Salesforce CPQ End-of-Sale 2025: Costs, Risks & the Future-Proof Path

Salesforce CPQ is ending sales. Discover true migration costs, hidden bundle taxes, and how servicePath™ delivers faster, flexible, future-proof CPQ for enterprises.

The enterprise software landscape is undergoing a seismic shift. Salesforce’s announcement of CPQ’s end-of-sale (EOS) status is not just a product change—it’s a strategic inflection point for senior executives and leaders. Over 6,000 organizations must now rethink their revenue technology architecture, vendor relationships, and long-term strategy. The stakes are high: those who act decisively will emerge with more agile, cost-effective, and future-proof revenue operations. Those who delay risk being locked into expensive, inflexible ecosystems that stifle growth and innovation.

Key Take Aways

- Strategic Jolt: Salesforce declared CPQ End-of-Sale (EOS) in March 2025, forcing >6 000 customers to reassess revenue-tech strategy.

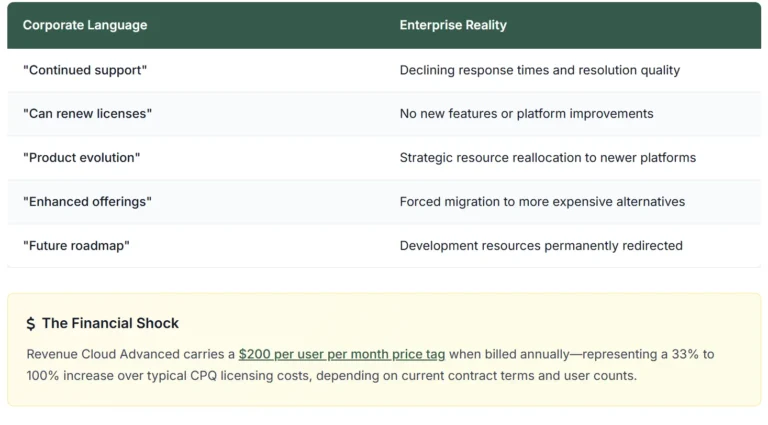

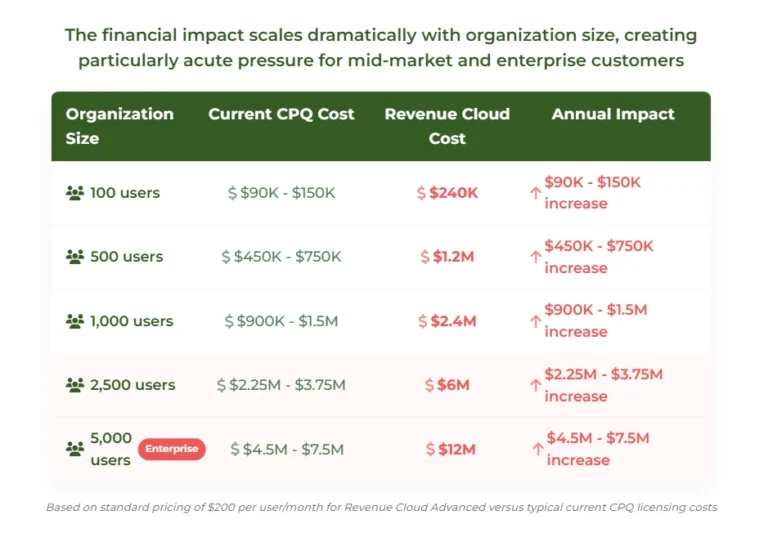

- Cost Shock: Migration path is Revenue Cloud Advanced at US $200 user/mo—a 33 % – 100 % licence hike plus a hidden US $125 – 200 user/mo bundle tax for billing and CLM.

- Rebuild Reality: Transition is not an upgrade—it demands a full 12- to 24-month rebuild and US $100 k – 500 k+ in services, with no performance guarantee.

- Shrinking Window: Support quality is already tapering, and partner capacity will tighten within 18 months; decisive action is measured in quarters, not years.

- Lock-In Risk: Post-migration renewals shift leverage to Salesforce, potentially escalating total cost of ownership for a decade. Vendor Lock-In – Bundled billing/CLM adds a hidden US $125–$200 per user/month “bundle tax.

- The Opportunity: Organizations evaluating alternatives now can leverage market disruption to optimize costs, reduce vendor dependency, and enhance capabilities through platforms like servicePath™.

- Strategic Opportunity: Senior leaders can leverage this disruption to optimize costs, reduce vendor dependency, and enhance capabilities through platforms like servicePath™.

