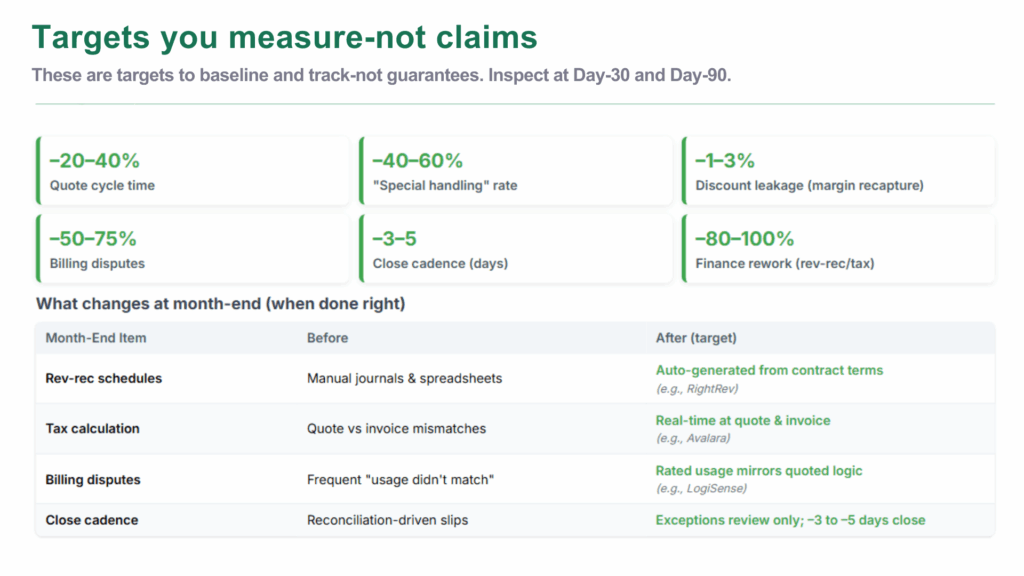

Executive Outcome Table (targets you measure—not claims)

A vendor‑neutral playbook (that works)

Step 1 — Inventory reality. Retire the museum of SKUs. Document what you actually sell: products, price books, discounts, approvals, usage metrics. Capture custom code and the five edge cases that always break quotes. This is the map.

Step 2 — Map dependencies. Upstream (CRM), within CPQ (configuration, pricing, approvals, document generation), and downstream (billing, revenue recognition, tax, provisioning/fulfillment, data lake, portals). CPQ rarely fails alone; it fails at seams—name them.

Step 3 — Choose target architecture. Decide in‑stack, hybrid, or best‑of‑breed against your motions, controls, and timeline. A low‑drama pattern for Salesforce shops: Salesforce CRM + specialized CPQ (pricing spine) + usage rating + rev‑rec + tax.

Step 4 — Pilot with live deals. Two motions (e.g., new‑logo subscription + a common usage bundle). Parallel‑run identical opportunities in legacy vs target. Validate pricing math, approvals, tax, billing handoff, rev‑rec schedules, and document generation. Success = faster with equal/better accuracy and governance.

Step 5 — Build the migration factory. Process over heroics: catalog mapping; rule conversion/simplification; template carry‑over; integration endpoints; training; cutover criteria + rollback.

Step 6 — Measure what matters. Cycle time, special‑handling rate, approval latency, discount leakage, attach rate, billing disputes, rev‑rec adjustments, days to close, and satisfaction (Sales & Finance). Publish Day‑30/90 deltas.

Step 7 — Turn on explainable AI. Guide configuration; suggest price bands with win‑rate context; summarize approvals; surface renewal risk from usage. Every recommendation shows what/why and offers an override. If AI can’t justify itself in one sentence inside the quote, it doesn’t ship.

“Bring back the scale—measure economics in‑quote. If AI can’t justify itself in one sentence, it doesn’t ship.”

