TL;DR (For Busy Execs)

-

The real problem: RevOps isn’t broken. Legacy CPQ is — especially aging, Salesforce CPQ managed-package implementations that can’t keep up with today’s monetization, data, and AI demands.

-

What changed: In 2025, Salesforce confirmed End-of-Sale (EOS) for its legacy CPQ managed package. No new customers, limited R&D, and ecosystem focus shifting to Revenue Cloud. (SalesforceBen)

-

What smart companies do in 2026: Treat CPQ as revenue infrastructure, not a sales plug-in. Clean up products and data, and decide whether to (a) nurse legacy short-term, (b) move to Revenue Cloud, or (c) adopt an AI-native, vendor-agnostic CPQ control plane.

Executive summary

By 2026, Revenue Operations (RevOps) is mainstream. Boards expect unified forecasting, stronger governance, and tight alignment across sales, marketing, customer success, and finance.

Yet most RevOps strategies still fail at the same point:

Legacy CPQ is breaking RevOps.

For years, leadership assumed CPQ would continue to be improved and modernised to match new pricing models, AI-driven workflows, and multi-entity complexity.

In March 2025, Salesforce confirmed that its legacy Salesforce CPQ managed package entered End-of-Sale (EOS) :

-

No new licenses for the legacy managed package

-

Existing customers can renew and receive support

-

Strategic focus and R&D are shifting to Revenue Cloud / Revenue Cloud Advanced instead. (SalesforceBen)

That announcement quietly ended a long-standing assumption:

the legacy CPQ engine at the centre of many revenue stacks is no longer evolving.

For RevOps leaders, 2026 becomes the first real decision year:

-

Do we continue to scale a modern RevOps strategy on top of an aging CPQ platform that’s no longer sold?

-

Do we re-platform inside the Salesforce stack (Revenue Cloud)?

-

Or do we move to a vendor-agnostic, AI-native CPQ control plane designed for multi-CRM, multi-ERP reality?

This article explains:

-

Why RevOps isn’t the real problem—legacy CPQ is

-

What Salesforce CPQ EOS changes for 2026–2028 planning

-

The three structural reasons CPQ undermines RevOps (regardless of vendor)

