Solar Panels & Sales Pipelines: Capture Every Ray of Profit in 2025

Missed margin is sunlight lost. Discover the five hidden profit leaks—and how AI-driven CPQ turns quotes into cash for tech enterprises in 2025.

“Profit is like sunlight; whatever you fail to capture is simply lost.”

— Mark Lewis, Gartner Senior Director Analyst, 2025 CSO & Sales Leader Conference

Last week, our CEO Daniel Kube attended the Gartner CSO & Sales Leader Conference in Las Vegas. One session led by Gartner’s Mark Lewis really stuck with him. Mark’s words? “Profit is like sunlight; whatever you fail to capture is simply lost.” It’s a vivid metaphor that sets the stage for everything senior executives and leaders need to know about profit optimization today.

Imagine the sun blazing overhead, yet your solar panels are incorrectly angled—capturing barely a quarter of the energy available. That’s your profit: abundant opportunity slipping away because your pricing, quoting, and margin processes aren’t aligned.

This fundamental truth about missed opportunity formed the core of a compelling message from Mark Lewis. He likens inefficient pricing and quoting processes in tech-enabled enterprises to misaligned or dusty solar panels—where abundant opportunity shines but little profit is actually captured.

Drawing from his own experience attempting to install solar panels, Lewis highlights two critical lessons for B2B sales leaders:

-

Speed Matters: The first quote wins. Delays erode trust and often mean lost deals. Being the fastest to respond is non-negotiable.

-

Know Your Customer’s Willingness to Pay: Underpricing—even if fast—leaves substantial profit on the table. Understanding and capturing customer value is key.

Many enterprises have great demand and solid products but fail to optimize their pricing, quoting, and discount processes—leading to significant, avoidable profit leakage. Senior leaders must treat pricing and quoting workflows as critical “profit panels,” fine-tuning them to capture every possible dollar of margin before it slips away.

Why 2025 Is the Year Profit Hits the Leadership Agenda

The global B2B landscape in 2025 is a crucible of challenges and opportunities. Inflation may be moderating, but volatile input costs leave scars. Buyers are savvier, pushing back on price, and competitors are relentless. The “growth at any cost” mantra is fading, replaced by a sharper focus on profitable growth.

Consider the tale of two unicorn enterprise software vendors:

- Company A: Doubled down on cost-cutting—headcount freezes, delayed R&D. Morale and innovation tanked, growth stalled.

- Company B: Invested in pricing analytics, restructured sales incentives, held firm on margin, and funneled profits into product development. Result? 12% revenue growth and a 3% margin expansion.

Which story would you want to tell your board?

- Persistent Margin Compression :55% of enterprises struggled to fully pass 2024 inflation onto customers, causing margin hits (Bain).

- Boardroom Mandate For Profit: Profitability-weighted KPIs now outrank revenue targets in boardrooms (Deloitte).

- Competitive Intensity :67% cite competitor discounting and customer pushback as major hurdles to price increases (Bain).

This is a pressure cooker, but with pressure comes opportunity-especially for those who see profit as a strategic initiative , not a tactical afterthought.

The Opportunity—Voices from the Top

Leading executives are not just acknowledging the challenge; they’re pointing the way forward:

-

Arvind Krishna, CEO, IBM: “Strong demand for generative AI is translating into long-term growth and profitability.” Their strategic AI pivot now delivers double-digit margin gains (IBM Q1 2025 Earnings Call).

-

Scott Herren, Outgoing CFO, Cisco: “Discipline on price and margin is how we keep reinvesting in innovation.” Their refined rebate model protected a 15% gross margin target during supply chain turmoil (Yahoo Finance, Cisco Q1 Earnings Call).

-

Satya Nadella, CEO, Microsoft: “Cloud and AI are the essential inputs for every business to expand output, reduce costs, and accelerate growth.” Azure’s $3 billion quarterly run rate proves premium services command premium prices (Reuters).

The Five Hidden Holes Where Margin Leaks Happen

Picture your profit as sunlight flooding your solar panels. Now imagine some of those panels are dirty, misaligned, or faulty—what happens? You lose precious energy, and your system’s efficiency plummets. The same holds true for your pricing and quoting process: hidden margin leaks quietly sap your profitability. If left unchecked, these “holes” can erode a substantial chunk of your bottom line.

