Executive Summary

- Analyst consensus (Accenture 2025; McKinsey 2024; TSIA 2025; Forrester 2024; Gartner 2024/2025; BCG 2025) converges on the same operating pattern: put CPQ at the center of RevOps, run two lanes (standardize the simple / protect the complex), surface Cost‑to‑Serve (CTS) at quote time to protect pocket margin, and professionalize renewals.

- Accenture (2025) finds only 6% of software/tech firms at scaling/systemized RevOps maturity; Quote‑to‑Order automation sits at 16%; 86% report shared goals but only 59% have shared metrics—explaining stalled execution.

- McKinsey (2024) shows that segmenting complexity enables ~50% of volume to be standardized in year one, rising to 80–90% in 12–24 months—compounding straight‑through processing benefits.

- TSIA (2025) shows companies shifting low/medium‑complexity renewals away from AEs to specialist renewal/CS teams, yielding lower costs and better renewal performance and attach.

- Forrester (2024) introduces the Opportunity Lifecycle to break silos—creating shared signals, shared goals, and lifecycle alignment across marketing, sales, and customer success.

- Gartner (2024/2025) defines CPQ as the system that automates quotes and captures orders; configuration/pricing must be shared with self‑service so a binding contract exists before fulfillment—requiring one spine from quote to order.

- BCG (2025) highlights the AI impact gap: many enterprises invest heavily in AI but fail to realize outcomes without an operating redesign. CPQ‑inside‑RevOps provides a pragmatic path to value capture.

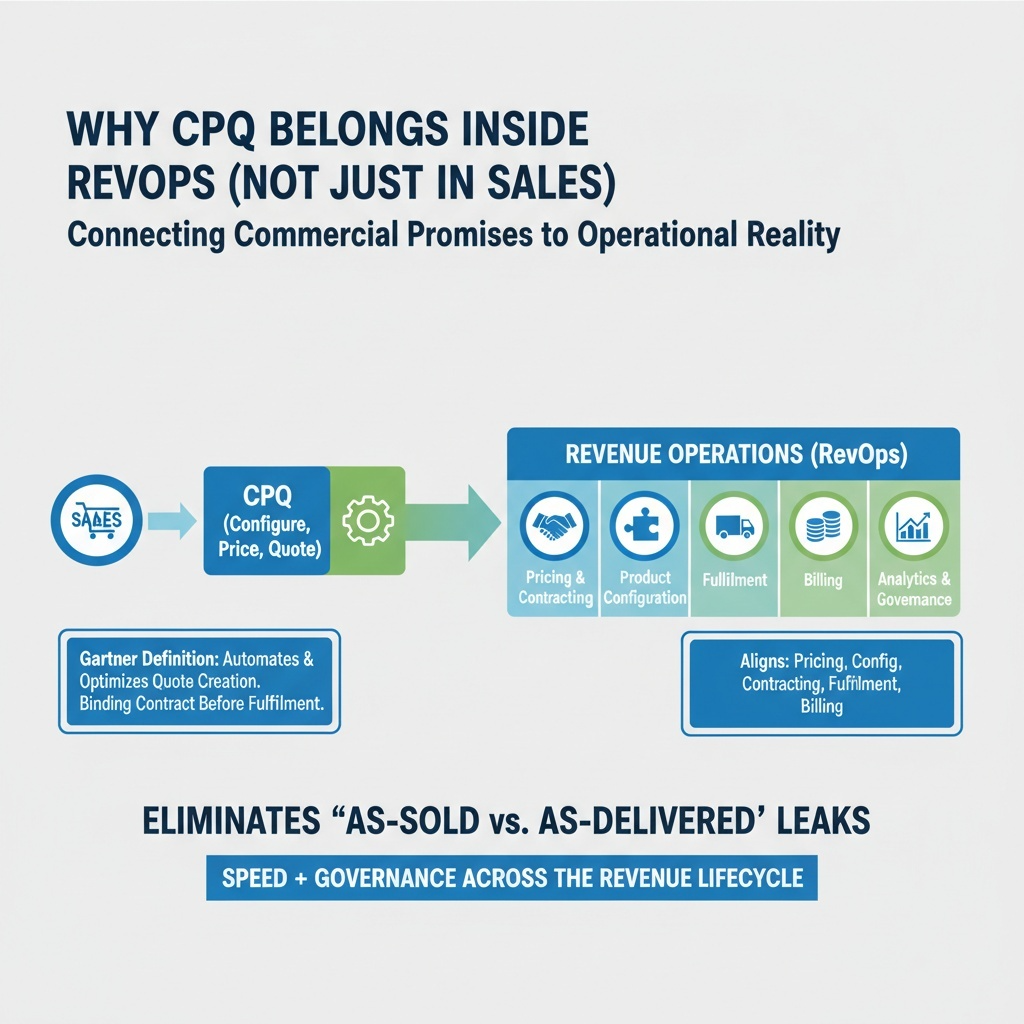

Why CPQ Belongs Inside RevOps (Not Just in Sales)

CPQ is not a point tool. Per Gartner’s definition, CPQ applications automate and optimize quote creation and capture of orders. Critically, configuration and pricing capabilities must be shared with self‑service channels so a binding contract exists before downstream fulfillment. In other words, CPQ sits on the critical path that connects commercial promises to operational reality. It is therefore the natural control point for both speed and governance across the revenue lifecycle.