- Future-Proof Alternative: Independent, Gartner-Visionary platforms such as servicePath™ retain Salesforce data, deliver sub-second quoting and avoid forced bundles—providing a clearer, lower-risk path to modern CPQ.

- Strategic Imperative: Leaders who move now can cut long-term cost, reduce vendor dependency and build a more agile revenue engine; hesitation cedes control to vendors and market pressures.

- The Timeline: With 6,000+ organizations still running CPQ and declining support quality already evident, the window for strategic decision-making is measured in quarters, not years.

Salesforce Confirms the Future of CPQ | Salesforce Ben

The Confirmation That Changed Everything

After months of ecosystem speculation and mounting customer concerns, SalesforceBen obtained official confirmation directly from Salesforce corporate headquarters:

“Salesforce CPQ will be entering an ‘End of Sale’ (EOS) phase.”

The official statement reads:

The official damage control statement reads: “Current Salesforce CPQ & Salesforce Billing customers will continue to receive full access including customer support and can renew and add additional licenses. For new customers and existing CPQ and Billing customers who are looking to update their products, we now offer Revenue Cloud Advanced and Revenue Cloud Billing.”

What End-of-Sale Really Means in Practice

Industry analysts and enterprise software experts who have witnessed this pattern multiple times recognize the corporate language for what it really signals: managed decline. Here’s the translation between corporate messaging and enterprise reality:

Enterprise Impact Analysis by Organization Size

Industry analysts and enterprise software experts who have witnessed this pattern multiple times recognize the corporate language for what it really signals: managed decline. Here’s the translation between corporate messaging and enterprise reality:

For many organizations, this represents the single largest unplanned IT expense increase in their recent history—all for functionality they already have and software that will require complete reimplementation.

The $360 Million Pivot: From SteelBrick Promise to Revenue-Cloud Mandate

The irony isn’t lost on industry veterans who remember Salesforce’s bold 2015 acquisition of SteelBrick for $360 million. The promises were compelling, the execution has been systematically disappointing, and the end game appears to have been planned from the beginning.

The Original SteelBrick Promise vs. 2025 Reality

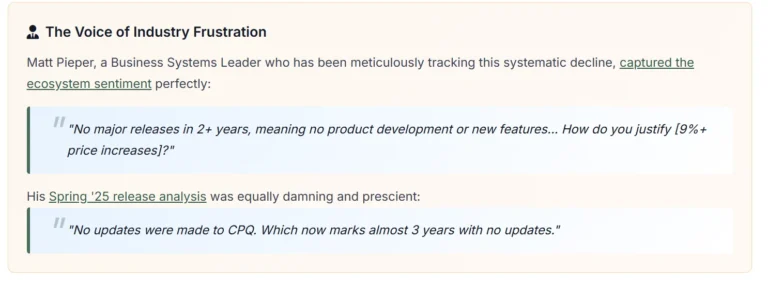

Matt Pieper, a Business Systems Leader who has been meticulously tracking this systematic decline, captured the ecosystem sentiment perfectly:

“No major releases in 2+ years, meaning no product development or new features… How do you justify [9%+ price increases]?”

His Spring ’25 release analysis was equally damning and prescient:

“No updates were made to CPQ. Which now marks almost 3 years with no updates.”

This wasn’t accidental neglect or resource constraints—it was strategic resource reallocation. While CPQ customers continued paying full licensing fees plus aggressive renewal increases, Salesforce systematically channeled those resources toward Revenue Cloud development, effectively using current customer revenue to build the expensive replacement platform they would eventually be pressured to adopt.

The Strategic Starvation Timeline

- 2015-2017: Post-Acquisition Integration: Post-acquisition integration period with basic platform connectivity while Salesforce developed long-term platform strategy and assessed competitive landscape.

- 2018-2021: Innovation Deceleration: Innovation deceleration becomes evident as resources shifted toward other strategic priorities, including the early development of what would become Revenue Cloud.

- 2022-2024: Complete Development Freeze: Complete development freeze while Revenue Cloud received full investment and development resources. CPQ customers experienced static functionality while paying increasing renewal fees.

- 2025: End-of-Sale Announcement: Official end-of-sale announcement with aggressive positioning toward Revenue Cloud as the “natural evolution.”

This timeline reveals a calculated approach: maintain revenue from existing CPQ customers while building their expensive replacement, then force migration when the new platform reaches market readiness. The strategy maximizes revenue extraction while minimizing customer choice and competitive alternatives.

Strategic Takeaways

- Two-Step Monetisation: squeeze legacy renewals → finance successor platform → mandate migration.

- Locked-In Leverage: once core processes sit on a single stack, switching costs neutralise customer bargaining power.