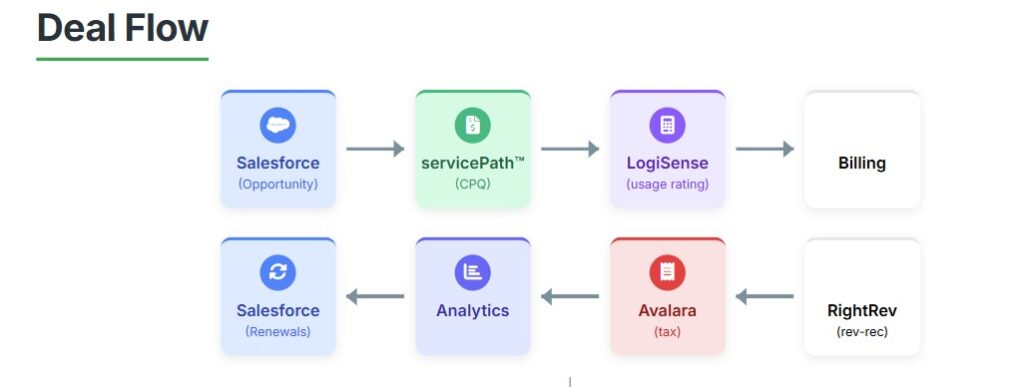

Architecture that de‑risks EOS

Most disciplined teams keep what works and upgrade what must:

-

Salesforce CRM stays the seller workspace—accounts, opportunities, pipeline.

-

servicePath™ provides the CPQ spine for configuration, pricing, approvals, and document generation—engineered for usage/hybrids, with guardrails and explainable guidance (servicepath.co).

-

LogiSense handles usage capture, mediation, and rating—turning events into economics (logisense.com).

-

RightRev automates revenue recognition from contract terms—making the audit trail a feature, not a fire drill (rightrev.com).

-

Avalara calculates tax in real time across jurisdictions and product types (avalara.com).

Downstream billing & provisioning receive clean, governed orders; analytics reflects a single commercial truth.

Operability & security (at a glance)

-

Role‑based access and full audit trails across configuration, approvals, and document generation.

-

SOC 2 Type II / GDPR alignment at the vendor level (confirm specifics with each vendor).

-

Versioning of pricing logic and quote templates for reproducible audits.

-

Integration health checks and alerts for failed handoffs and non‑standard deltas.

Cutover SLOs & Observability

-

SLOs: Quote accuracy 100% parity on pilot SKUs; approval routing < 2 hours median; document generation < 15s.

-

Observability: Integration health dashboard (rating, tax, billing, rev‑rec); alerts on failed handoffs; daily exception summary to Finance + RevOps.

-

Rollback triggers: pricing variance > 0.5% on any pilot SKU; sustained approval latency > 24h; unresolved tax variance past T+1.

The “how‑to” moves that actually work

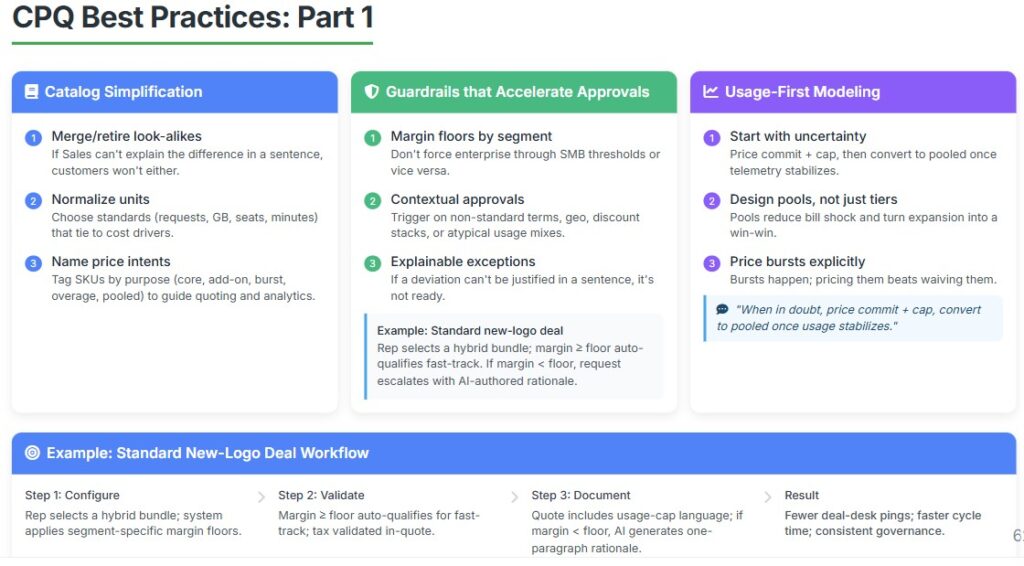

Catalog simplification—before configuration

-

Merge/retire look‑alikes. If Sales can’t explain the difference in a sentence, customers won’t either.