Here are the top five profit leak culprits tech-enabled enterprises must fix—fast.

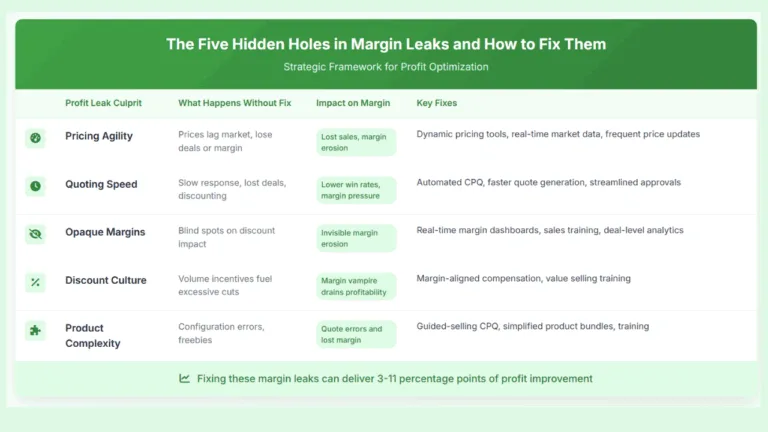

1.Pricing Agility — The Static Danger

If your pricing updates feel like dial-up internet in a fiber-optic world, you’re already behind. Market factors shift daily—tariffs spike, competitor prices fluctuate, supplier costs swing—yet your prices remain stubbornly static. This mismatch turns profit into lost opportunity.

Daniel Kube, CEO of servicePath™, puts it bluntly:

“Organizations need to build pricing agility to respond quickly to cost fluctuations and competitive pressures.”

Without nimble pricing, your quotes are outdated before they even land on a prospect’s desk. The result? Either you lose the deal or give away margin just to stay competitive. Neither is a winning strategy.

2.Quoting Speed — The Slow-Motion Killer

In B2B sales, speed isn’t just important—it’s everything. A well-known sales axiom states:

“The first quote usually wins, so speed is critical to capturing profit.”

CloudSense research reveals that quotes delivered within 24 hours convert three times better than slower ones.

Slow quoting is a silent killer. It kills momentum, drives buyers into competitors’ arms, and forces sales teams into panicked discounting just to close. Fast, accurate quotes keep you ahead of the pack and protect your margins.

3.Opaque Margins — The Invisible Erosion

When sales teams don’t have real-time visibility into how discounts, product choices, and configurations impact margins, profits bleed quietly but steadily.

McKinsey research shows that implementing real-time margin dashboards can add 3 percentage points of margin in just months—a huge win.

Mark Lewis warns:

“Without clear margin visibility at the point of sale, companies are unknowingly eroding profits.”

This invisible erosion is often the hardest to spot and fix because it’s spread across many deals and people—until you have the right analytics and dashboards.

4.Discount Culture — The Margin Vampire

Volume-focused incentives are a margin vampire, sucking profitability dry by encouraging sales teams to slash prices just to hit numbers.

Daniel Kube’s warning is clear:

“No technology can fix an incentive plan that rewards volume at any cost.”

Fixing this requires a fundamental shift—align incentives to margin goals and rigorously train sales teams to sell value, not just volume.

5.Product Complexity — The Configuration Quagmire

Complex product bundles, multi-SKU offerings, and usage-based pricing create quoting chaos. Without guided-selling CPQ tools, errors multiply, freebies sneak in, and margin evaporates.

This complexity traps enterprises in a quagmire of inconsistent pricing and costly mistakes—leaking profit with every faulty quote.

Table: The Five Hidden Holes in Margin Leaks and How to Fix Them

Why These Holes Matter: The Cost of Margin Leaks

Margin leaks don’t just chip away profits quietly—they undermine your entire growth engine. Companies often underestimate how much margin disappears through these operational cracks. Here’s why fixing them is urgent:

-

Lost Deals: Poor pricing agility and slow quoting allow competitors to swoop in.

-

Margin Erosion: Discounting without oversight and invisible margin leaks erode profits deal-by-deal.

-

Increased Costs: Errors from product complexity cause costly reworks and delayed revenue recognition.

-

Cultural Misalignment: Sales teams chasing volume over margin sabotage pricing strategies.