- Hidden Cost Curve: development freeze shifts total-cost-of-ownership from licence line-item to opportunity cost (features lost, talent attrition, technical debt).

- Action Imperative: Enterprises that remain passive subsidise a roadmap they may not want. Those that pivot—whether to Revenue Cloud or an independent CPQ—reclaim control over spend, timeline and innovation pace.

Revenue Cloud Advanced: Deconstructing the “Upgrade” Myth

Perhaps the most challenging aspect of this transition is Salesforce’s positioning of Revenue Cloud Advanced as a natural “evolution” or “upgrade” of CPQ capabilities. Industry implementation experts and organizations that have attempted the migration paint a starkly different picture of what this transition actually entails.

The Complete Rebuild Reality

CPQ integration specialists with extensive migration experience are unambiguous about what organizations should expect:

The $360 million SteelBrick acquisition represented more than just technology—it was about market positioning and customer capture. Industry analysis suggests Salesforce’s true strategic goals were:

- Eliminate competitive threat: SteelBrick was gaining significant market traction as an independent platform

- Capture customer base: Bring existing SteelBrick customers into the Salesforce ecosystem

- Create migration pathway: Develop integrated platform that would eventually force customers toward more expensive bundled solutions

- Market consolidation: Remove a successful independent vendor from the competitive landscape

The end-of-sale announcement represents the completion of this strategy. Customers who joined the Salesforce ecosystem through CPQ now face expensive migration to Revenue Cloud or complex transitions to alternative platforms—exactly the vendor lock-in scenario that independent platforms like SteelBrick originally helped customers avoid.

What “Migration” Actually Means in Practice:

❌ Not an upgrade: Complete system reconstruction required from the ground up

❌ Not data migration: Business logic, workflows, and configurations must be rebuilt from scratch

❌ Not feature enhancement: Often results in performance degradation and functionality gaps

❌ Not process improvement: Frequently disrupts established workflows that took years to optimize

✅ Actually: Full reimplementation project with enterprise-scale complexity and risk

Novutech’s implementation analysis confirms the comprehensive scope that many organizations underestimate:

Migration Cost Breakdown

Understanding the Risks of Migrating from Salesforce CPQ to Revenue Cloud

The migration risks extend far beyond implementation costs and timeline disruptions. Max Rudman, CEO of Prodly and founder of the original Steelbrick (which became Salesforce CPQ), offers unique insights into these challenges based on his deep understanding of both the technical architecture and the business implications.

The Steelbrick Founder’s Perspective

Migration Complexity Reality

Complete Business Logic Recreation

Unlike traditional software upgrades that preserve existing configurations and customizations, Revenue Cloud migration requires rebuilding every aspect of quote-to-cash processes:

- Price calculation rules: Complex pricing logic built over years must be reconstructed using Revenue Cloud’s different calculation engine

- Approval workflows: Multi-stage approval processes require complete rebuild using Revenue Cloud’s workflow tools

- Product configuration: Bundle and configuration rules must be reimplemented in Revenue Cloud’s product catalog structure

- Integration points: Every connection to ERP, billing, finance, and third-party systems requires redevelopment

- Custom fields and objects: Business-specific data structures must be recreated and mapped to Revenue Cloud’s data model

Data Migration Complexity

Moving from CPQ to Revenue Cloud isn’t a straightforward data transfer:

- Data structure differences: CPQ and Revenue Cloud use different data models requiring complex transformation logic

- Historical quote preservation: Maintaining access to historical quotes and configurations requires custom development

- Integration data synchronization: Ensuring data consistency across all connected systems during migration

- Reporting and analytics continuity: Historical reporting often breaks during migration requiring dashboard reconstruction

Performance and Operational Risk Assessment

System Performance Degradation

Early Revenue Cloud implementations have documented significant performance challenges:

- Quote generation times: 30 seconds → 5+ minutes

- System timeouts during normal operations

- API delays and synchronization issues

- Peak usage performance degradation

User Productivity Impact

The transition creates immediate productivity challenges:

- Extensive retraining requirements

- Workflow inefficiencies and complexity

- Customer experience disruption

- IT support complexity increase

Hidden Cost and Risk Factors

Change Management Requirements

Revenue Cloud migration creates organization-wide change management challenges:

- Extensive retraining: All users require comprehensive training on new processes and interfaces

- Process documentation: Business processes and procedures require complete rewriting

- User adoption challenges: Resistance to change often higher when new system is slower or more complex

- Productivity ramp-up: Organizations typically experience 3-6 months of reduced productivity during user adaptation

Integration Development Risks

Revenue Cloud’s integration requirements often exceed initial estimates:

- API redevelopment: All existing integrations require complete rebuilding rather than simple configuration changes

- Data synchronization complexity: Ensuring real-time data consistency across systems more complex than anticipated

- Third-party tool compatibility: Many tools integrated with CPQ may not have Revenue Cloud equivalents

- Custom development requirements: Business-specific integrations often require expensive custom development

The Performance Reality Check

Early Revenue Cloud implementations have revealed concerning performance issues that directly impact sales productivity and customer experience:

Documented Performance Problems:

- Quote generation times increasing from 30 seconds to 5+ minutes for complex configurations

- Sales representatives experiencing timeouts during live customer presentations

- System crashes during peak usage periods requiring manual workarounds

- Integration failures between Revenue Cloud and existing ERP/billing systems

- Memory limitations causing system slowdowns during high-volume quote periods

- Migration Complexity: Beyond Technology

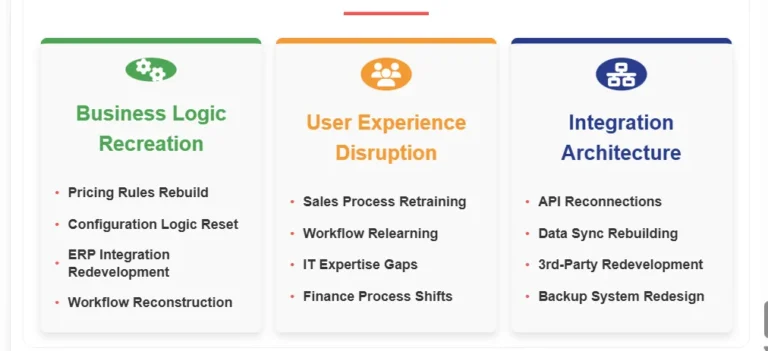

The Revenue Cloud migration challenge extends far beyond technical platform changes. Organizations face fundamental business process disruption:

Business Logic Recreation: Unlike traditional data migrations, Revenue Cloud requires rebuilding core business processes:

- Price calculation rules and approval workflows need complete reconstruction

- Product configuration logic and bundling rules must be reimplemented

- Integration points with ERP, billing, and finance systems require redevelopment

- Custom fields, objects, and automation workflows need complete rebuilding

- Reporting and analytics dashboards require reconstruction from scratch

User Experience Disruption: Revenue Cloud’s interface and workflow differences create extensive retraining requirements:

- Sales teams must learn completely new processes for quote generation

- Sales managers need retraining on approval workflows and reporting

- IT teams require specialized Revenue Cloud expertise for ongoing support

- Finance teams must adapt to new billing and revenue recognition processes

Integration Architecture Changes: Revenue Cloud’s platform architecture differs significantly from CPQ:

- API connections to existing systems require complete redevelopment

- Data synchronization processes need comprehensive rebuilding

- Third-party tool integrations often require custom development

- Backup and disaster recovery processes must be redesigned

- Understanding the Risks of Migrating from Salesforce CPQ to Revenue Cloud

“This is a re-platform, not an upgrade.” — Max Rudman, SteelBrick founder & Prodly CEO

Rudman, whose team supports hundreds of Salesforce data deployments, warns that most companies underestimate two core hazards:

-

Architectural Break-Fit

-

Revenue Cloud runs on a different data model, pricing engine and API layer.

-

Result: every rule, object and integration must be rebuilt from scratch, not migrated.

-

-

Business-Process Rebuild

-

Years of CPQ-tuned workflows—approvals, bundles, discount logic—do not port over.

-

Firms face a wholesale redesign of quote-to-cash processes, often requiring custom code and 12–24 months of services.

-

- In short, moving to Revenue Cloud means replacing, not upgrading, your current system—bringing major cost, time-line and change-management risk.

Eight Risk Layers Every CPQ-to-Revenue Cloud Migration Must Confront

Migrating to Revenue Cloud isn’t a simple upgrade; it touches every layer of your quote-to-cash stack. The table below breaks down the eight risk areas—from architecture to change-management—that can inflate costs, lengthen timelines and erode sales velocity if not addressed up-front.

Bottom line: migrating to Revenue Cloud is a wholesale re-implementation that touches every layer—data, process, integrations, people and ongoing operations—introducing sizeable cost, timeline and performance risks.

The Vendor Lock-in Trap: Understanding Strategic Dependency

Revenue Cloud is more than expensive software—it’s architectural vendor lock-in designed to make future platform changes prohibitively complex and costly.

The Architecture of Dependency

Revenue Cloud’s design creates multiple layers of vendor dependency that compound over time:

The Bundling Tax: Paying for What You Don’t Need

Revenue Cloud forces enterprises to license capabilities they often already have through other specialized systems:

Total Annual Bundling Tax: $125-200 per user monthly for potentially redundant capabilities that organizations must license but may never use effectively.