-

What “AI-native CPQ” actually means

-

A practical 2026 playbook for RevOps and architecture leaders

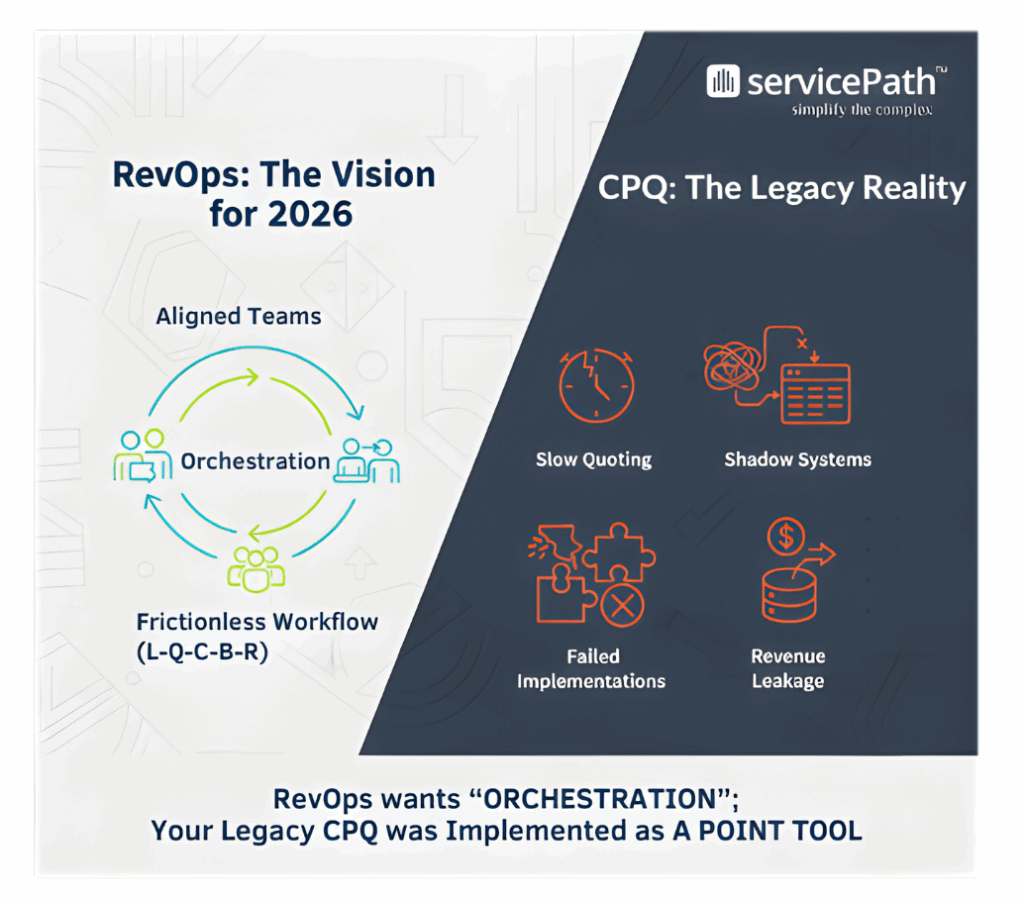

1. RevOps Isn’t Broken — Your CPQ Is

By 2026, most high-growth companies have adopted some form of RevOps model, integrating sales, marketing, customer success, and often finance into one revenue engine.

On paper, RevOps is meant to:

-

Align GTM teams around a shared revenue architecture

-

Standardise data across sales, CS, marketing, and finance

-

Remove friction from lead → quote → contract → billing → renewal

In reality, when you talk to RevOps leaders, you hear the same story:

The RevOps strategy looks great on the slide.

It falls apart when it hits CPQ.

This is where strategy collides with daily execution:

-

Slow, high-friction quoting

-

Complex deals still require “special handling”

-

Approvals can stretch into days or weeks

-

Independent analysts and partners frequently cite CPQ projects as among the most delayed and contentious CRM extensions. (TechGrid)

-

-

Shadow spreadsheets and side systems

-

Sales and pre-sales teams fall back to Excel or local tools when CPQ can’t handle real-world complexity

-

CPQ failure case studies repeatedly highlight “shadow CPQ” as a governance and data-quality problem

-

-

Failed or stalled implementations

-

One CPQ vendor’s 2025 analysis suggests up to two-thirds of CPQ implementations fail to reach full completion or adoption, often due to poor data, over-customisation, and rushed design (SaaSteps)

-

-

CPQ–billing gaps

-

What CPQ outputs is often not what billing or revenue recognition can ingest

-

This drives manual work, revenue leakage, and audit friction (Emorphis)

-

Underneath it all:

RevOps wants orchestration. CPQ was implemented as a point tool.

Impact on revenue and risk (2026 lens)

-

Revenue drag

-

Longer cycle times, especially for complex or multi-year deals

-

Under-selling high-margin services because they’re “too hard to quote”

-

-

Margin leakage

-

Inconsistent enforcement of discounting rules and approval thresholds across regions and business units

-

-

Operational and audit risk

-

Misaligned quote → contract → billing data

-

Opaque rules that are hard to explain to auditors or regulators

-

With RevOps under board-level scrutiny, “CPQ is where things fall over” is no longer an acceptable answer in 2026.