Closing these holes doesn’t require magic—it demands focus, technology, and cultural change. With CPQ software, AI-driven pricing, and a culture focused on margin, you can patch leaks and turn your profit panels into a revenue powerhouse.

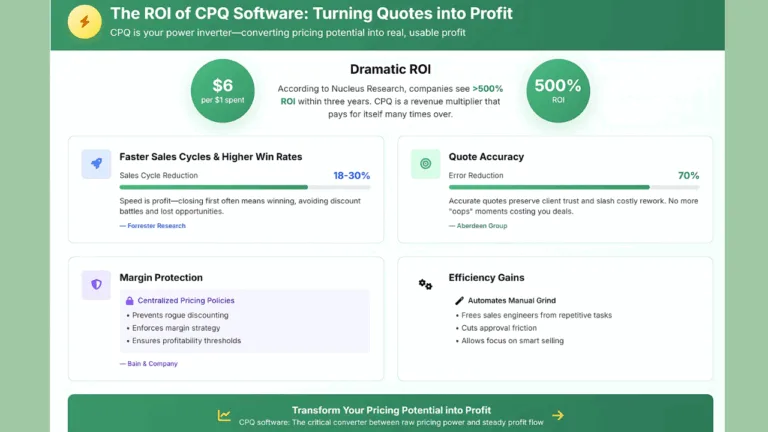

The ROI of CPQ Software: Turning Quotes into Profit

If pricing optimization is like solar technology capturing raw energy, then CPQ software is your power inverter—the critical device that converts that potential into real, usable profit. It’s the difference between scattered rays and a steady power flow driving your business forward.

Dramatic ROI

The numbers don’t lie. According to Nucleus Research, companies investing in CPQ software see over $6 in returns for every $1 spent within three years. This >500% ROI is no fluke—it reflects real efficiency gains, higher sales, and tighter margin control. Think of CPQ as a revenue multiplier that pays for itself many times over.

Faster Sales Cycles & Higher Win Rates

Forrester Research highlights that CPQ can cut sales cycle times by 18-30%, meaning your teams close deals faster and more often. Speed is profit—closing first often means winning, avoiding discount battles and lost opportunities.

Quote Accuracy

Aberdeen Group reveals CPQ reduces quoting errors by 70%, which preserves client trust and slashes costly rework. Accurate quotes eliminate embarrassing mistakes, accelerate fulfillment, and reduce delayed revenue recognition—no more “oops” moments costing you deals.

Margin Protection

Bain & Company shows centralized pricing policies embedded in CPQ prevent rogue discounting, enforcing your margin strategy across the Salesforce. This governance ensures that every deal respects your profitability thresholds.

Efficiency Gains

CPQ automates the manual grind—freeing sales engineers and approval teams from repetitive tasks, cutting friction, lowering costs, and allowing reps to focus on selling smartly rather than paperwork.

The takeaway?

CPQ isn’t just software—it’s a strategic profit lever powering faster, smarter, and more profitable sales.

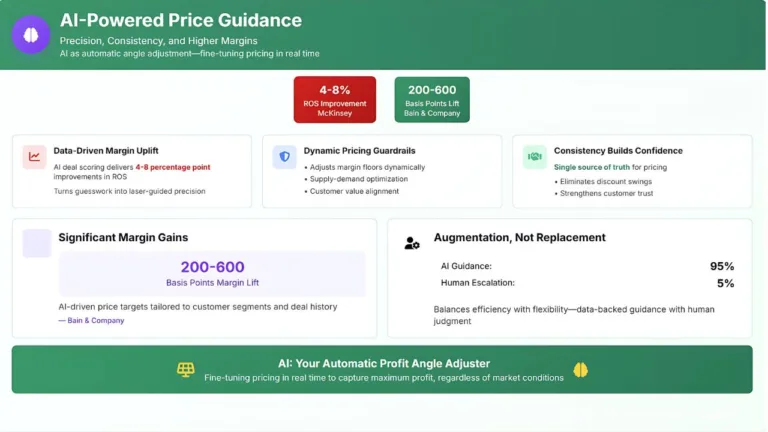

AI-Powered Price Guidance: Precision, Consistency, and Higher Margins

Think of AI as the automatic angle adjustment system on your solar panels—fine-tuning pricing in real time to capture the maximum profit, no matter the market conditions.