Historical Precedent and Strategic Compulsion

Enterprise software analysts recognize this pattern from previous Salesforce acquisitions and broader industry consolidation trends:

- Acquire a fast-growing independent product.

- Embed it tightly into the vendor’s proprietary stack.

- Announce End-of-Sale, signalling the standalone version’s sunset.

- Mandate Migration to a pricier, bundled successor.

- Exploit Switching Costs to push 20-40 % annual renewal hikes.

Analysts have seen this sequence across multiple software categories; once customers are locked into a single-vendor ecosystem, pricing leverage shifts decisively to the vendor.

Community Reality Check: What Your Peers Are Actually Saying

The Reddit r/salesforce community has become ground zero for CPQ transition discussions, revealing practical concerns and real-world experiences that corporate messaging doesn’t address:

Community Sentiment Analysis

Pricing Shock and Accessibility Concerns:

“Salesforce Revenue Cloud Advanced is built for the enterprise. Just its list price at $200 per user month puts it out of reach for SMB / Mid-Market companies.”

This comment reflects a broader concern that Revenue Cloud’s pricing strategy effectively eliminates mid-market organizations from Salesforce’s CPQ ecosystem, forcing them toward alternative platforms regardless of their preference for staying within the Salesforce environment.

Support Quality Degradation Fears:

“CPQ has reached ‘End of Sale’ by Salesforce, it’s hard to truly believe that anyone will get the kind of support they’d need going forward.”

Users are expressing skepticism about Salesforce’s commitment to maintaining CPQ support quality when the platform is officially deprecated and resources are being redirected toward Revenue Cloud.

Migration Timeline Reality Check:

“Moving from CPQ to Revenue Cloud – What to expect? We all know CPQ is being deprecated and being replaced with Revenue Cloud… There are still 6k customers on CPQ, and it’ll likely be supported for another 10 years.”

This comment reveals the disconnect between corporate timelines and user expectations, with community members recognizing that practical support may continue longer than strategic messaging suggests, but quality will likely decline over time.

Professional Development Concerns:

“Did I waste my time learning Salesforce CPQ? It’s end of sale. Most companies are still on CPQ and will be for years.”

Salesforce professionals are concerned about career implications and skill obsolescence, reflecting broader ecosystem uncertainty about the transition timeline and market adoption of Revenue Cloud.

Key Themes:

Implementation complexity anxiety, alternative platform interest, and vendor relationship skepticism.

The servicePath™ Alternative: Strategic Escape Route

While Salesforce built expensive vendor lock-in, servicePath™ focused on what enterprises actually need: powerful CPQ without ransom pricing, forced bundling, or architectural dependency that constrains future flexibility.

Modern B2B sales demand speed, precision, and flexibility—qualities that bundled suites often lack. servicePath™ is a specialist CPQ layer designed to integrate seamlessly with your Salesforce org, scale with your evolving tech stack, and avoid the “bundle-tax” of forced add-ons. Built for intricate pricing, real-time performance, and vendor independence, servicePath™ transforms quoting into a strategic advantage.

Key Platform Differentiators

- Excel-grade modelling — automates multi-tier discounts, bundles and cost-plus logic; eliminates > 90 % of spreadsheet workarounds.

- API-first / iPaaS-ready — plug-and-play connectors for leading CRM/ERP systems; cuts integration build time from three months to four weeks.

- Sub-second quoting — real-time quote generation drives 30 % faster quote-to-cash and 25 % fewer re-quotes.

- Global governance — role-based approvals, margin controls and audit trails reduce pricing exceptions by 40 % in multinational deployments.

- Transparent economics — CPQ-only licensing with no forced bundles lowers total cost of ownership by 25–35 %.