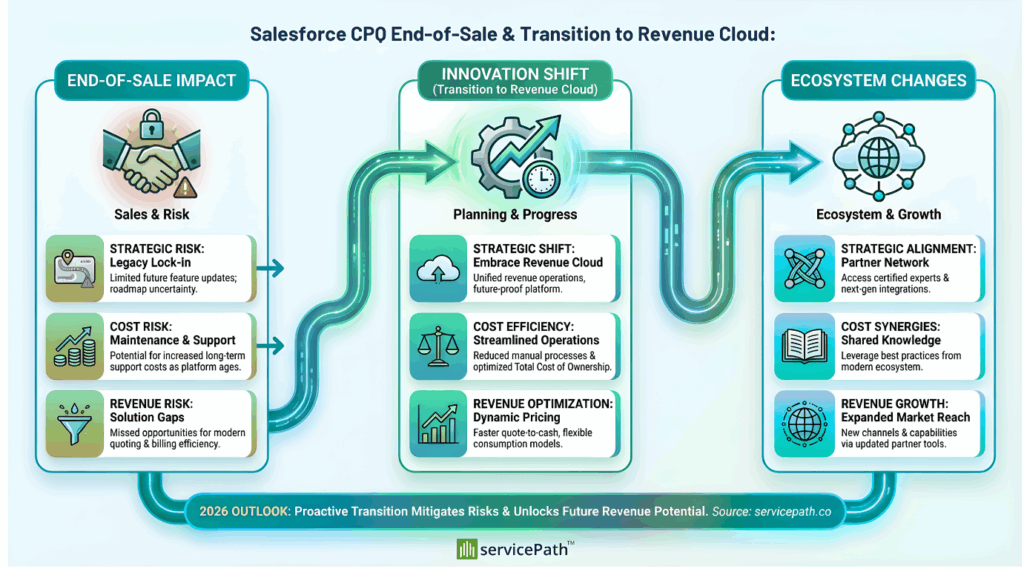

2. What Salesforce’s CPQ End-of-Sale Actually Changed

Salesforce CPQ is End-of-Sale, not End-of-Life yet — but it is legacy

SalesforceBen and multiple ecosystem analysts summarise Salesforce’s position roughly as:

-

Salesforce CPQ (legacy managed package) has entered End-of-Sale (EOS)

-

Salesforce has stopped selling the legacy CPQ managed package to new customers

-

Existing customers can continue to use CPQ, renew licenses, and receive support

-

New and upgrading customers are being directed toward Revenue Cloud (including Revenue Cloud Advanced and Billing)

Several consulting partners now describe Salesforce CPQ as a legacy product, urging customers to plan a transition rather than wait for a distant End-of-Life (EOL) date.

Some estimate an EOL window around 2029–2030, based on typical enterprise software lifecycles, but these are partner projections, not official Salesforce statements.

servicePath™’s own 2025 EOS analysis frames this as a strategic inflection point, estimating that over 6,000 organisations worldwide will need to rethink their CPQ and revenue stack over the next several years. (servicePath™)

Impact at a glance (CFO/Board view)

-

EOS now, EOL later → multi-year planning window, not an emergency shutdown

-

Innovation focus moved → new capabilities land in Revenue Cloud, not legacy CPQ

-

Ecosystem shift → partner talent, best-practice patterns, and reference architectures are moving away from the legacy package

Why this matters specifically for RevOps in 2026

End-of-Sale doesn’t mean “off tomorrow,” but it does mean:

-

You’re investing process and data on top of a product Salesforce no longer sells

-

Most new R&D is pointed at Revenue Cloud, not the older CPQ managed package

-

The ecosystem’s attention and talent are shifting—architects and partners prefer to work on Revenue Cloud or modern alternatives

For RevOps, 2026 is the first full planning year where “we’ll deal with CPQ later” stops being neutral.