- Data-Driven Margin Uplift: According to McKinsey, AI deal scoring delivers 4–8 percentage point improvements in return on sales (ROS), turning guesswork into laser-guided precision.

- Significant Margin Gains: Bain & Company reports clients achieve 200–600 basis points margin lifts by implementing AI-driven price targets tailored to customer segments and deal history.

- Dynamic Pricing Guardrails: AI dynamically adjusts margin floors and target prices based on supply-demand shifts, customer value, and strategic considerations—ensuring your pricing adapts to market realities instantly.

- Consistency Builds Confidence :AI creates a “single source of truth” for pricing, eliminating wild discount swings and boosting sales team confidence. Consistent pricing strengthens customer trust and drives better margins.

- Augmentation, Not Replacement :AI doesn’t replace human judgment—it augments it. Sales reps get data-backed guidance for 95% of quotes but can escalate exceptions when needed, balancing efficiency with flexibility.

Bottom line:

AI-driven price guidance is a profit multiplier that boosts quoting accuracy and margin capture while empowering your sales force to sell smarter every day.

Culture: The True Solar Tracker

Technology and process are powerful—but without the right culture, profit leaks continue unabated. Culture is the ultimate “solar tracker” that aligns your team’s behavior with your margin goals.

- Shift Incentives: Move away from volume-based rewards and towards value- and margin-based compensation. This realignment motivates reps to sell smarter, not just harder.

- Drive Transparency: Use real-time dashboards to show margin performance across teams. Visibility fosters accountability and encourages reps to own profitability.

- Celebrate High-Margin Wins: Highlight and share success stories around deals that hit margin targets. Peer recognition builds a learning culture focused on profitable growth, not just revenue volume.

- Invest in Training: Equip your sales teams with skills in negotiation and value-based selling. Bain’s research shows this can add 20–30% more margin capture annually—proof that soft skills pay hard profits.

McKinsey finds that companies embracing a profit-focused culture outperform peers by 5–10 points in margin growth.

Mark Lewis sums it up perfectly:

“No technology can fix an incentive plan that rewards volume at any cost.”Our CEO Daniel Kube echoes this truth: culture is your ultimate solar tracker, ensuring every ray of profit is not just captured, but converted into lasting success.

Next Steps: The Case for servicePath™

Your “profit panels”—pricing rules, discount policies, approvals—may already exist, but are they aligned to capture every ray of margin?

servicePath™ offers an integrated CPQ platform designed to realign your profit panels and maximize margin capture across complex enterprise sales.

-

High-Speed CPQ & Margin Engine: Quote complex deals in minutes with real-time margin analytics embedded at every line item. Prevent unprofitable deals before they happen.

-

AI Price Advisor: Sophisticated AI suggests optimal price bands based on segmentation, deal history, and market trends. Like a solar tracker for pricing—never leave money on the table.

-

Rebate Orchestration: Automate strategic rebates, track accruals, ensure compliance, and turn rebates from cost centers into profit drivers.

-

Real-Time Dashboards: From line-item profitability to global P&L views, empower all stakeholders with data-driven insights to foster profit discipline.

servicePath™ helps you capture every ray of margin—turning your sales pipeline into a high-efficiency solar farm powering sustained growth.

Conclusion: Don’t Leave Profit on the Table

As Mark Lewis reminds us:

“Profit is like sunlight; whatever you fail to capture is simply lost.”

The opportunity in 2025 is blindingly bright. Your challenge: ensure your profit panels are fully aligned and optimized to catch every ray. With modern CPQ tools, AI-driven pricing, and a culture of margin discipline, you can unlock unseen profitability and fuel long-term innovation.

The sun is shining—are your profit panels angled right?

Ready to Take the Next Step?

-

Read More: Explore additional blogs and insights on CPQ, quoting transformation, and digital sales enablement.

-

Download Our Case Studies: See how leading enterprises have transformed revenue operations with servicePath™.

-

Check Out Our G2 Reviews: Discover what real users love about servicePath™.

-

Recognized by Gartner: Find out why we’ve been named a Visionary in the Gartner Magic Quadrant for CPQ Application Suites three years in a row.

-

Book a Virtual Coffee: Let’s chat about your challenges and explore how servicePath™ can help. No pressure—just insights.