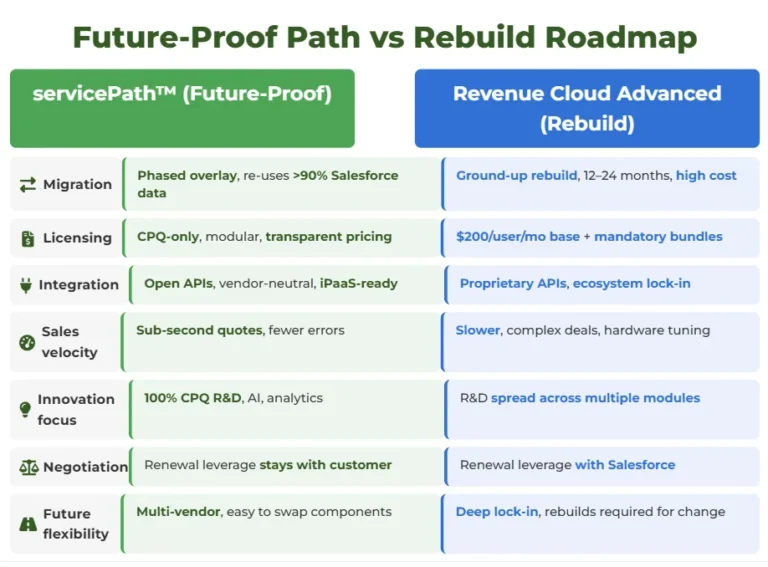

servicePath™ vs. Revenue Cloud: Comprehensive Platform Comparison

Senior leaders face a strategic choice: overlay and optimize with servicePath™, or commit to a costly, time-consuming rebuild on Salesforce Revenue Cloud. The right path accelerates value and preserves flexibility; the wrong one locks in budget and roadmap to a single vendor.

Choose agility, not overhaul. servicePath™ layers onto your current Salesforce data in weeks and keeps pricing transparent—while Revenue Cloud demands a year-plus rebuild, mandatory bundles, and long-term lock-in.

- Migration -servicePath™ :phased overlay re-uses 90 %+ of existing metadata; Revenue Cloud: 12-24 mo ground-up rebuild

- Licensing -servicePath™: CPQ-only, modular, no hidden fees; Revenue Cloud: US $200 user/mo plus bundled add-ons

- Integration -servicePath™: open APIs, iPaaS-ready, vendor-neutral; Revenue Cloud: proprietary APIs, tight ecosystem lock-in

- Sales velocity-servicePath™: sub-second quotes, 30 % faster Q-to-C; Revenue Cloud: multi-minute quotes on complex deals

- Innovation focus-servicePath™: 100 % R&D on CPQ (AI, analytics); Revenue Cloud: resources spread across suite modules

- Negotiation leverage-servicePath™: renewal power stays with you; Revenue Cloud: leverage shifts to Salesforce

- Future flexibility-servicePath™: multi-vendor architecture, easy swap-outs; Revenue Cloud: deep lock-in—future changes = new rebuild

Takeaway: servicePath™ empowers revenue leaders with a specialist CPQ engine that accelerates deals, protects margins, and keeps budgets predictable—unlike Salesforce Revenue Cloud, which demands a costly rebuild and embeds permanent bundle dependency. Choose agility over technical debt.

Act Now: The Strategic Window for CPQ Transformation

The Salesforce CPQ end-of-sale marks a rare, high-stakes inflection point for senior executives responsible for revenue operations and digital transformation. Over the next 12–18 months, enterprise buyers have a fleeting opportunity to secure the most favorable pricing, contract terms, and access to top-tier implementation partners for their next-generation CPQ platform. This window is rapidly closing as market demand surges and vendor capacity is consumed. Acting now means retaining leverage and choice; waiting means accepting higher costs, fewer options, and increased risk.

Why Immediate Action Is Critical

The market is already shifting beneath your feet. Early adopters are capitalizing on the best deals, locking in discounts, and securing the most experienced implementation partners. As more organizations accelerate their transitions, the competitive advantage of moving first is quickly eroding. The longer you wait, the more you risk being left with higher prices, less flexible contracts, and limited access to top-tier resources. In this environment, speed is not just an advantage—it’s a necessity for protecting your organization’s bottom line and future growth.

Vendors are aggressively targeting strategic accounts with deep discounts, flexible contract structures, and accelerated project timelines. According to Forrester’s CPQ Wave, these advantages are already fading as more organizations initiate their transitions. As vendor capacity tightens, the most experienced implementation teams are being reserved by early movers, and the most attractive commercial terms are disappearing. The sooner you act, the more negotiating power and resource access you retain.

The Risks of Waiting

Delaying your decision doesn’t just mean missing out on savings—it actively increases your exposure to risk and cost. As the market becomes saturated with late movers, vendors will shift their focus to standard contracts and higher pricing, while the best implementation partners will be fully booked. Emergency migrations will command premium rates, and your organization may be forced into less favorable terms or rushed projects that jeopardize long-term success. Inaction now can lead to operational disruption, budget overruns, and lost competitive ground.

If you wait, you risk losing access to competitive pricing and being forced into standardized, vendor-friendly contracts. Gartner’s CPQ Market Guide warns that late adopters often face higher normalized costs, limited partner availability, and “take-it-or-leave-it” scenarios. Emergency implementations come with premium price tags, and your choice of top-tier partners will be severely limited.