Revenue & risk (2026 lens)

-

Revenue risk

-

A hurried migration in 2027–2028 (triggered by support or commercial pressure) risks disrupting your pipeline during already volatile markets

-

-

Cost risk

-

Re-implementing CPQ on a new stack—Revenue Cloud or otherwise—is a substantial programme; doing it under time pressure inflates cost and risk

-

-

Strategic risk

-

Remaining on legacy CPQ while competitors move to AI-native platforms makes it harder to deliver AI-driven pricing, configuration, and forecasting that boards increasingly expect

-

3. The Three Structural Limits of Legacy CPQ for Modern RevOps (Regardless of Vendor)

3.1 CPQ was designed for simpler businesses than the one you run now

First-generation CPQ deployments were often scoped around:

-

Relatively simple product catalogues

-

Discount tables and static approval hierarchies

-

One dominant GTM model (e.g., direct, license-based sales)

By 2026, most tech-enabled enterprises operate very differently:

-

Multiple monetisation models

-

Subscriptions, usage-based, outcome-based, managed services, XaaS hybrids

-

-

Mixed channels

-

Direct, partners, distributors, marketplaces, field teams, and digital self-service

-

-

Multi-entity, multi-region structures

-

Each with different tax, regulatory, and approval rules

-

Where CPQ logic can’t keep up, teams bolt on:

-

Custom code

-

Sidecar tools

-

Manual exceptions

Over time, the system becomes opaque and fragile—the opposite of what RevOps needs. (Noltic)

Revenue & risk in 2026

-

Revenue: Complex, multi-year, or cross-portfolio deals become “special projects” rather than scalable, repeatable motions

-

Risk: Pricing and configuration knowledge lives in experts’ heads and brittle scripts, not in a governed platform

3.2 CPQ is isolated from billing, CLM, and service delivery

Many RevOps failure stories boil down to:

What CPQ outputs is not what billing and revenue recognition can ingest. (Nue.io)

Common issues:

-

Different product and pricing models in CPQ vs. billing vs. ERP

-

Mid-term events (upgrades, downgrades, co-terms) that require manual intervention

-

Contract structures in CLM that don’t match what was originally quoted

When Salesforce CPQ sits as a managed package with its own data model, misalignments can be particularly acute if billing or ERP live outside the Salesforce core.

Revenue & risk in 2026

-

Revenue: Renewal and expansion motions are slow and error-prone; customers see inconsistent quotes vs. invoices

-

Risk: Revenue leakage, billing disputes, and audit findings on contract vs. invoice mismatches

3.3 Everything requires a project (no low-code safety valve)

Most legacy CPQ stacks were built before:

-

Low-code configuration became standard in enterprise platforms

-

AI-native tooling became realistic for configuration, pricing, or approvals

-

RevOps existed as an empowered function that expects to own process and logic

As a result:

-

New bundles, price models, or approval changes often require IT tickets or external consultants

-

RevOps teams can’t respond quickly to market shifts (new tariffs, competitor moves, cost shocks) because CPQ change cycles are measured in months, not days

-

Workarounds proliferate, eroding data quality and governance

Modern CPQ commentators (including former SteelBrick leaders) are blunt: “lift-and-shift” CPQ projects that simply recreate old processes on new tech are a primary cause of CPQ failure

Revenue & risk in 2026

-

Revenue: You miss windows to launch new offers or pricing changes at the speed markets now move

-

Risk: “Shadow CPQ” (spreadsheets, side tools) grows in parallel, undermining governance and AI/analytics reliability

4. 2026: The Year RevOps Meets AI-Native CPQ

2026 is not only about Salesforce CPQ EOS; it coincides with a broader technology agenda:

-

AI-native platforms as a foundation, not a bolt-on

-

Domain-specific and task-specific AI models outperforming generic LLMs for specialised workflows

-

Multi-agent systems and digital trust, where AI agents and automation coordinate complex workflows under strong governance

In parallel, analysts like McKinsey estimate that generative AI could add trillions of dollars of annual value across sales, marketing, and operations, with high tech and financial services among the biggest beneficiaries. (McKinsey)

Within that environment, CPQ can’t remain:

-

A simple rules engine attached to CRM

-

A static quote generator

-

A standalone app with a few AI “features” on top

For RevOps to deliver in 2026, CPQ has to become the AI-native control plane for configuration, pricing, and deal design.