-

Normalize units. Choose standards (requests, GB, seats, minutes) that tie to cost drivers.

-

Name price intents. Tag SKUs by purpose (core, add‑on, burst, overage, pooled) to guide quoting and analytics.

Guardrails that accelerate approvals

-

Margin floors by segment. Don’t force enterprise through SMB thresholds or vice versa.

-

Contextual approvals. Trigger on non‑standard terms, geo, discount stacks, or atypical usage mixes.

-

Explainable exceptions. If a deviation can’t be justified in a sentence, it’s not ready.

Example—standard new‑logo deal: Rep selects a hybrid bundle; margin ≥ floor auto‑qualifies fast‑track (no VP approval). Tax is validated in‑quote. The quote document includes usage‑cap language. If margin < floor or non‑standard terms appear, the request escalates with an AI‑authored one‑paragraph rationale. Result: fewer deal‑desk pings; faster cycle.

Usage‑first modeling

-

Start with uncertainty. Price commit + cap, then convert to pooled once telemetry stabilizes.

-

Design pools, not just tiers. Pools reduce bill shock and turn expansion into a win‑win.

-

Price bursts explicitly. Bursts happen; pricing them beats waiving them.

Sales talk track for usage uncertainty

-

“When in doubt, price commit + cap, convert to pooled once usage stabilizes.”

-

“Use three‑tier good/better/best with explicit burst pricing—no silent overages.”

-

“We align price to the value you consume—and we cap risk. Here’s how.”

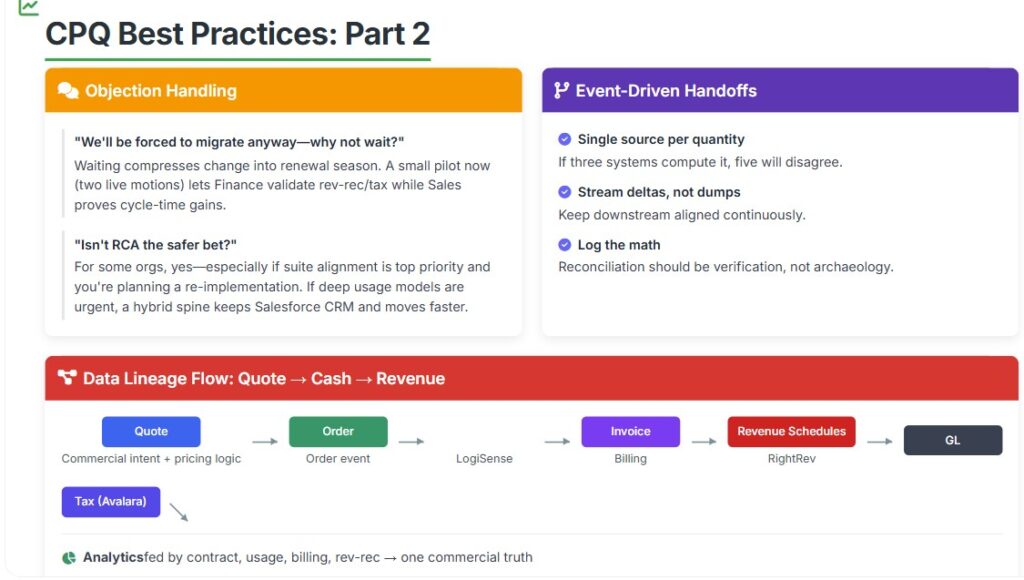

Objection: “We’ll be forced to migrate anyway—why not wait?”

Response: Waiting compresses change into renewal season. A small pilot now (two live motions) lets Finance validate rev‑rec/tax while Sales proves cycle‑time gains.

Objection: “Isn’t RCA the safer bet?”

Response: For some orgs, yes—especially if suite alignment is top priority and you’re planning a re‑implementation. If deep usage models are urgent, a hybrid spine keeps Salesforce CRM and moves faster.

Event‑driven handoffs

-

Single source per quantity. If three systems compute it, five will disagree.

-

Stream deltas, not dumps. Keep downstream aligned continuously.

-

Log the math. Reconciliation should be verification, not archaeology.