Key Takeaway:

Every quarter you delay, your options narrow and your costs rise. (Gartner)

Erosion of Leverage: How the Market Shifts

The CPQ market is evolving at an unprecedented pace. As the end-of-sale deadline approaches, the balance of power is shifting rapidly from buyers to vendors. Early in the transition, organizations enjoy a wide array of choices, aggressive pricing, and highly customized contract terms. But as the months pass, these advantages diminish. By the time the majority of enterprises are ready to act, the market will have consolidated, and the best deals and partners will be gone. Understanding this timeline is essential for making a strategic, not reactive, move.

In the first year, you have the most choice and leverage. By 12–18 months, options shrink and prices rise. After 18 months, you may be forced into unfavorable terms and costly, last-resort implementations. SalesforceBen’s analysis and Gartner’s CPQ Market Guide both highlight this rapid erosion of buyer leverage.

Executive Action Framework

To maximize this fleeting window of opportunity, senior leaders must take a disciplined, cross-functional approach. This is not a routine software upgrade—it’s a strategic transformation that will impact revenue, operations, and customer experience for years to come. By mobilizing a dedicated task force, aligning stakeholders, and rigorously evaluating both business and technical requirements, you can ensure your organization is positioned to capture the full value of this market shift. The right preparation now will pay dividends in cost savings, operational agility, and long-term growth.

- Quantify the financial and operational impact of the CPQ transition

- Document all customizations and integrations to avoid costly surprises (SalesforceBen: CPQ Customization Risks)

- Brief leadership on risks and opportunities, ensuring alignment at the board level

- Assign a cross-functional task force with executive sponsorship to drive the initiative

- Research leading alternatives like servicePath™ and benchmark against

- Engage with peer organizations for lessons learned and best practices

- Request estimates and migration roadmaps from multiple vendors

- Ensure solutions align with long-term digital and revenue strategy

- Align IT, sales, finance, and operations on evaluation criteria

- Set a realistic, quarter-by-quarter timeline for assessment, selection, and implementation

- Build a compelling business case for transition, including ROI and risk mitigation

- Secure executive buy-in and budget to move decisively

Key Takeaway:

Proactive, cross-functional planning is the only way to secure the best outcome. (Gartner)

Market Timing: The Closing Window of Opportunity

The best deals and partners are available now—but not for long.

The convergence of Salesforce’s end-of-sale announcement and a surge in enterprise demand has created a unique, but rapidly shrinking, window for buyers. Those who act now will benefit from the most competitive pricing, the broadest selection of partners, and the greatest flexibility in contract negotiations. As the market becomes saturated, these advantages will disappear, leaving late movers with higher costs and fewer choices. Forrester and Gartner both emphasize that acting now is the only way to maximize negotiating power and secure the best resources.

Strategic Action Timeline

A structured, phased approach is essential to maximize your leverage and minimize risk during this transition. Leading analysts, including Gartner and Forrester, recommend the following timeline for enterprise buyers:

Months 1–3:

Begin with a comprehensive assessment of your current CPQ environment. Document all customizations, integrations, and business processes that will be impacted. Define clear evaluation criteria aligned with your long-term revenue strategy, and initiate exploratory conversations with leading CPQ vendors.

Months 4–6:

Move into formal evaluation. Issue RFPs to shortlisted vendors, conduct proofs-of-concept to validate fit, and benchmark total cost of ownership (TCO) against your current solution. This is also the time to negotiate commercial terms and service-level agreements, leveraging your position while vendor competition is still high.

Months 7–12:

Finalize your vendor selection and begin implementation. Engage your chosen partner’s top resources and launch a robust change management program to ensure adoption across sales, finance, and IT. Early implementation allows you to avoid the resource bottlenecks and premium rates that will emerge as the market tightens.

Success Metrics from Proactive Transitions

The benefits of acting early are well-documented. According to the Gartner CPQ Market Guide, 2024, organizations that initiate their CPQ transition within the first year of the end-of-sale announcement achieve:

- 30–50% lower CPQ-related costs due to competitive vendor pricing and reduced implementation premiums.

- Faster sales cycles and improved sales productivity, as new platforms streamline quoting and approval workflows.

- Stronger negotiating position with a broader range of vendor options and more favorable contract terms.

- Greater architectural flexibility to support future business models and integrations.

For real-world examples of successful transitions, see these case studies.

Strategic Decision Framework

The transition away from Salesforce CPQ will unfold in distinct phases, each with its own risks and opportunities. Aligning your response to these phases is critical for minimizing disruption and maximizing value.