What “AI-native CPQ” actually means (in concrete terms)

An AI-native CPQ platform should:

Act as a central configuration and pricing brain

- One source of truth used consistently by CRMs, ERPs, billing, commerce, and partner portals

Use AI for guided configuration and pricing—with guardrails

-

AI suggests bundles, configurations, and pricing scenarios

-

RevOps defines the rules, constraints, and approval thresholds

Provide explainable, auditable outputs

-

Clear rationale for price and discount decisions

-

Audit-ready logs for CFOs, auditors, and regulators

Support complex monetisation models by design

-

Subscriptions, usage-based pricing, managed services, outcome-based contracts, and hybrids

Give RevOps and product teams low-code control

-

Pricing, bundles, and guardrails are updated in configuration—not custom code

That’s the design philosophy behind servicePath™ CPQ+, which Capterra describes as:

“The AI-native Configure Price Quote (CPQ) platform built for the speed and complexity of modern technology vendors, Managed Services Providers, software companies, SIs, and VARs.”

Gartner has repeatedly named servicePath™ a Visionary in its Magic Quadrant for CPQ Application Suites, recognising its ability to simplify complexity and support advanced revenue operations.

5. How AI-Native CPQ Fixes the RevOps–CPQ Breakage

The key for 2026–2028 planning is to use Salesforce’s CPQ sunset as a trigger to fix structural issues, not just to swap platforms.

5.1 Treat CPQ as revenue infrastructure, not a sales plug-in

Make a deliberate mindset shift:

-

From: “CPQ is a sales productivity tool”

-

To: “CPQ is the authoritative source of truth for products, pricing, discounts, and deal structures across the entire revenue lifecycle”

This mirrors how modern CPQ and Revenue Cloud platforms are now described: as the central revenue nervous system, not just a quoting add-on.

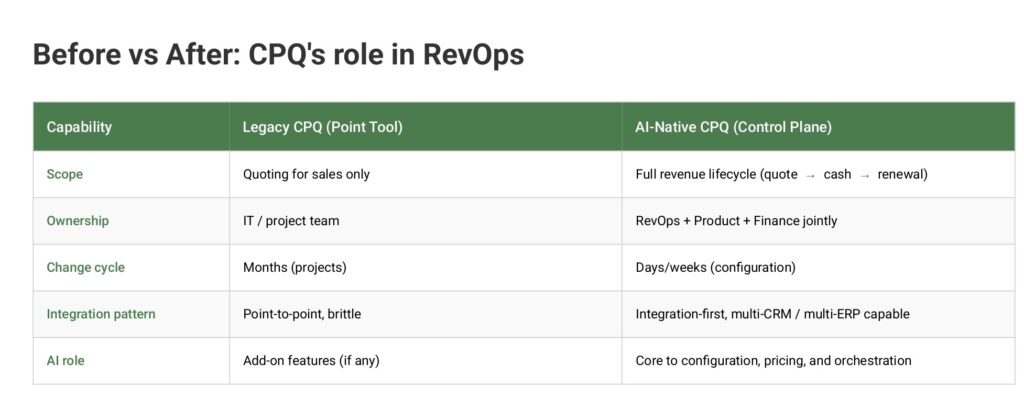

Before vs After: CPQ’s role in RevOps

Revenue & risk

-

Revenue: Fewer leaks between pipeline, quoting, billing, and renewal; faster rollout of new offers and commercial models

-

Risk: One governed place to manage rules and approvals instead of a patchwork of tools

5.2 Use the Salesforce CPQ sunset to simplify, not just migrate

Whatever you choose next—Revenue Cloud or an AI-native alternative—you can use this moment to:

-

Rationalise SKUs and bundles

-

Retire low-value or “zombie” SKUs that add complexity without meaningful revenue

-

-

Align CPQ, CLM, and billing around one deal structure

-

Ensure that the same structure works from quote through to revenue recognition

-

-

Bake RevOps metrics into the design from day one

-

Time-to-quote, discount leakage, expansion revenue, renewal uplift

-

Revenue & risk

-

Revenue: Cleaner offers, less friction for cross-sell/upsell and renewals; faster enablement for new reps or partners

-

Risk: Fewer “special” exceptions and reduced dependence on individual heroes who “know how CPQ really works”

5.3 Give RevOps and product teams low-code control

A wave of 2025 CPQ and RevOps commentary is consistent: implementations fail when everything has to go through IT.

In an AI-native CPQ model:

-

RevOps and product owners manage pricing, bundles, and guardrails through low-code interfaces

-

Integration into Salesforce, Dynamics, SAP, ServiceNow, and billing systems is handled through an integration-first architecture, not brittle point-to-point scripts

-

AI features are configured against clean, structured data, not scraped from PDFs or spreadsheets

Revenue & risk

-

Revenue: You can test and roll out new pricing or packaging in weeks, not quarters, capturing 2026 market shifts instead of reacting a year later

-

Risk: Less custom code means fewer brittle dependencies when systems, vendors, or teams change

6. A 2026 RevOps & CPQ Health Check: 7 Questions for Your Next Steering Meeting

You don’t need a 200-slide deck to start.

Ask these questions honestly:

- Are we still investing in process on top of a CPQ our vendor no longer sells?

- Do our most complex, strategic deals flow cleanly from CPQ into contracts, billing, and revenue recognition—or are they “special projects”?

- How many spreadsheets, side tools, or shadow systems are still part of our quoting reality?

- If we changed a key price model next month, how long would it take to implement globally—days, weeks, or months?

- Can we explain (and audit) how discounts and approvals are applied today across all regions and business units?

- Where does AI live in our revenue stack today—and is CPQ a first-class participant or a blind spot?

- By the end of 2026, do we want CPQ to be:

A legacy app we’re nursing along, a monolithic module inside a single vendor’s stack, or an AI-native control plane we can trust to govern configuration and pricing across the enterprise?

If your answers make you uneasy, that’s not a failure of your RevOps strategy.

It’s a sign that CPQ is still the weak link—and that Salesforce’s CPQ sunset has simply made that weakness impossible to ignore.

7. Your 2026 Options: A Simple Comparison

Here’s a straightforward view of the three strategic paths most enterprises are evaluating:

The right answer depends on your landscape—but “do nothing” is now a deliberate choice with clear opportunity cost.

8. What to Do Next in 2026 (And Where the Playbook Fits)

If Salesforce CPQ sits anywhere near the centre of your revenue stack, 2026 is the year to move from vague concern to concrete plans.

8.1 Decide your strategic direction

You don’t need every detail decided, but you do need a direction of travel:

-

Stay on Salesforce CPQ short-term while you clean data and design your target state

-

Re-platform onto Revenue Cloud as part of a broader Salesforce-centric strategy

-

Or shift to an AI-native, vendor-agnostic CPQ like servicePath™ CPQ+ at the centre of a multi-CRM, multi-ERP landscape

8.2 Start with data and catalogue cleanup

Regardless of platform choice, the same foundation applies:

Fixing products, pricing, and discount logic is the single best thing you can do for any future CPQ, AI, or RevOps initiative.

-

Rationalise product catalogues and bundles

-

Standardise discount structures and approval thresholds

-

Define a consistent data model for quote → contract → billing → revenue

8.3 Pilot AI-native CPQ where complexity is highest

Use a focused pilot to prove 2026-ready capabilities:

-

Complex MSP offerings

-

Telecom or ICT bundles

-

Multi-year managed services contracts

-

Multi-entity deals with different tax or approval rules

Validate:

-

AI-assisted configuration and pricing

-

Guardrailed approvals

-

Time-to-quote reduction

-

Data quality and governance improvements

8.4 Plan a phased migration

Avoid a “big-bang” in a single quarter.