Contract‑as‑system‑of‑record

-

Capture commercial intent, not just numbers. Otherwise you relitigate it at amendment.

-

Version deliberately. Preserve historical pricing logic for auditability and renewal sanity.

-

Instrument lifecycle events. Upgrades, term changes, expansions should read like a clear timeline.

Data lineage (quote → cash → revenue)

-

Quote (commercial intent + pricing logic) → Order event

-

Usage captured & rated (LogiSense) → Invoice (billing)

-

Revenue schedules generated from contract terms (RightRev) → GL

-

Tax calculated at quote & invoice (Avalara) → Compliance

-

Analytics fed by contract, usage, billing, rev‑rec → one commercial truth

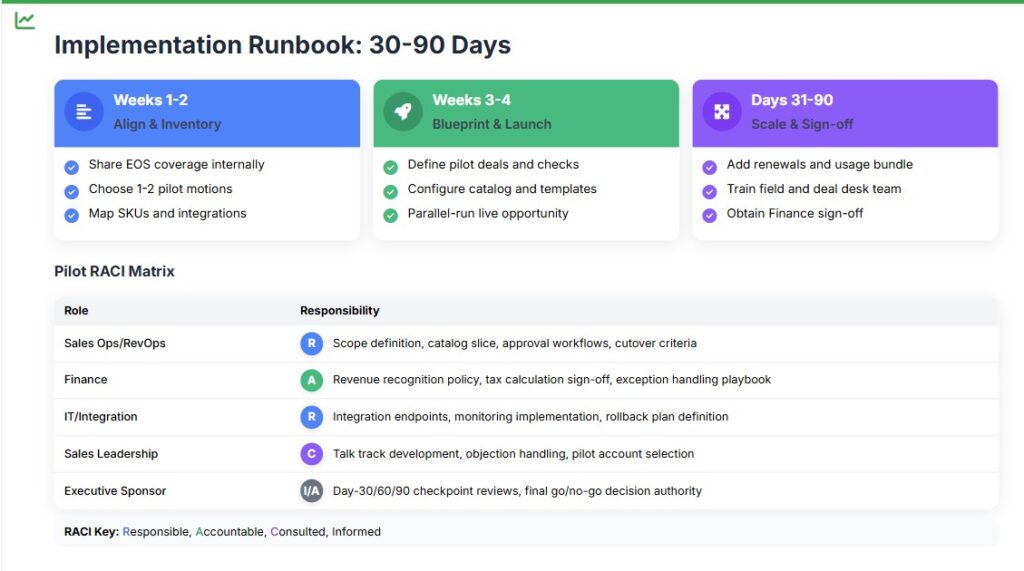

A 30‑day runbook you can start Monday

-

Share EOS coverage internally to align the why (SalesforceBen).

-

Choose 1–2 pilot motions (e.g., standard new‑logo subscription + a common usage bundle).

-

Appoint a cross‑functional owner (Sales Ops/RevOps) with Finance as co‑owner.

Week 2 — Inventory & architecture

-

Map SKUs actually sold, active price books, discounts/approvals, usage metrics, custom code, integrations.

-

Decide in‑stack, hybrid, or best‑of‑breed. If hybrid, document who stays in Salesforce vs behind the glass.

Week 3 — Pilot blueprint

-

Define pilot deals and validation checks (pricing accuracy, approvals, tax, billing handoff, rev‑rec schedules, doc gen).

-

Set success criteria: faster with equal/better accuracy and governance; schedule the Day‑30 checkpoint.

Week 4 — Launch the pilot

-

Configure the catalog slice, guardrails, templates; connect tax (and usage/rating if in scope).

-

Parallel‑run a live opportunity; when discrepancies appear, fix the model, not the data.

-

Prepare the Day‑30 brief: deltas, causes, fixes, and the go/no‑go to expand.

Days 31–60

-

Add renewals + one usage bundle; enable explainable AI for approvals.

-

Run integration soak tests; draft cutover criteria (success gates + rollback plan).

Days 61–90

-

Train field & deal desk; parallel‑run three regions.

-

Obtain Finance sign‑off; finalize rollback; executive go/no‑go.