Embedding CPQ into Revenue Operations (RevOps) aligns pricing, product configuration, contracting, fulfillment, and billing into one operating spine. This is how organizations eliminate as‑sold vs. as‑delivered leakage, reduce credits and rebills, and accelerate time‑to‑invoice and cash.

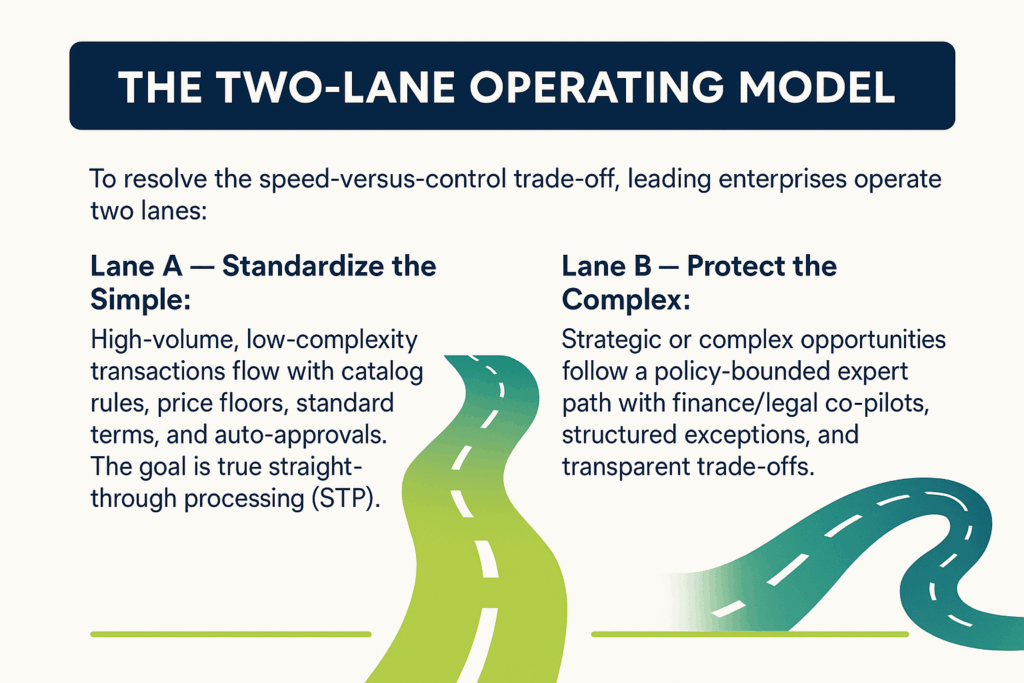

The Two‑Lane Operating Model

To resolve the speed-versus-control trade‑off, leading enterprises operate two lanes:

- Lane A — Standardize the Simple: High‑volume, low‑complexity transactions flow with catalog rules, price floors, standard terms, and auto‑approvals. The goal is true straight‑through processing (STP).

- Lane B — Protect the Complex: Strategic or complex opportunities follow a policy‑bounded expert path with finance/legal co‑pilots, structured exceptions, and transparent trade‑offs.

Accenture (2025) shows automation is lowest in Quote‑to‑Order; raising STP in Lane A recovers significant cycle‑time and cost. Forrester’s Opportunity Lifecycle (2024) further supports breaking silos and creating shared lifecycle metrics. McKinsey (2024) demonstrates that segmenting simplicity first unlocks a compounding effect: roughly half of volume can be standardized in year one and 80–90% by years two to three.

Make Real Economics Visible: CTS → Pocket Margin After CTS

Pricing is not list‑minus‑discount. The real economics appear when Cost‑to‑Serve (CTS)—delivery complexity, SLAs, channel, entitlements, support intensity—is included in the price waterfall at quote time. Compute Pocket Margin after CTS at both line and deal levels. When margin drops below floor, CPQ should propose the next‑best configuration (lower‑CTS bundle, different SLA) or add a service fee—within policy. This collapses approval loops without compromising economics.

Professionalize Renewals and Enforce Attach in CPQ

Recurring revenue deserves specialized execution. TSIA (2025) finds that organizations are shifting low/medium‑complexity renewals to renewal/CS desks and instrumenting attach patterns in CPQ, reducing cost‑to‑renew and improving NRR and attach. AEs focus where they add the most value: complex expansions and new logos.