Design a path where legacy Salesforce CPQ and your new control plane co-exist during transition:

-

Start with one business unit, region, or product line

-

Integrate with your existing Salesforce environment

-

Expand as confidence, adoption, and data quality improve

By 2026, CPQ Is Your RevOps Strategy

No board is questioning whether RevOps matters in 2026. The real question is whether your CPQ can keep up with the strategy you’ve already agreed on.

Salesforce’s CPQ End-of-Sale announcement removed the illusion of stability. The status quo is no longer neutral: every month spent on a legacy, end-of-life CPQ is a month spent hard-wiring complexity, technical debt, and migration risk deeper into your revenue engine.

You now have a clear fork in the road:

-

You can nurse a shrinking, legacy platform, hoping it lasts until you’re forced to move.

-

You can double down on a single-vendor stack, accepting tighter lock-in in exchange for familiarity.

-

Or you can elevate CPQ into an AI-native control plane that sits above CRM, billing, and ERP—governing products, pricing, and deal design across the entire revenue lifecycle.

The organisations that win the next cycle won’t be the ones with the prettiest RevOps slide. They’ll be the ones that treated CPQ as revenue infrastructure, cleaned up their data before they were forced to, and designed a control plane that can outlive any single front-end system.

If you’re looking at your answers to the seven health-check questions and feeling uncomfortable, that’s your signal—not that RevOps has failed, but that CPQ has reached the end of what it can do for you.

The decision is now on the table:

Will CPQ remain the weak link you work around—or the backbone you can finally build your revenue strategy on?

Citations:

-

Javier Ramirez, “Salesforce CPQ Is End of Sale: What Are Your Options?”

SalesforceBen, April 25, 2025. Salesforce Ben -

SalesforceBen editorial team, “Salesforce Confirms the Future of CPQ”

SalesforceBen / The Picklist, March 19, 2025. Salesforce Ben+1 -

Emorphis Technologies, “Salesforce CPQ Is Retiring: What’s Next? Your Options, Risks, and Migration to Revenue Cloud Roadmap Explained”

Emorphis blog, June 26, 2025. blogs.emorphis -

Danny Mareco, “Salesforce CPQ End of Sale—Here’s What MSP Sales Leaders Need to Know”

TechGrid, June 11, 2025. techgrid.com+1 -

servicePath, “Salesforce CPQ End-of-Sale 2025: Costs, Risks & the Future-Proof Path”

servicePath blog, August 5, 2025. servicepath.co+1 -

servicePath, “Recovering from a Failed CPQ Implementation (Telent Case Study)”

servicePath case study PDF, 2020. servicepath.co+1 -

servicePath, “servicePath™ Recognized as a Visionary in the 2025 Gartner® Magic Quadrant™ for CPQ Application Suites”

News release, January 28, 2025. servicepath.co+1 -

Ron Costa, “Why 67% of CPQ Implementations Fail (And How to Avoid It)”

SAASTEPS, August 31, 2025. SAASTEPS+1 -

http://Nue.io , “CPQ & Billing: Why They Need to Work Together”

http://Nue.io resources, 2024/2025. nue -

Michael Chui, Eric Hazan, Roger Roberts, Alex Singla, Kate Smaje, Alex Sukharevsky, Lareina Yee, Rodney Zemmel,

“The Economic Potential of Generative AI: The Next Productivity Frontier”

McKinsey Global Institute, June 2023. McKinsey & Company+2McKinsey & Company+2

⭐ 2026 CPQ Decision Playbook: Choose Your Next Step

See the Future of Post-EOS CPQ

Watch servicePath™ CPQ+ in Action

See how modern enterprises move beyond legacy Salesforce CPQ with AI-native configuration, governed pricing, and RevOps-grade orchestration. In 15 minutes, we’ll show how to fix the bottlenecks highlighted in this article: cycle time, accuracy, approvals, and cross-system alignment.