Pilot RACI (example)

-

Sales Ops/RevOps (R): scope, catalog slice, approvals, cutover criteria

-

Finance (A): rev‑rec policy, tax sign‑off, exception playbook

-

IT/Integration (R): endpoints, monitoring, rollback plan

-

Sales Leadership (C): talk tracks, objections, pilot accounts

-

Executive Sponsor (I/A): Day‑30/60/90 checkpoints, go/no‑go

Closing

The market rarely grants certainty, but it does offer tells. In San Francisco, three were unmistakable: usage is the operating model, AI must carry its commercial weight, and Finance belongs at the drafting table. The SteelBrick CPQ shift didn’t create those realities. It clarified them.

Treat EOS as a decision window. Bring back the scale: measure economics at the moment of configuration. Guard against jagged economics with explainable rules. And borrow from the Shinkansen: be on time by design. Choose an architecture that keeps sellers fast, Finance confident, and customers clear on value and price.

Want a neutral second opinion on architecture? → Book an EOS Readiness Check

About servicePath™

servicePath™ is an AI-native CPQ and revenue-lifecycle platform built to simplify complex enterprise quoting. Designed by veterans who’ve lived spreadsheet pain, it helps telecommunications, IT services, MSPs, software vendors, and VARs execute faster, more accurate deals. Teams can model cost-to-serve, run multi-year scenarios, and configure sophisticated bundles via guided workflows. AI-driven guidance (config, price bands, margin guardrails) is explainable and approval-aware. A one-click quote engine assembles pricing, configurations, and supporting docs into brand-consistent proposals across regions, with multi-currency and self-serve support for cost-plus, territory-based, and usage-based pricing. Admins get no-code control over catalogs, workflows, and pricing; role-based permissions, audit logs, and CRM/ERP integrations ensure governance at global scale.

Why now: Steel Brick-lineage Salesforce CPQ is in End-of-Sale (EOS)—innovation is directed to Revenue Cloud Advanced/Billing while existing customers can still renew and receive support (SalesforceBen, Mar 19, 2025). In typical lifecycles, EOS precedes End-of-Life (EOL); no EOL date has been announced. To avoid compressed timelines and to add modern AI-native pricing/approval guardrails, many teams adopt a hybrid path: keep Salesforce CRM as the seller workspace and modernize CPQ with servicePath™.

Ready to De-Risk the SteelBrick CPQ Sunset? Start Here

See servicePath™ in Action

Watch how teams modernize CPQ for usage models, explainable AI, and Finance-grade governance—without derailing the quarter. In 15 minutes, we’ll show the mechanics and how to track the targets from this article (cycle time, disputes, discount leakage).

→ Book Executive Demo

Let’s Talk Architecture Strategy

If SteelBrick CPQ is EOS and EOL is a matter of when—not if—get a neutral read on your options. We’ll map your motions, Finance guardrails, and timeline, then recommend in-stack, hybrid, or best-of-breed with clear cutover criteria and a documented rollback.

→ Book an EOS Readiness Check

See the Outcomes (Real Implementations)

Explore outcomes aligned to the Executive Outcome Table—how organizations reduced quote cycle time, disputes, and Finance rework while enabling usage-based models with audit-ready rev-rec and tax.

→ View Case Studies

Get Smarter About CPQ Modernization

Skip vendor hype. Our insights cut through enterprise software noise with field-tested guidance on usage pricing, AI guardrails, and Finance co-design.

→ Read Enterprise Insights

Don’t let EOS become an EOL fire drill. Keep Salesforce CRM where sellers live, and modernize CPQ with servicePath™—AI-native guidance, usage-first pricing, and Finance-grade controls designed for today’s revenue architecture.

Frequently Asked Questions

Is Salesforce exiting CPQ?

No. Salesforce is evolving CPQ. On Mar 19, 2025, SalesforceBen reported the SteelBrick‑lineage CPQ moved to End‑of‑Sale; Salesforce steers new/upgrading customers to Revenue Cloud Advanced/Billing, while existing CPQ customers can renew and receive support (SalesforceBen).

Can we keep Salesforce CRM and still modernize CPQ?

Absolutely. Many customers run Salesforce CRM for sales engagement + servicePath CPQ for quoting, pricing, approvals, and revenue operations.

Why this works:

-

Sales reps stay in familiar CRM environment

-

CPQ operates behind scenes, integrated via APIs

-

Quotes generated in servicePath display within Salesforce UI

-

Opportunity data flows seamlessly

-

You get specialized CPQ capabilities without abandoning CRM investment

Analogy: Like keeping your iPhone but using Google Maps. Best-of-breed where it matters.