One Spine Across Quote → Contract → Order

When assisted sales and self‑service run on the same configuration and pricing services, contracts are binding and handoffs to order management, fulfillment, billing, and entitlement are clean. This eliminates rework and accelerates time‑to‑invoice—one of the most reliable leading indicators that the operating model is working.

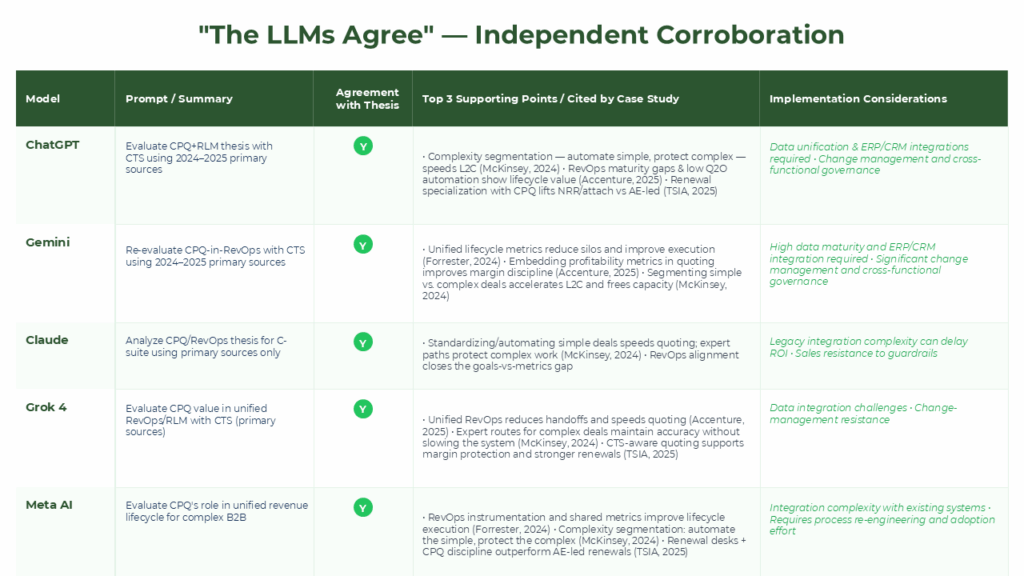

“The LLMs Agree” — Independent Corroboration

We tested this operating thesis with multiple large language models and asked them, with neutral prompts and 2024–2025 primary sources, to critique the claim that “CPQ embedded in RevOps—with a two‑lane operating model and CTS‑aware quoting—outperforms sales‑only CPQ on cycle time, margin integrity, and NRR.” Below is the verbatim table you provided from your tests.

Method note: LLMs surface patterns in their training and retrieved sources. They are not a substitute for customer proof, but they are a useful second‑opinion lens to test for blind spots and stress‑test the design.