→ Book Executive Demo

Get a Neutral, Architecture-Level Recommendation

2026 CPQ Pathfinding Workshop

End-of-Sale means your next CPQ architecture decision sets the foundation for the next decade. We’ll map your Revenue Cloud, hybrid, and AI-native options with a clear, board-ready assessment covering rollout risk, data readiness, and total cost.

→ Book CPQ Strategy Session

See Real Post-Salesforce CPQ Transformations

Outcomes From Leading ICT, MSP, and Tech Providers

Explore how organizations like Dell EMC and Telent removed spreadsheets, cut quote times, strengthened governance, and modernized pricing models—all without disrupting Salesforce CRM.

→ View Case Studies

Stay Ahead of EOS, AI, and RevOps Trends

Enterprise-Grade CPQ Insights

Cut through vendor hype with research-backed guidance on AI-native models, pricing governance, multi-CRM/ERP strategy, and building a revenue control plane ready for 2026.

→ Read Expert Insights

⚡ Don’t Let EOS Become a 2027 Fire Drill

Trusted by Gartner. Proven by Enterprise Leaders.

servicePath™ is recognized as a Visionary in the Gartner Magic Quadrant for CPQ—chosen by organizations modernizing complex, multi-entity revenue operations.

→ See Gartner Recognition

Keep Salesforce CRM where your sellers already live—

and modernize CPQ with servicePath™ CPQ+:

AI-native intelligence, usage-based pricing, and Finance-grade controls powering the next generation of RevOps.

FAQ: Most Asked Questions About Salesforce CPQ End-of-Sale and RevOps (2026)

1. What does “End-of-Sale” for Salesforce CPQ actually mean?

“End-of-Sale” (EOS) means Salesforce stops selling new licenses for the legacy Salesforce CPQ managed package.

-

Existing customers can continue to use the product, renew licenses, and receive support

-

New innovation and roadmap focus is shifting to Revenue Cloud

EOS is not the same as End-of-Life (EOL), where support would fully end.

2. Is Salesforce CPQ going End-of-Life in 2029 or 2030?

Salesforce has not announced an official End-of-Life date.

Several partners and analysts infer a likely EOL window around 2029–2030, based on typical enterprise software lifecycles, but these are projections, not confirmed dates.

3. Do we have to migrate to Salesforce Revenue Cloud, or can we use another CPQ?

You do not have to migrate to Revenue Cloud.

-

Revenue Cloud is Salesforce’s strategic successor to legacy CPQ and a strong choice if you want to standardise deeply on Salesforce

-

Many enterprises will also evaluate third-party, AI-native CPQ platforms (like servicePath™ CPQ+) that integrate with Salesforce and other systems while providing more flexibility long term.

4. How long does a typical Salesforce CPQ migration take?

Timeframes vary by complexity, but partners and independent guides often frame CPQ → Revenue Cloud migrations as 12–18-month programmes for mid-market and enterprise organisations—especially when you include:

-

Catalogue rationalisation

-

Data migration

-

Integration re-work

Migrations to an AI-native CPQ control plane can often be phased more gradually, starting with specific business units or complex offerings and expanding over time.

5. How does an AI-native CPQ help RevOps in 2026?

An AI-native CPQ:

-

Centralises configuration and pricing logic across CRM, ERP, billing, and commerce

-

Uses AI for guided selling, configuration, and pricing recommendations with explicit guardrails

-

Provides explainable, auditable pricing and discount decisions for finance and regulators

-

Supports complex monetisation models such as subscriptions, usage-based pricing, and managed services out of the box.

For RevOps, that translates into:

-

Faster, more reliable quoting

-

Better margin control

-

A revenue stack that’s genuinely ready for 2026-and-beyond AI use cases—not just AI sprinkled on top of legacy constraints.