Is Revenue Cloud Advanced a drop‑in replacement for SteelBrick CPQ?

For heavily customized orgs, field posts and partner write‑ups indicate it’s typically a re‑implementation, not a one‑click upgrade (Aquiva Labs; HIC Global Solutions; Reddit 1, 2).

How hard is usage-based pricing with revenue recognition?

Hard if you bolt it on. Straightforward if you design it upfront.

What makes it complex:

-

Usage events need clean capture and mediation

-

Rating logic must match what you quoted

-

Revenue schedules must handle variable usage

-

ASC 606 requires allocation and SSP determination

-

Auditors need complete traceability

How we make it manageable:

-

servicePath quotes define the pricing model

-

LogiSense captures and rates actual usage

-

RightRev automatically generates compliant revenue schedules

-

Full audit trail from quote to invoice to recognized revenue

Do we need to rip and replace everything?

No. Most teams adopt staged modernization:

- Phase 1: Pilot with high-value motion (new business or strategic renewals)

- Phase 2: Expand to additional deal types

- Phase 3: Migrate everything and decommission old system

Example phasing:

- Month 1-3: New business subscription quotes

- Month 4-6: Add usage-based pricing for new products

- Month 7-9: Migrate renewals and amendments

- Month 10: Decommission old CPQ

Benefit: Prove value incrementally, manage change systematically, reduce risk dramatically.

What’s the practical risk of waiting?

Compression around renewals, fewer options, and more brittle customizations. Moving now enables controlled pilots, time to fix seams, and better pricing governance,

What should we measure in a pilot?

Cycle time, special‑handling rate, approval latency, discount leakage, attach rate, billing disputes, rev‑rec adjustments, days to close, and seller/Finance satisfaction. Baseline on Day‑0; review at Day‑30/90.

Sources

Primary EOS & Summit context

-

SalesforceBen — Salesforce Confirms the Future of CPQ (Mar 19, 2025): Salesforce Confirms the Future of CPQ | Salesforce Ben

-

Usage Economy Summit 2025 — event site: Usage Economy Summit 2025

Migration reality & practitioner views

-

Aquiva Labs — Salesforce CPQ vs Revenue Cloud Advanced Migration (Sep 11, 2025): Salesforce CPQ vs Revenue Cloud Advanced | Blog | Aquiva Labs

-

HIC Global Solutions — Salesforce CPQ End of Sale (Sep 24, 2025): Salesforce CPQ End of Sale: Complete Guide to Risks, Impact, Migration to Revenue Cloud Advanced

-

Reddit r/salesforce — Moving from CPQ to Revenue Cloud: What to expect (May 22, 2025): Moving from CPQ to Revenue Cloud – What to expect?

-

Reddit r/salesforce — CPQ end of renewal (Sep 18, 2025): CPQ end of renewal

Salesforce pricing & historical context

-

Salesforce — Revenue Lifecycle Management Pricing: Revenue Lifecycle Management Pricing

-

Salesforce Help — Past Product & Feature Retirements (login may be required): Salesforce Help

Cost‑of‑waiting perspective

- Salesforce CPQ end‑of‑life: the cost of waiting to migrate (Sep 18, 2025): Salesforce CPQ end-of-life: the cost of waiting to migrate

Additional commentary (industry sentiment)

-

Apparound — Salesforce CPQ End of Sale—why Apparound is the smart move (Sep 7, 2025): Salesforce CPQ replacement: How to quickly choose the right alternative

-

LinkedIn — Matthew Pieper on SteelBrick/CPQ (login may be required): Salesforce CPQ is EOL: A dying product with no future updates. | Matt Pieper posted on the topic | LinkedIn

-

LinkedIn — The CPQ Crisis: Why Your Company Has Just 5 Years to Get Off Salesforce CPQ (login may be required): The CPQ Crisis: Why Your Company Has Just 5 Years to Get Off Salesforce CPQ

Partner/product references used in architecture

-

servicePath™ — product/company site: Home – servicepath | CPQ for complex technology sales

-

LogiSense — usage rating & mediation: The experts in usage-based billing – LogiSense

-

RightRev — revenue recognition: Revenue Recognition Software for Complex Accounting | RightRev

-

Avalara — tax automation: Tax Compliance Software – Avalara