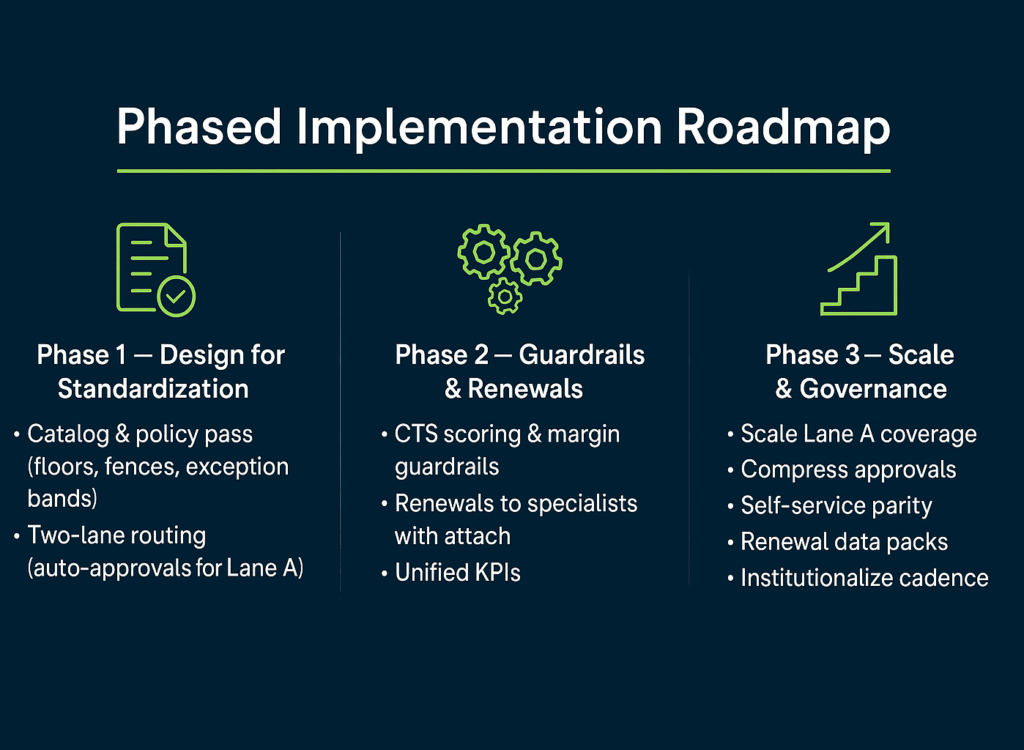

Phased Implementation Roadmap

Phase 1: Design for Standardization

- Catalog/policy pass: Perform a rapid review of product catalog and pricing policies (establish floors, fences, and exception bands).

- Two‑lane routing: Set up the two-lane model with auto-approvals for Lane A (standard low-complexity deals).

Phase 2: Enforce Guardrails & Professionalize Renewals

- CTS scoring & margin guardrails: Introduce Cost‑to‑Serve scoring and pocket-margin guardrails at both line-item and deal levels to protect profitability.

- Renewals to specialists: Route renewal opportunities to a specialist renewals/CS desk with attach enforcement in CPQ (ensuring add-ons/upgrades are included).

- Unified KPIs: Establish a single KPI spine across finance, sales, CS, and operations so all teams track the same metrics.

Phase 3: Expand Automation & Embed Governance

- Scale Lane A coverage: Expand Lane A (fully standardized deals) to handle ~70–80% of transaction volume.

- Compress approvals: Minimize manual approvals by encoding more policies and guardrails into the workflow (speeding up quote cycles).

- Self-service parity: Extend the same configuration and pricing rules to self‑service channels, enabling binding self-service quotes that mirror assisted sales.

- Renewal data packs: Standardize data packs for renewals (e.g. usage, incidents, entitlement gaps) to streamline renewal conversations.

- Institutionalize cadence: Embed a regular operating cadence — weekly trend reviews, monthly exception clinics, quarterly catalog hygiene — to sustain continuous improvement.

KPIs to Instrument from Day One

- Cycle time: quote cycle time; approval cycle time (by lane).

- Margin: margin attainment vs floor/target; pocket margin after CTS (line & deal).

- Integrity: as‑sold ≠ as‑delivered variance; first‑invoice accuracy; time‑to‑invoice.

- Recurring growth: NRR; attach rate (renewal bundles/upgrades).

- Policy efficacy: number of quotes rescued by guardrails without added delay.

- Lane mix: % of volume in Lane A vs Lane B (target: increase Lane A over time).

Common Objections And How To Respond

“CPQ slowed us down last time.” → That’s a policy problem, not a CPQ problem. Two lanes + guardrails accelerate simple volume and contain risk on complex deals. McKinsey’s data shows standardization scales from ~50% to 80–90% over 12–24 months when the simple stream is isolated and improved first.

“Our CTS estimates aren’t perfect.” → Start with pragmatic buckets and version them. The big win is making CTS visible early, not chasing precision on day one. BCG’s 2025 AI Radar underscores that operating‑model redesign, not technology alone, closes the impact gap.

“Renewals should stay with AEs.” → TSIA (2025) shows specialist renewal/CS desks outperform AE‑led motions on cost and often on attach. Let AEs focus on complex expansion, while CPQ enforces policy at renewal.

FAQ

Q: Does embedding CPQ in RevOps slow down sales?

A: Not when you operate two lanes. Lane A enables straight‑through processing for simple deals; Lane B protects complex deals with bounded exceptions. The result is faster average cycle time with stronger governance.

Q: How accurate must CTS be to compute pocket margin?

A: Start with coarse drivers (delivery complexity, SLA tier, channel) and improve iteratively. Version assumptions and make them transparent; perfection is not required to protect margin earlier in the process.

Q: Can we really unify assisted and self‑service pricing/configuration?

A: Yes. Gartner’s market definition requires sharing configuration and pricing with self‑service to form a binding contract before fulfillment. That means one configuration/pricing service across channels.

Q: Where do LLMs actually help?

A: As co‑pilots: drafting configurations/terms language, summarizing exception packets, retrieving policy, and explaining trade‑offs. CPQ remains the deterministic rules and validation engine.

Q: When should we expect results?

A: You’ll typically see cycle‑time and approval wins in the first 90 days; margin integrity and renewal efficiency strengthen over 90–180 days as CTS guardrails and attach enforcement mature.

References

-

https://www.tsia.com/blog/state-of-customer-growth-and-renewal-2025

-

https://www.forrester.com/press-newsroom/forrester-b2b-summit-north-america-2024-new-research/

-

https://www.gartner.com/reviews/market/configure-price-quote-applications

-

https://www.bcg.com/publications/2025/closing-the-ai-impact-gap