Assessment Framework

Before making any decisions, conduct a thorough assessment of your current CPQ landscape. Inventory all technical customizations and integrations, analyze the business process impact of migration, define your future-state requirements for scalability and compliance, and assess your organization’s risk tolerance. This foundational work will inform your vendor selection and implementation strategy, reducing the risk of costly surprises down the line. Download our executive assessment checklist.

Final Key Takeaways for Senior Leaders

- Act now to secure pricing, terms, and talent .

- Delay means higher costs, fewer options, and increased risk .

- A structured, cross-functional approach is essential .

- The window for strategic advantage is closing—move before market leverage disappears .

The strategic window is closing. Act now to secure your competitive future and avoid the pitfalls of last-minute, high-risk migrations.

Contact servicePath™ for a strategic evaluation.

FAQ: Salesforce CPQ End-of-Sale Transition

-

How long do we really have before we must migrate? Most organizations require 18–24 months for a safe, strategic transition. Support quality will decline well before official end-of-life. Read the SalesforceBen analysis.

-

Can we realistically just stay on Salesforce CPQ indefinitely? Technically possible, but risks compound: declining support, security vulnerabilities, integration failures, compliance gaps, and competitive disadvantage.

-

Is Revenue Cloud Advanced as expensive as the analysis suggests? Yes. Beyond the $200/user/month license, hidden bundling and opportunity costs can double or triple total cost of ownership. See our TCO breakdown.

-

What happens to our existing Salesforce integrations and customizations? Revenue Cloud migration requires rebuilding all integrations and customizations. servicePath™ preserves your Salesforce investment with native integration.

-

How do we evaluate CPQ alternatives without disrupting current operations?Follow a structured approach: assessment, market research, proof of concept, pilot, and migration planning—typically 6–9 months. Request a migration assessment.

-

What specific questions should we ask potential CPQ vendors?Ask about migration approach, timeline, business continuity, SLAs, complex pricing, integration, total cost, pricing structure, references, roadmap, innovation, and support. Download our vendor evaluation guide.

-

How do we build a business case for an unplanned CPQ transition?Frame it as risk mitigation and cost optimization: consider the cost of inaction, performance degradation, competitive vulnerability, capability enhancement, and market timing. Access our business case template.

Ready to Future‑Proof Your Revenue Engine?

Salesforce has confirmed that its CPQ product is entering an “End‑of‑Sale” (EOS) phasesalesforceben.com. Existing customers can still renew, but new sales have stopped – a clear signal that resources are shifting to Revenue Cloud. The new Revenue Cloud Advanced edition is priced at US $200 per user per monthcyntexa.com and requires a full rebuild with longer implementation times and added costscpq-integrations.com. This is an inflection point: act decisively and you can reduce vendor lock‑in, avoid bundle taxes and build a more agile revenue stack. Delay and you risk being locked into a costly, inflexible ecosystem for the next decade.

Your Next Steps

- Book a CPQ Modernization Diagnostic – Know Your TCO

We’ll analyse your Salesforce CPQ setup, quantify the true cost of migrating to Revenue Cloud (including licence fees, hidden bundle taxes and rebuild expenses), and map a path that reuses your existing metadata. See how servicePath™ integrates natively with Salesforce and delivers sub‑second quoting without forced bundles. - Request a Live Demo – See Post‑CPQ Agility

Watch us configure complex quotes live and detect margin leaks in real time. Fifteen minutes, zero commitment – just a clear view of how a specialist CPQ platform transforms quoting into a strategic advantage. - Read our Blogs

Our research‑backed guide distils insights from Salesforce Ben’s EOS reportsalesforceben.com and independent analyses that reveal why Revenue Cloud isn’t a simple upgrade but a full reimplementationcpq-integrations.com. Understand the risks, costs and timelines, and explore independent CPQ alternatives. - Grab the Case‑Study Pack – Proof in Action

See how enterprises like Telent and Dell EMC cut quote times by 90 % and 98 % respectively and closed a $180 M deal in half the cycle using servicePath™. Real results from organizations that chose agility over lock‑in. - Partner with a Gartner‑Visionary – Credibility That Counts

servicePath™ has been recognized as a Visionary in the Gartner Magic Quadrant for CPQ three years running. Leverage a vendor with a proven track record and high customer satisfaction to accelerate your digital transformation. - Decode the CPQ EOS Glossary – Speak the Same Language

From “CPQ AI” to “Sales Operations” and “Revenue Operations,” our glossary turns buzzwords into actionable insights so every stakeholder understands the issues at hand.

The strategic window is closing. Act now to secure your competitive future.

Contact servicePath™ today to begin your evaluation while market dynamics still provide maximum leverage and choice.